- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3416

Global Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a mix of record highs in the U.S. and cautious optimism in Europe, investors are navigating an environment marked by robust job growth and fluctuating trade dynamics. In this backdrop, dividend stocks present a compelling option for those seeking steady income streams, as they often offer stability through regular payouts regardless of market volatility.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.26% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.04% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.12% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.40% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.65% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.10% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 5.90% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 1540 stocks from our Top Global Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

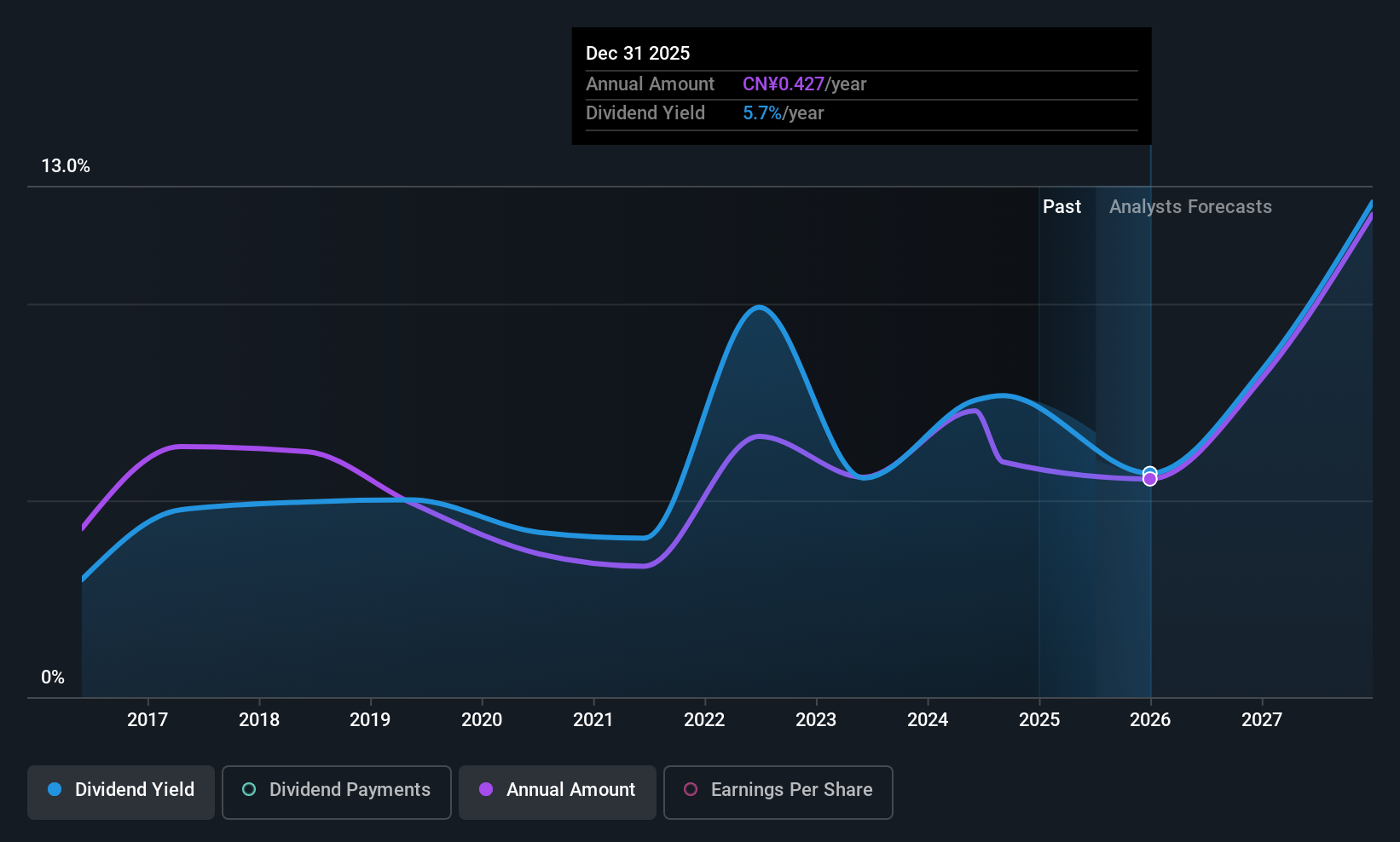

Hla Group (SHSE:600398)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hla Group Corp., Ltd. is a Chinese company that manufactures and sells menswear, womenswear, kids' apparel, professional attire, and home furnishing products with a market cap of CN¥34.72 billion.

Operations: Hla Group Corp., Ltd. generates revenue primarily from the sales of clothing supplies, amounting to CN¥20.97 billion.

Dividend Yield: 4.8%

Hla Group's dividend yield of 4.8% places it among the top 25% of dividend payers in China, supported by earnings and cash flows with payout ratios of 87.3% and 83.2%, respectively. Despite this, its dividend history has been volatile over the past decade, with significant annual drops exceeding 20%. Recent Q1 results show stable revenue growth to CNY 6.19 billion and improved net income at CNY 935.2 million, indicating potential for future stability in payouts.

