- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3583

Scientech And 2 More Growth Stocks Insiders Are Heavily Invested In

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing out a strong year despite recent slumps and economic indicators showing varied performance across regions, investors are increasingly focused on growth opportunities that align with insider confidence. In this context, companies like Scientech stand out as compelling prospects due to their high insider ownership, which can signal strong internal belief in the company's potential amidst broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 23.8% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

Scientech (TWSE:3583)

Simply Wall St Growth Rating: ★★★★★★

Overview: Scientech Corporation specializes in the R&D, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power generation industries with a market cap of NT$30.93 billion.

Operations: The company's revenue is derived from two main segments: Brokerage, contributing NT$6.01 billion, and Manufacturing, accounting for NT$3.10 billion.

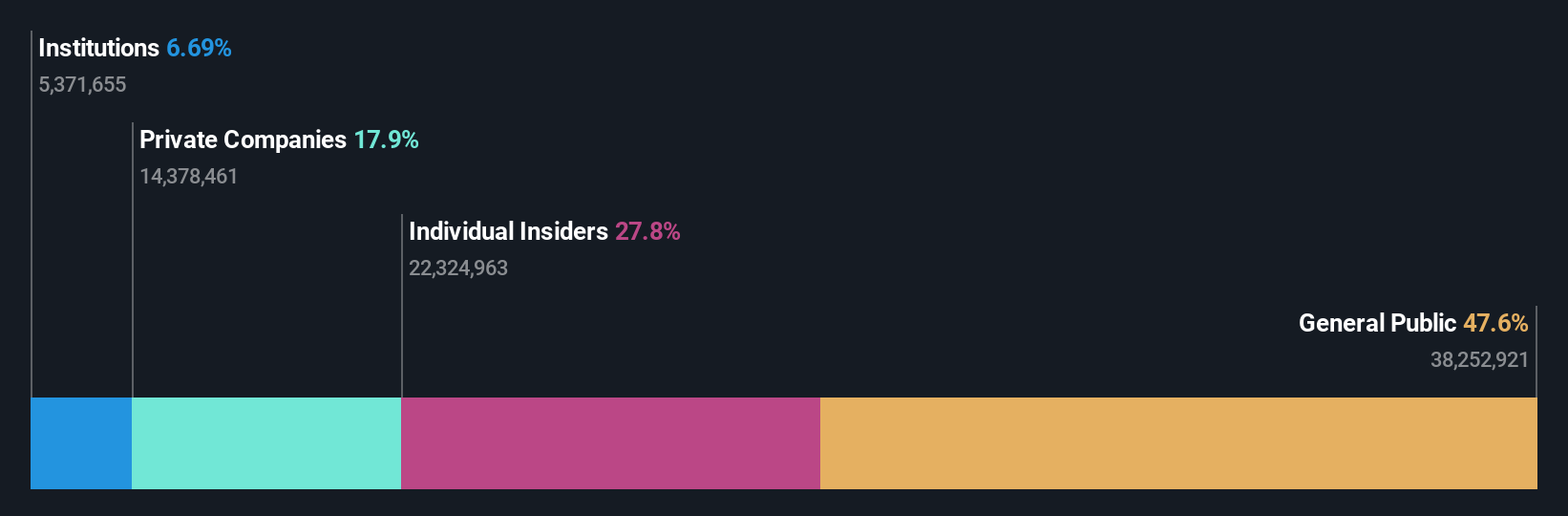

Insider Ownership: 31.3%

Revenue Growth Forecast: 20.3% p.a.

