- Taiwan

- /

- Semiconductors

- /

- TPEX:4974

3 Dividend Stocks Yielding As High As 6.2%

Reviewed by Simply Wall St

As global markets continue to reach record highs, buoyed by positive economic indicators and geopolitical developments, investors are increasingly seeking stable income sources amid fluctuating policy landscapes. In this context, dividend stocks offer an attractive opportunity for those looking to capitalize on steady returns, particularly in a market environment where traditional growth avenues may face uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.60% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.28% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.91% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.24% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.52% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

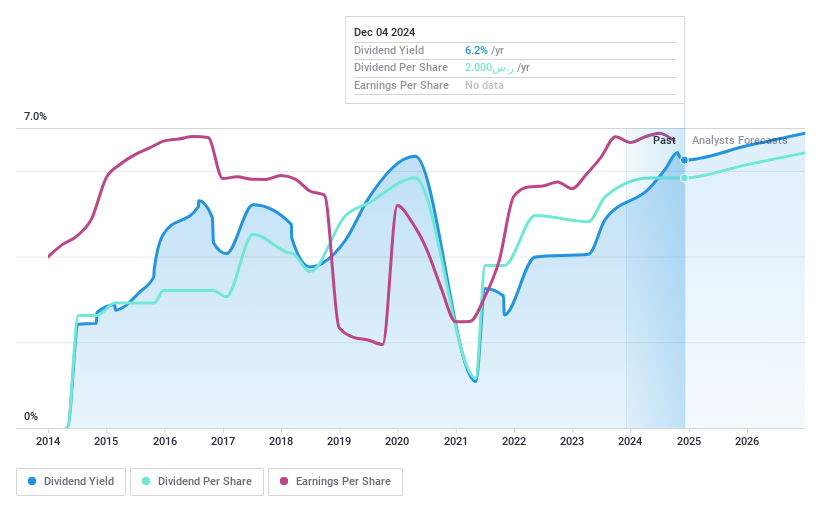

Banque Saudi Fransi (SASE:1050)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banque Saudi Fransi offers banking and financial services to individuals and businesses both in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR37.91 billion.

Operations: Banque Saudi Fransi's revenue is primarily derived from Retail Banking (SAR6.37 billion), Corporate Banking (SAR5.41 billion), and Investment Banking & Brokerage (SAR541.34 million).

Dividend Yield: 6.2%

Banque Saudi Fransi's dividend yield is among the top 25% in the Saudi Arabian market, with a payout ratio currently at 59.7%, indicating dividends are covered by earnings. Despite past volatility in dividend payments, there has been growth over the last decade. The stock trades below analyst price targets, suggesting potential appreciation. However, its unstable dividend history may concern some investors despite forecasts showing future coverage by earnings remaining strong at a 50.7% payout ratio in three years.

- Click here and access our complete dividend analysis report to understand the dynamics of Banque Saudi Fransi.

- The valuation report we've compiled suggests that Banque Saudi Fransi's current price could be quite moderate.

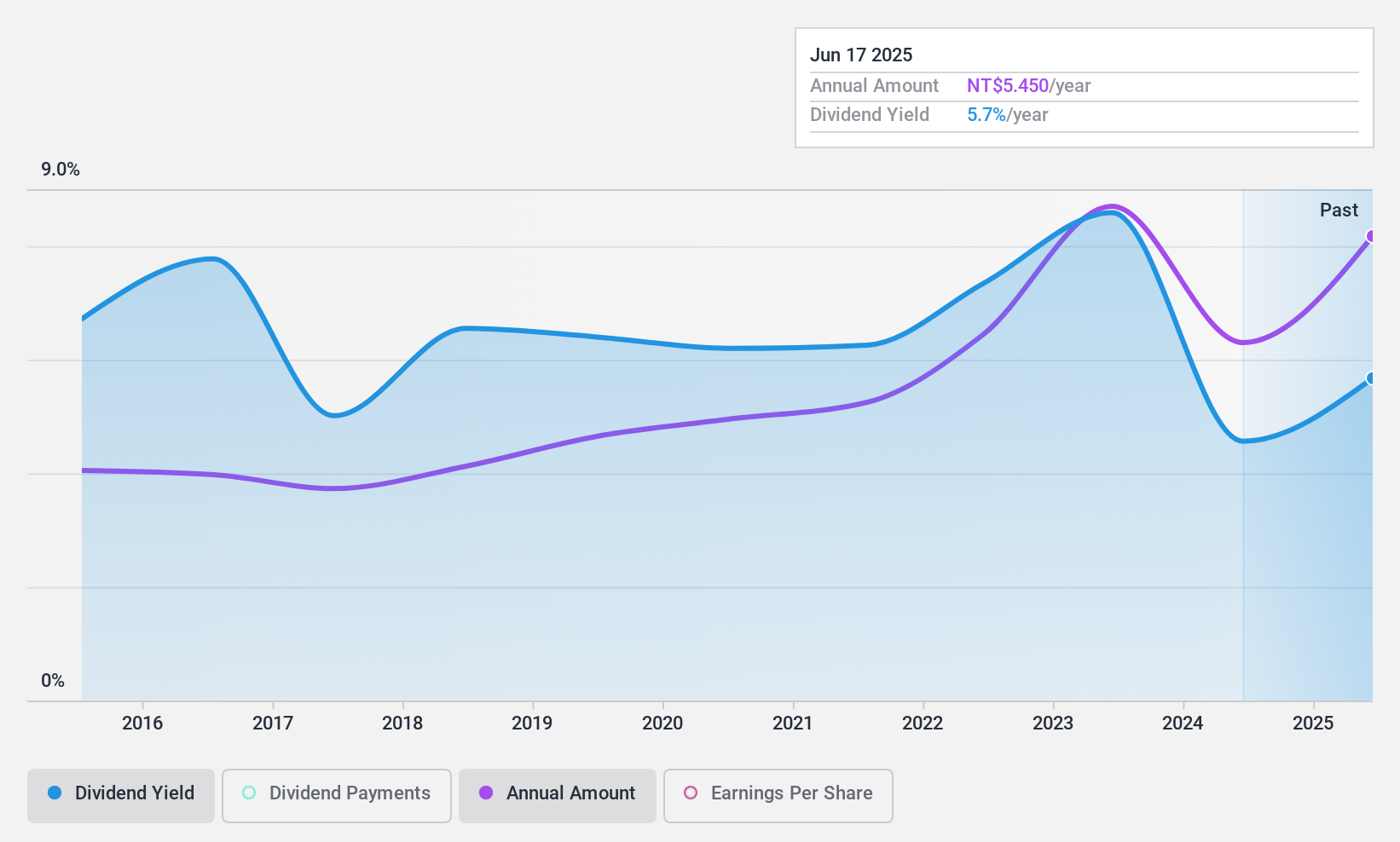

Asia Tech Image (TPEX:4974)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Tech Image Inc. manufactures and sells contact image sensor modules in Taiwan and China, with a market cap of NT$6.55 billion.

Operations: Asia Tech Image Inc.'s revenue segments are comprised of NT$5.44 billion from Asia and NT$3.86 billion from Domestic markets.

Dividend Yield: 4.4%

Asia Tech Image's recent earnings report shows solid growth, with net income and sales increasing significantly year-over-year. Despite trading below estimated fair value, the dividend yield is slightly below the top 25% in Taiwan. The dividend payout ratio of 67.8% suggests dividends are covered by earnings and cash flows, yet a history of volatility in payments may concern investors seeking stability. While dividends have grown over ten years, past unreliability remains a factor to consider.

- Take a closer look at Asia Tech Image's potential here in our dividend report.

- According our valuation report, there's an indication that Asia Tech Image's share price might be on the cheaper side.

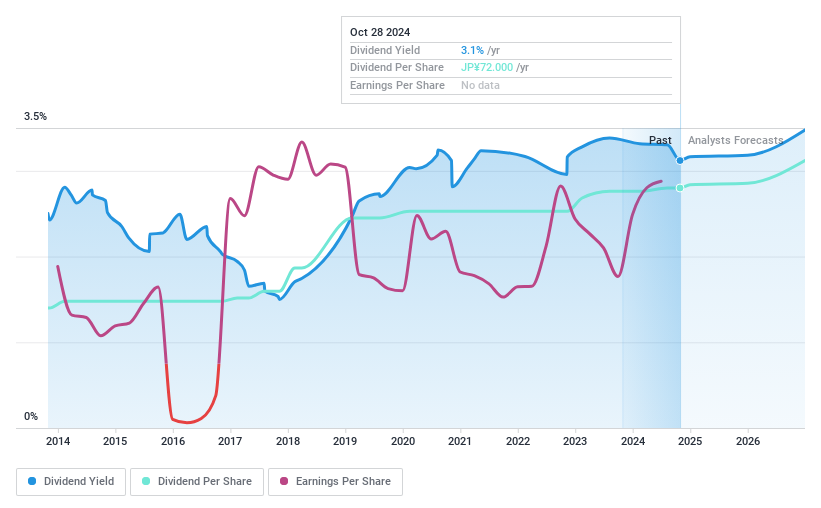

Kirin Holdings Company (TSE:2503)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kirin Holdings Company, Limited operates in the food and beverages, pharmaceuticals, and health science sectors with a market cap of ¥1.73 trillion.

Operations: Kirin Holdings Company, Limited's revenue segments include Japan Beer and Spirits at ¥713.87 billion, Pharmaceuticals at ¥498.98 billion, and Japan Non-Alcoholic Beverages at ¥293.67 billion.

Dividend Yield: 3.3%

Kirin Holdings' dividend payments have been reliable and stable over the past decade, with a consistent growth trajectory. The company's dividends are well-covered by earnings and cash flows, maintaining a sustainable payout ratio of 54%. Despite trading at 41% below its estimated fair value, the dividend yield of 3.33% is lower than the top tier in Japan. Kirin's high debt level may pose some risk, but strong earnings growth supports its financial position.

- Delve into the full analysis dividend report here for a deeper understanding of Kirin Holdings Company.

- Our valuation report unveils the possibility Kirin Holdings Company's shares may be trading at a discount.

Summing It All Up

- Access the full spectrum of 1970 Top Dividend Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4974

Asia Tech Image

Manufactures and sells contact image sensor modules in Taiwan and China.

Flawless balance sheet, good value and pays a dividend.