- Unlock comprehensive insights into our analysis of Hla Group stock in this dividend report.

- Our valuation report here indicates Hla Group may be undervalued.

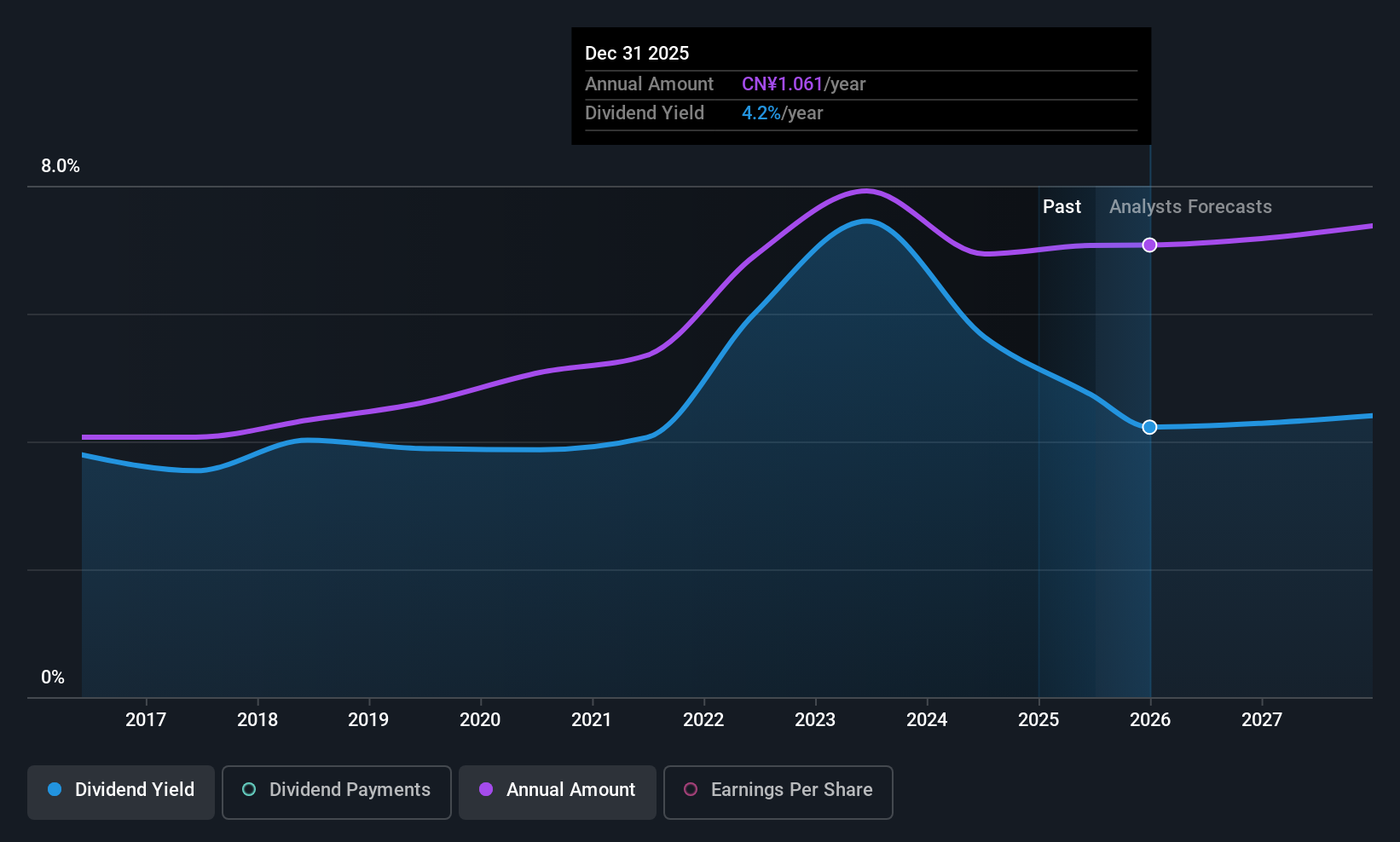

Industrial Bank (SHSE:601166)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Industrial Bank Co., Ltd. offers banking services in the People’s Republic of China and has a market cap of CN¥525.47 billion.

Operations: Industrial Bank Co., Ltd. generates revenue primarily from its Commercial Bank segment, amounting to CN¥151.08 billion.

Dividend Yield: 4.2%

Industrial Bank offers a dividend yield of 4.22%, ranking in the top 25% of Chinese dividend payers, with a stable and growing payout history over the past decade. Its dividends are well covered by earnings, evidenced by a low payout ratio of 30.4%, ensuring sustainability. Recent Q1 results show net interest income at CNY 37.72 billion, though net income slightly decreased to CNY 23.8 billion from the previous year, maintaining overall financial stability for dividends.

- Get an in-depth perspective on Industrial Bank's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Industrial Bank's current price could be quite moderate.

