Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3583

Exploring High Growth Tech Stocks And 2 Other Dynamic Innovators

Reviewed by Simply Wall St

As global markets continue to reach new heights, with indices like the Russell 2000 hitting record levels, investors are closely watching how domestic policies and geopolitical events impact market sentiment. In this dynamic environment, identifying high-growth tech stocks and innovative companies requires a focus on those that can navigate economic shifts and leverage technological advancements effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

China Greatwall Technology Group (SZSE:000066)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Greatwall Technology Group Co., Ltd. is a company engaged in the information technology and electronics industry, with a market cap of approximately CN¥54.17 billion.

Operations: Greatwall Technology focuses on the information technology and electronics sectors, generating revenue through diverse product offerings. The company's gross profit margin has shown notable fluctuations over recent periods, reflecting changes in cost structures or pricing strategies.

China Greatwall Technology Group has demonstrated resilience and adaptability in a challenging tech landscape, evidenced by its 18.2% annual revenue growth, surpassing the Chinese market average of 13.8%. Despite current unprofitability, the company is on a trajectory for substantial improvement with earnings expected to surge by 101.82% annually. This optimistic outlook is bolstered by strategic AI-driven product enhancements and a recent share repurchase initiative totaling CNY 44.29 million, reflecting confidence in its future direction. These efforts underscore Greatwall's commitment to innovation and market expansion, positioning it as a noteworthy contender in the high-growth tech arena despite some financial hurdles like negative operating cash flow coverage of debt.

- Get an in-depth perspective on China Greatwall Technology Group's performance by reading our health report here.

Understand China Greatwall Technology Group's track record by examining our Past report.

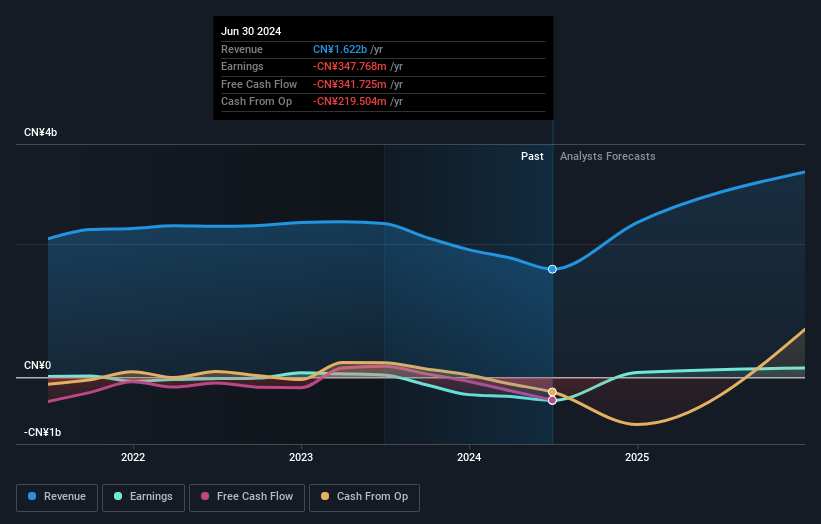

Dongguan Mentech Optical & Magnetic (SZSE:002902)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Mentech Optical & Magnetic Co., Ltd. operates in the optical and magnetic components industry with a market capitalization of CN¥5.51 billion.

Operations: Mentech Optical & Magnetic generates revenue primarily through the production and sale of optical and magnetic components. The company focuses on leveraging its expertise in these areas to cater to various industries, offering products that are integral to modern technology applications.

Dongguan Mentech Optical & Magnetic has been navigating a challenging landscape with a reported 44.8% annual revenue growth, significantly outpacing the Chinese market average of 13.8%. Despite current unprofitability and a recent net loss increase to CNY 139.46 million from last year's CNY 36.38 million, the company is poised for a turnaround with earnings expected to grow by an impressive 159.9% annually. This optimistic projection is supported by substantial R&D investments aimed at driving future innovations and market competitiveness in high-tech sectors, reflecting a strategic focus on long-term growth despite short-term setbacks. Recent activities including the acquisition of a 5.01% stake by Shenzhen Jiayi Asset Management highlight market confidence in Mentech's potential, further underscored by its inclusion in the S&P Global BMI Index. The company's commitment to reinventing its technological base and enhancing product offerings through focused R&D spending underscores its potential to emerge as a stronger player in the tech industry, making it one to watch as it moves towards profitability and beyond current financial challenges.

Scientech (TWSE:3583)

Simply Wall St Growth Rating: ★★★★★★

Overview: Scientech Corporation focuses on the R&D, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power industries with a market cap of NT$33.34 billion.

Operations: Scientech Corporation generates revenue through its involvement in the semiconductor, LCD, LED, and solar power sectors by developing and maintaining specialized process equipment. The company's market capitalization stands at NT$33.34 billion.

Scientech, amidst a robust tech landscape, has demonstrated significant financial growth with a 47.2% increase in revenue to TWD 7.12 billion over nine months, paralleled by a net income rise to TWD 677.11 million. This performance is underpinned by substantial R&D investments which are not just maintaining but enhancing its competitive edge in the technology sector. The firm's strategic presence at forums like the Strategic Taiwan Investment Forum underscores its proactive approach in capitalizing on industry trends and networking opportunities for future growth. With earnings expected to surge by 50.4% annually, Scientech is navigating its trajectory through innovation and strategic market engagements, positioning itself as a resilient contender in high-growth tech sectors despite broader market uncertainties.

- Navigate through the intricacies of Scientech with our comprehensive health report here.

Gain insights into Scientech's past trends and performance with our Past report.

Key Takeaways

- Get an in-depth perspective on all 1289 High Growth Tech and AI Stocks by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3583

Scientech

Engages in the research and development, production, sale, and maintenance of process equipment for semiconductors, liquid crystal displays (LCDs), light-emitting diodes (LEDs), and solar power generation industries.