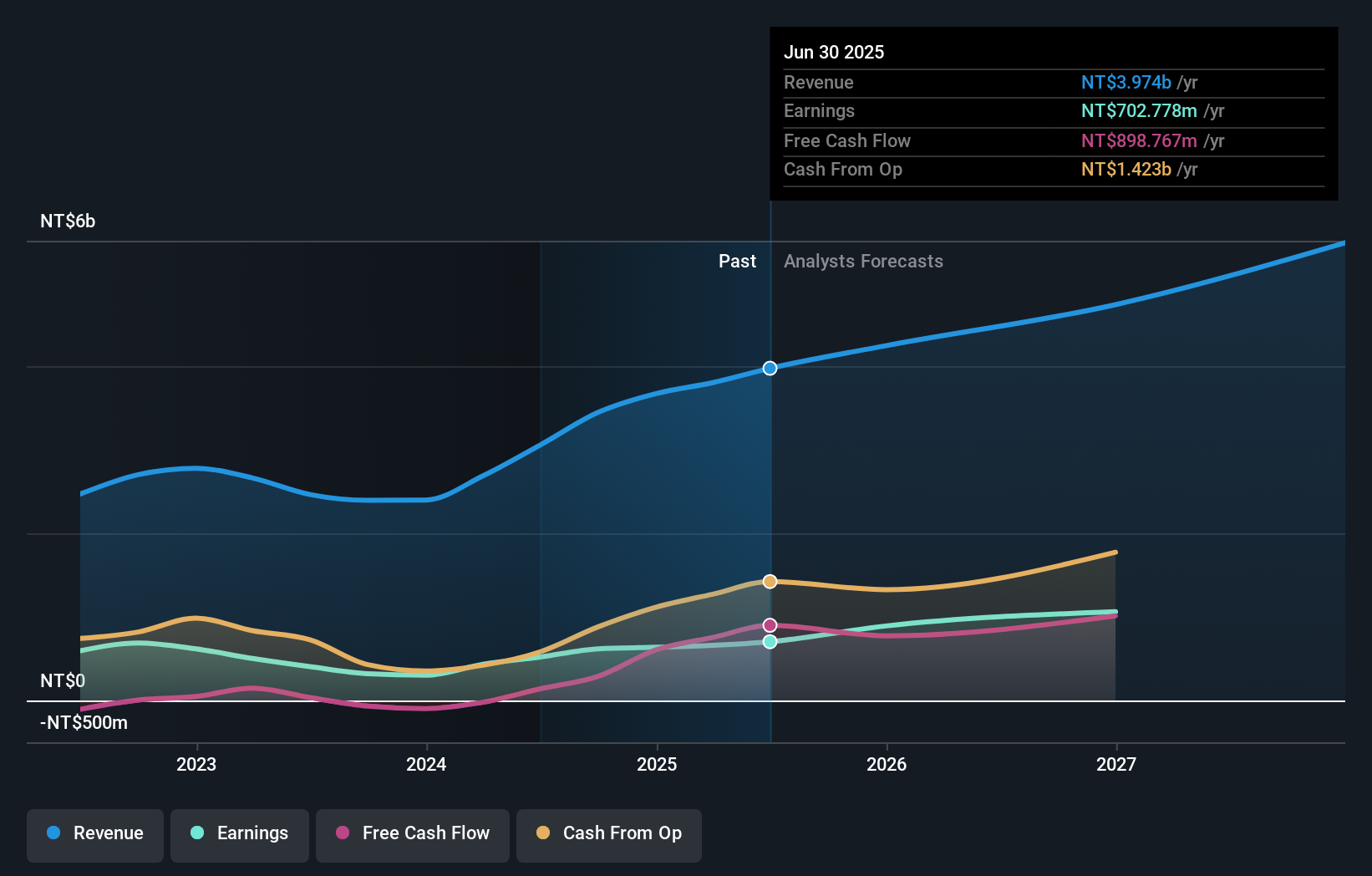

Scientech's growth prospects are strong, with forecasted earnings growth of 50.4% annually, outpacing the TW market. Revenue is also expected to grow at 20.3% per year, exceeding market averages. Recent financials show significant improvement; Q3 revenue rose to TWD 2.5 billion from TWD 1.74 billion a year ago, and net income increased to TWD 240.92 million from TWD 167.95 million. The company’s strategic moves include potential acquisitions as discussed in recent board meetings.

- Click here and access our complete growth analysis report to understand the dynamics of Scientech.

- Our comprehensive valuation report raises the possibility that Scientech is priced higher than what may be justified by its financials.

Visco Vision (TWSE:6782)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Visco Vision Inc. manufactures and sells silicone hydrogel contact lenses across Asia, Europe, and the Americas with a market capitalization of NT$11.06 billion.

Operations: The company's revenue is primarily derived from the manufacturing and trading of disposable contact lenses, totaling NT$3.45 billion.

Insider Ownership: 23.6%

Revenue Growth Forecast: 12.7% p.a.

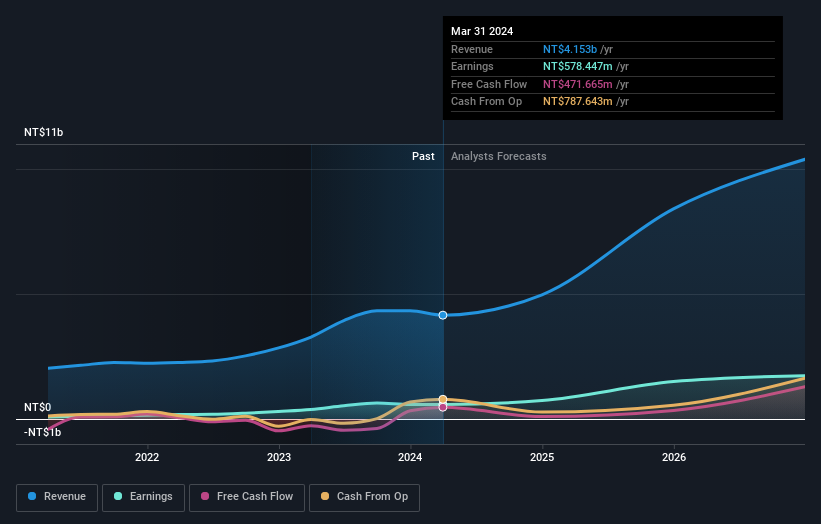

Visco Vision shows promising growth potential, with earnings expected to rise significantly at 20.7% annually, surpassing the TW market's average. Recent Q3 results highlighted a substantial increase in sales to TWD 1.04 billion from TWD 647.57 million and net income doubling to TWD 198.54 million year-on-year. Despite no recent insider trading activity, the stock trades well below its estimated fair value and analysts anticipate a price increase of approximately 45.9%.

- Dive into the specifics of Visco Vision here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Visco Vision's current price could be quite moderate.

Kaori Heat Treatment (TWSE:8996)

Simply Wall St Growth Rating: ★★★★★★

Overview: Kaori Heat Treatment Co., Ltd. specializes in the research, development, manufacture, and sale of heat exchanger solutions across Taiwan, Asia, the United States, Europe, and internationally with a market cap of NT$28.68 billion.

Operations: The company's revenue is primarily derived from its Plate Heat Exchanger segment, generating NT$1.77 billion, and its Energy Conservation Product Segment, which includes metal products and processing, contributing NT$2.14 billion.

Insider Ownership: 12.1%

Revenue Growth Forecast: 40.9% p.a.

Kaori Heat Treatment is poised for significant growth, with earnings projected to increase 51.1% annually, outpacing the TW market. Despite recent share price volatility and past shareholder dilution, the stock trades at a 28.7% discount to its estimated fair value. Analysts forecast a 26.2% rise in stock price, supported by strong revenue growth expectations of 40.9% annually. The company recently appointed Wu Chih Hsyong as CEO effective January 2025, potentially impacting strategic direction positively.

- Take a closer look at Kaori Heat Treatment's potential here in our earnings growth report.

- Our valuation report unveils the possibility Kaori Heat Treatment's shares may be trading at a discount.

Seize The Opportunity

- Reveal the 1500 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3583

Scientech

Engages in the research and development, production, sale, and maintenance of process equipment for semiconductors, liquid crystal displays (LCDs), light-emitting diodes (LEDs), and solar power generation industries.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion