High Growth Tech And 2 Other Promising Stocks With Strong Potential

Reviewed by Simply Wall St

In a week where most major stock indexes declined, the technology-heavy Nasdaq Composite stood out by reaching a new record high, highlighting the ongoing strength of growth stocks compared to their value counterparts. As global markets navigate economic shifts and interest rate adjustments, investors are increasingly focused on identifying stocks with strong growth potential and resilience in dynamic market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1269 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

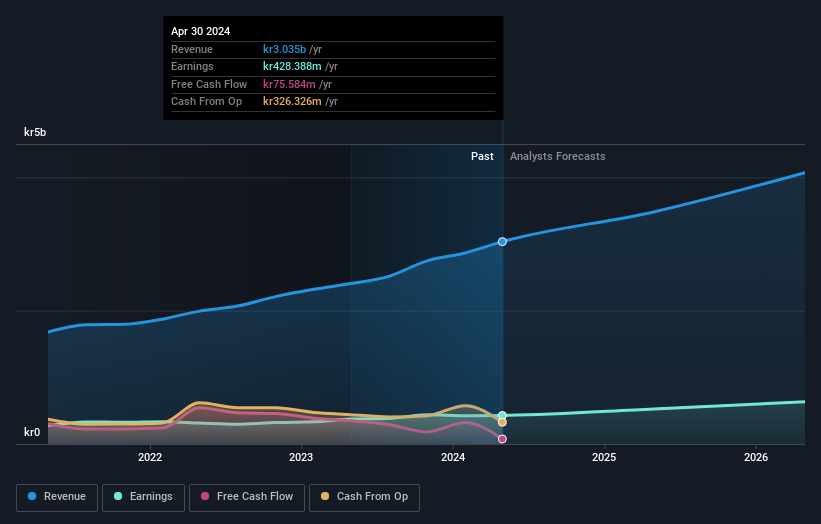

Sectra (OM:SECT B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sectra AB (publ) is a company that offers solutions in the medical IT and cybersecurity sectors across Sweden, the United Kingdom, the Netherlands, and other parts of Europe, with a market capitalization of approximately SEK51.38 billion.

Operations: Imaging IT Solutions is the primary revenue driver for Sectra AB, contributing SEK2.61 billion to its operations, followed by Secure Communications at SEK425.85 million. The company operates within the medical IT and cybersecurity sectors across Europe.

Sectra, a Swedish firm specializing in medical imaging IT and cybersecurity, has shown robust financial performance with significant revenue growth of 15.3% per year, outpacing the Swedish market's average of 1.3%. Despite a challenging fiscal period where net income dropped to SEK 168.16 million from SEK 212.12 million year-over-year, Sectra continues to innovate in digital healthcare solutions. Recent expansions include the integration of digital pathology into Norway's Helse Nord RHF healthcare region and new enterprise imaging contracts with major hospitals like AZ Sint-Lucas Gent and UZ Leuven in Belgium. These strategic moves highlight Sectra's commitment to enhancing diagnostic processes and patient care through advanced technology solutions, positioning it well for future growth despite short-term earnings volatility.

- Navigate through the intricacies of Sectra with our comprehensive health report here.

Gain insights into Sectra's historical performance by reviewing our past performance report.

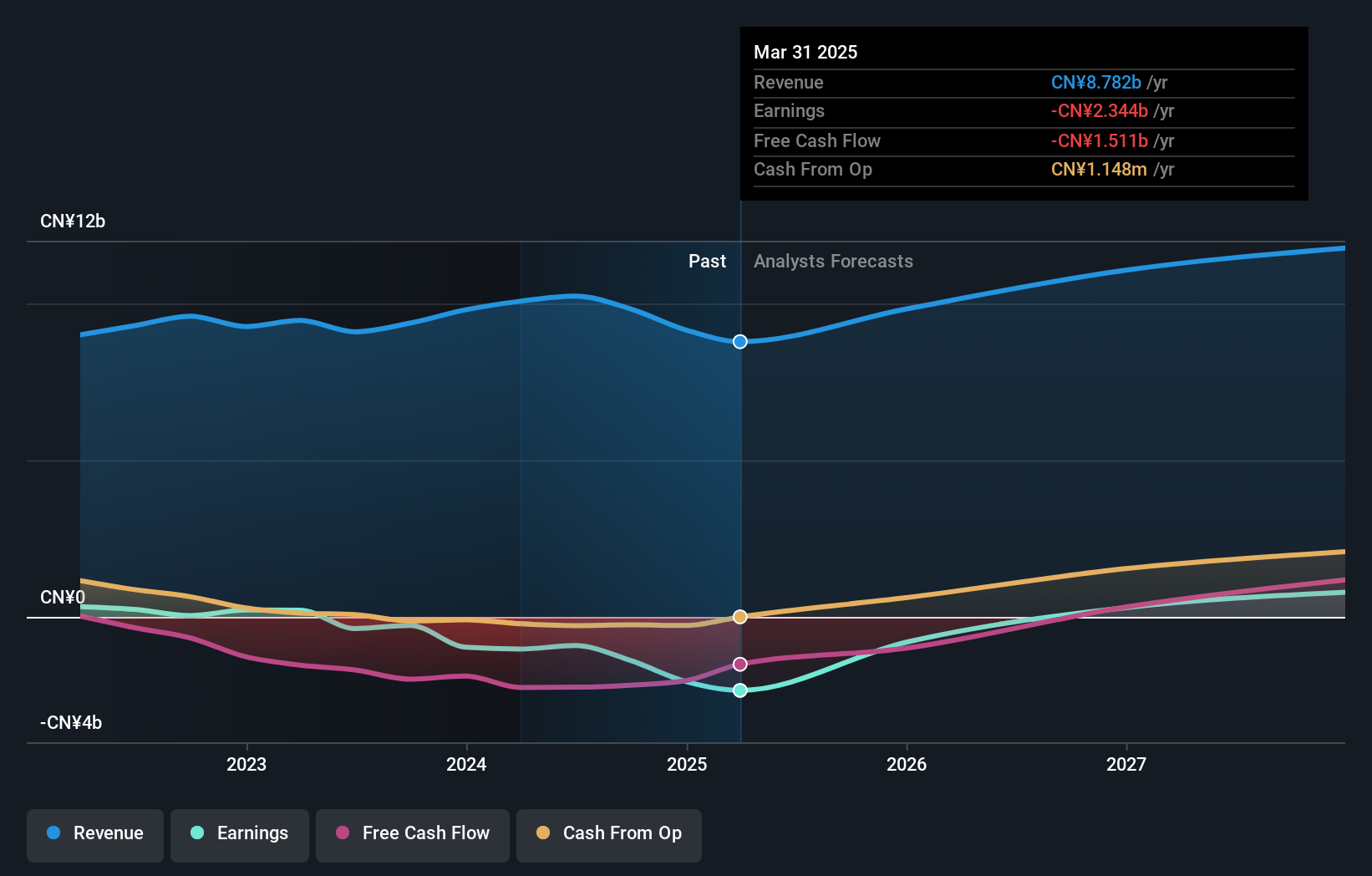

Yonyou Network TechnologyLtd (SHSE:600588)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yonyou Network Technology Co., Ltd., along with its subsidiaries, offers digital software and services to enterprises and public organizations both in China and internationally, with a market cap of CN¥40.73 billion.

Operations: The company generates revenue primarily from its Cloud Service and Software Business, which contributed CN¥9.83 billion.

Yonyou Network Technology has demonstrated resilience amid challenges, with a notable revenue increase to CNY 5.738 billion, up slightly from the previous year. Despite facing a net loss widening to CNY 1.455 billion, the company is actively managing its capital through strategic share buybacks, repurchasing 100,000 shares recently. This approach underscores its commitment to shareholder value while navigating current financial headwinds. Moreover, Yonyou's focus on expanding its software solutions portfolio is expected to bolster future profitability, evidenced by an impressive forecasted earnings growth of 122.27% annually.

- Click to explore a detailed breakdown of our findings in Yonyou Network TechnologyLtd's health report.

Understand Yonyou Network TechnologyLtd's track record by examining our Past report.

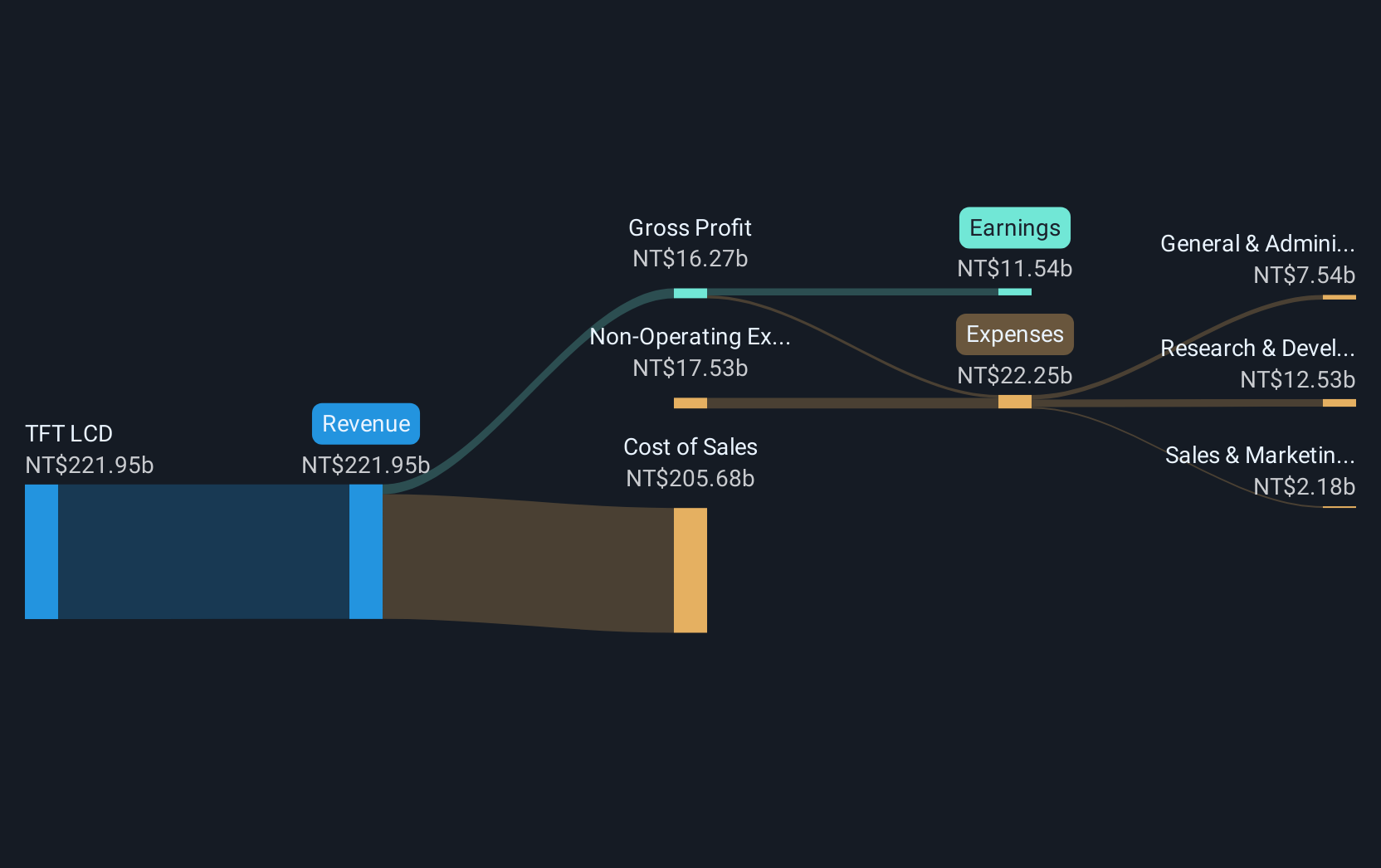

Innolux (TWSE:3481)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innolux Corporation, along with its subsidiaries, engages in the research, design, development, manufacturing, and sale of LCD modules and monitors including color filters and TFT-LCD panels with a market cap of NT$121.77 billion.

Operations: Innolux generates revenue primarily from its TFT LCD segment, which accounts for NT$216.23 billion. The company focuses on the production and sale of various display technologies, including low temperature poly-silicon TFT-LCDs and panels.

Innolux has demonstrated adaptability in a fluctuating market, evidenced by its recent unaudited revenue of TWD 18.8 billion for November 2024, marking an 11.3% monthly and 7.8% yearly increase. Despite a challenging past, the company turned a profit this quarter with TWD 421 million compared to last year's loss, showcasing significant recovery and operational improvement. With earnings forecasted to grow by an impressive 61.79% annually, Innolux is strategically positioning itself for sustainable growth through focused R&D efforts and market expansion strategies evident from their active participation in major industry conferences like the Morgan Stanley Asia Pacific Summit and Nomura Taiwan Corporate Day.

- Unlock comprehensive insights into our analysis of Innolux stock in this health report.

Evaluate Innolux's historical performance by accessing our past performance report.

Next Steps

- Explore the 1269 names from our High Growth Tech and AI Stocks screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600588

Yonyou Network TechnologyLtd

Provides digital software and services to enterprises and public organizations in China and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives