- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3481

Innolux Corporation's (TWSE:3481) Business And Shares Still Trailing The Industry

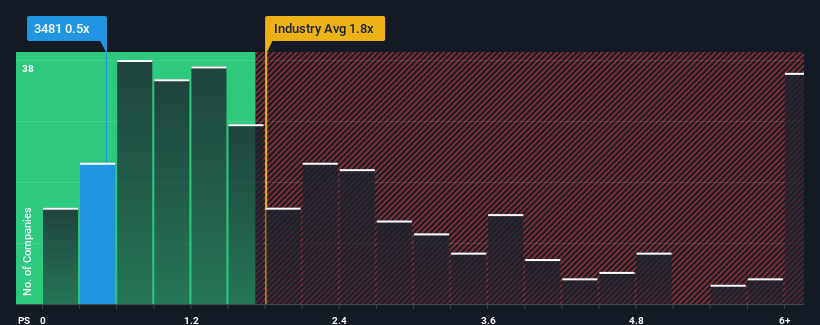

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Innolux Corporation (TWSE:3481) is a stock worth checking out, seeing as almost half of all the Electronic companies in Taiwan have P/S ratios greater than 1.8x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Innolux

What Does Innolux's Recent Performance Look Like?

Innolux could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Innolux.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Innolux's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 4.8%. However, this wasn't enough as the latest three year period has seen an unpleasant 38% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 2.4% as estimated by the six analysts watching the company. With the industry predicted to deliver 34% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Innolux's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Innolux maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - Innolux has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3481

Innolux

Provides electronic components in Taiwan, Hong Kong, the United States, Europe, China, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives