- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6187

Exploring Three High Growth Tech Stocks For Potential Portfolio Enhancement

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a notable upswing, with key indices such as the Dow Jones Industrial Average and S&P 500 reaching record intraday highs. This momentum in the broader market, despite geopolitical tensions and tariff concerns, underscores the potential for small-cap stocks to enhance portfolios through strategic exposure to high-growth sectors like technology. In this context, identifying tech stocks that demonstrate robust growth prospects and resilience amid economic shifts can be crucial for investors looking to capitalize on current market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 28.04% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

DongHua Testing Technology (SZSE:300354)

Simply Wall St Growth Rating: ★★★★★★

Overview: DongHua Testing Technology Co., Ltd. specializes in providing structural mechanical property testing services in China with a market capitalization of CN¥4.99 billion.

Operations: DongHua Testing Technology generates revenue primarily from its instrumentation testing segment, which amounts to CN¥426.74 million.

DongHua Testing Technology has demonstrated robust financial performance with a notable increase in net income to CNY 99.04 million from CNY 82.33 million year-over-year, reflecting strong operational execution. This growth is underpinned by a significant revenue jump of 35.6% annually, outpacing the broader CN market's growth rate of 13.8%. Additionally, the company's commitment to innovation is evident from its R&D investments, crucial for sustaining its competitive edge in the fast-evolving tech landscape. Looking ahead, DongHua's future appears promising with earnings expected to surge by an impressive 41% per year. Such growth not only surpasses the CN market forecast of 26.1% but also positions DongHua favorably against industry peers experiencing slower momentum. This trajectory suggests that while challenges remain, particularly in matching industry average earnings growth rates due to past negative performance trends (-29.6%), the company’s strategic focus on enhancing its technological capabilities and expanding market reach could yield substantial rewards.

- Get an in-depth perspective on DongHua Testing Technology's performance by reading our health report here.

Gain insights into DongHua Testing Technology's past trends and performance with our Past report.

Long Young Electronic (Kunshan) (SZSE:301389)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Long Young Electronic (Kunshan) Co., Ltd. operates in the packaging and containers industry with a market cap of CN¥4.79 billion.

Operations: The company generates revenue primarily from its packaging and containers segment, amounting to CN¥275.97 million.

Long Young Electronic (Kunshan) has demonstrated a dynamic growth trajectory with its revenue forecast to surge by 66.6% annually, significantly outpacing the broader Chinese market's growth rate of 13.8%. This performance is underlined by an aggressive R&D investment strategy, crucial for maintaining competitive advantage in the rapidly evolving tech sector. Despite facing challenges with a net income drop to CNY 52.66 million from CNY 79.81 million year-over-year, the firm's commitment to innovation and market expansion is evident from its substantial R&D expenditure which remains a pivotal element of its strategy moving forward.

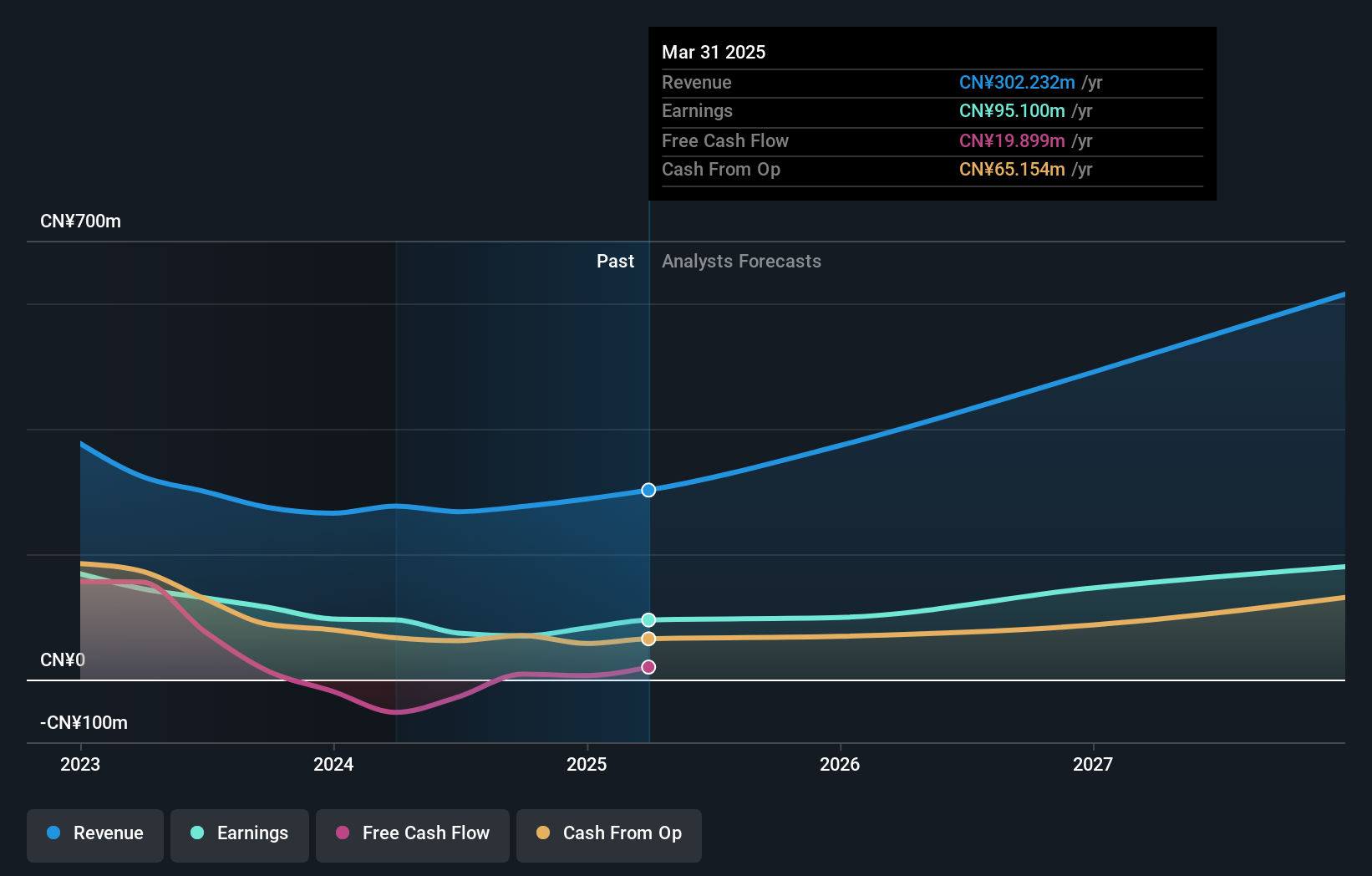

All Ring Tech (TPEX:6187)

Simply Wall St Growth Rating: ★★★★★★

Overview: All Ring Tech Co., Ltd. specializes in the design, manufacture, and assembly of automation machines in Taiwan and China, with a market capitalization of NT$43.28 billion.

Operations: All Ring Tech Co., Ltd. generates revenue primarily from its subsidiary, All Ring Technology Co., Ltd., contributing NT$4.40 billion, and WAN Run Jing Ji Co., Ltd., adding NT$684.53 million. The company operates within the automation machinery sector in Taiwan and China, focusing on design, manufacturing, and assembly processes.

All Ring Tech has emerged as a formidable contender in the tech arena, with a notable 21.6% annual revenue growth projection outpacing the broader Taiwanese market's 12.1% expansion. This growth is underpinned by robust R&D investments, which have surged to represent a significant portion of its revenue, aligning with industry trends towards innovation-driven strategies. Recently, the company showcased its advancements and strategic direction at multiple high-profile conferences, signaling strong future prospects amid competitive pressures. Its commitment to research has not only fueled impressive earnings growth of 26.3% annually but also positions it well for sustained market relevance and agility in adapting to technological shifts.

- Click to explore a detailed breakdown of our findings in All Ring Tech's health report.

Gain insights into All Ring Tech's historical performance by reviewing our past performance report.

Make It Happen

- Delve into our full catalog of 1284 High Growth Tech and AI Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6187

All Ring Tech

Engages in the design, manufacture, and assembly of automation machines in Taiwan and China.

Exceptional growth potential with solid track record.