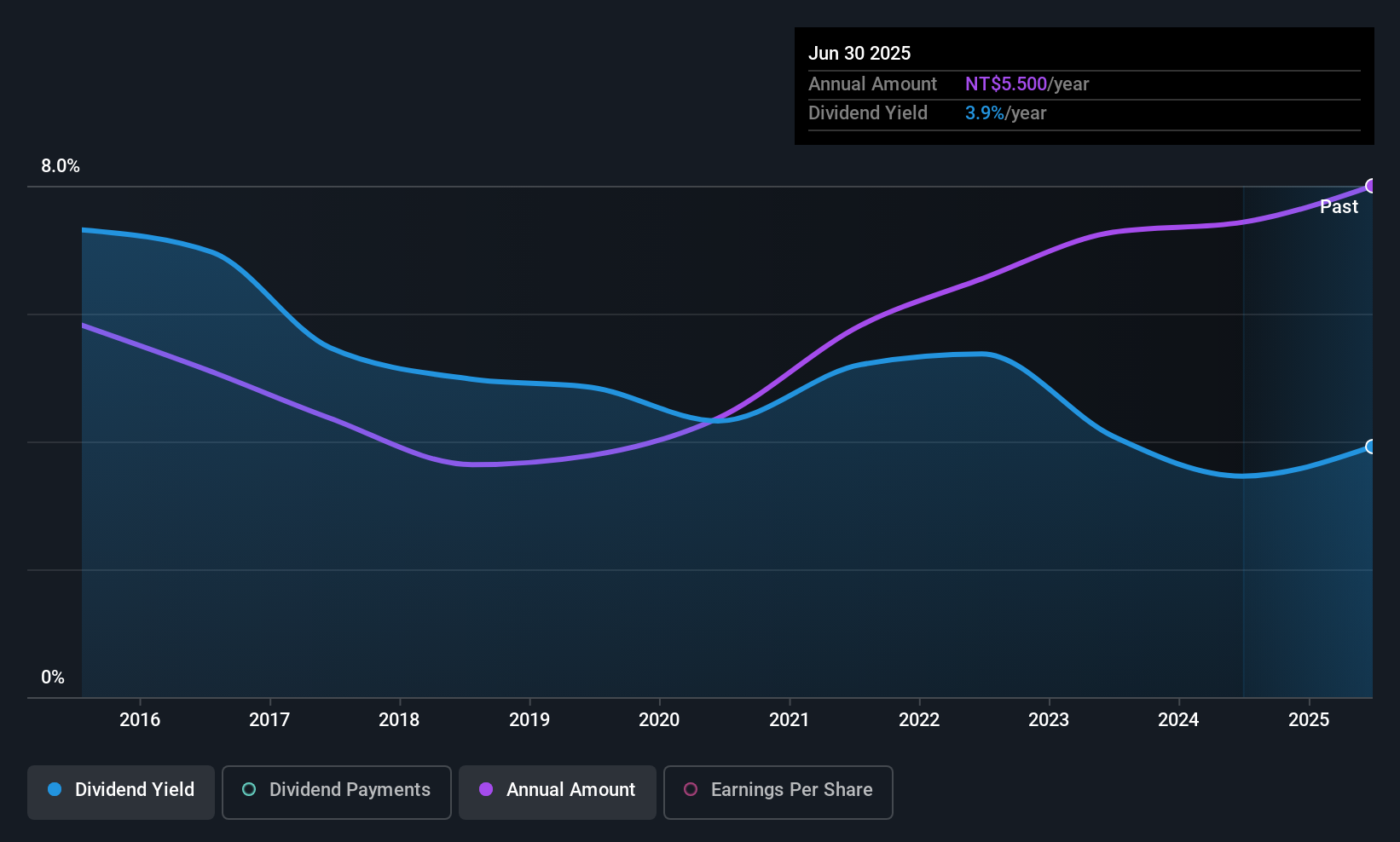

Winmate (TWSE:3416)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Winmate Inc. specializes in the research, development, manufacture, and sales of rugged display equipment and mobile computers across Europe, Asia, the United States, and other international markets with a market cap of NT$11.48 billion.

Operations: Winmate Inc.'s revenue is primarily derived from its Liquid Crystal Display Application Equipment and Embedded System Modules segment, which generated NT$3.16 billion.

Dividend Yield: 3.8%

Winmate's dividend yield of 3.79% is below the top 25% in Taiwan but remains reliable and stable over the past decade. Dividends are covered by earnings (76.5% payout ratio) and cash flows (86.5% cash payout ratio), ensuring sustainability. Recent approval of a TWD 5.5 per share dividend, including a TWD 1 distribution from capital surplus, highlights continued commitment to shareholder returns amidst growing revenues and profits, with Q1 sales increasing to TWD 800.87 million.

- Click here to discover the nuances of Winmate with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Winmate's current price could be inflated.

Where To Now?

- Click through to start exploring the rest of the 1537 Top Global Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Winmate might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3416

Winmate

Engages in the research and development, manufacture, and sales of rugged display equipment and rugged mobile computer in Europe, Asia, the United States, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives