- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3533

Subdued Growth No Barrier To Lotes Co., Ltd (TWSE:3533) With Shares Advancing 26%

The Lotes Co., Ltd (TWSE:3533) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 58% in the last year.

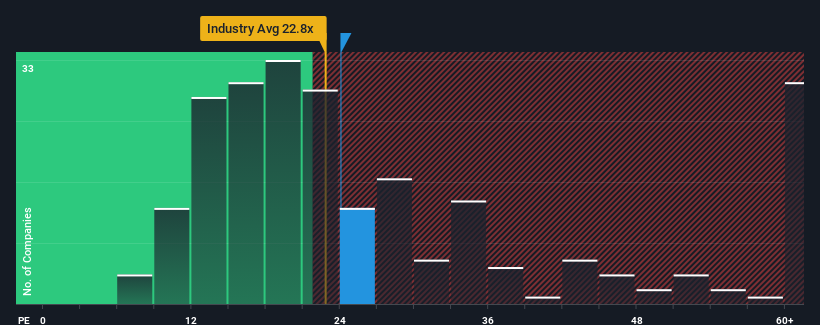

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Lotes' P/E ratio of 24.1x, since the median price-to-earnings (or "P/E") ratio in Taiwan is also close to 22x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With only a limited decrease in earnings compared to most other companies of late, Lotes has been doing relatively well. It might be that many expect the comparatively superior earnings performance to vanish, which has kept the P/E from rising. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue outplaying the market.

See our latest analysis for Lotes

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Lotes would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 3.3% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 100% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 20% over the next year. With the market predicted to deliver 23% growth , the company is positioned for a weaker earnings result.

With this information, we find it interesting that Lotes is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

Its shares have lifted substantially and now Lotes' P/E is also back up to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Lotes' analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Lotes has 3 warning signs we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3533

Lotes

Designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives