- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3607

There's No Escaping Coxon Precise Industrial Co., Ltd's (TWSE:3607) Muted Revenues Despite A 31% Share Price Rise

Coxon Precise Industrial Co., Ltd (TWSE:3607) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

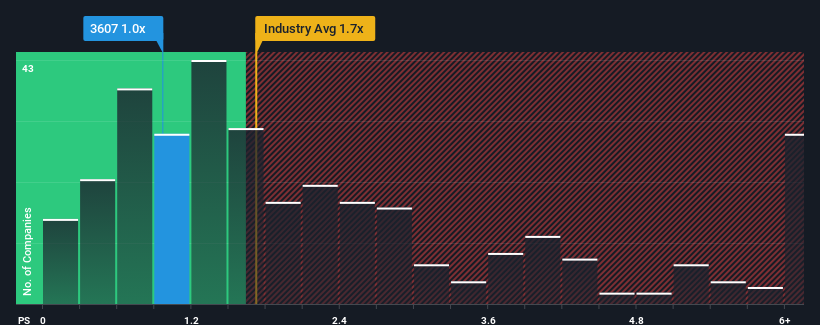

Even after such a large jump in price, Coxon Precise Industrial's price-to-sales (or "P/S") ratio of 1x might still make it look like a buy right now compared to the Electronic industry in Taiwan, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Coxon Precise Industrial

How Coxon Precise Industrial Has Been Performing

It looks like revenue growth has deserted Coxon Precise Industrial recently, which is not something to boast about. One possibility is that the P/S is low because investors think this benign revenue growth rate will likely underperform the broader industry in the near future. Those who are bullish on Coxon Precise Industrial will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Coxon Precise Industrial's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

Coxon Precise Industrial's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 29% overall from three years ago. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 20% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Coxon Precise Industrial's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Coxon Precise Industrial's P/S?

Coxon Precise Industrial's stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Coxon Precise Industrial confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Coxon Precise Industrial that you should be aware of.

If these risks are making you reconsider your opinion on Coxon Precise Industrial, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3607

Coxon Precise Industrial

Manufactures and sells molds, and metal and plastic components in Taiwan, China, the United States, Japan, and internationally.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion