- Austria

- /

- Construction

- /

- WBAG:STR

3 Reliable Dividend Stocks Offering Yields Up To 9.7%

Reviewed by Simply Wall St

As global markets experience mixed reactions with major indices reaching record highs and growth stocks outperforming value shares, investors are keenly observing economic indicators such as job growth and potential interest rate changes by central banks. Amidst this backdrop, dividend stocks continue to attract attention for their ability to provide steady income streams, making them a compelling choice for those seeking stability in an unpredictable market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.95% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.35% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.78% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.85% | ★★★★★★ |

Click here to see the full list of 1936 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

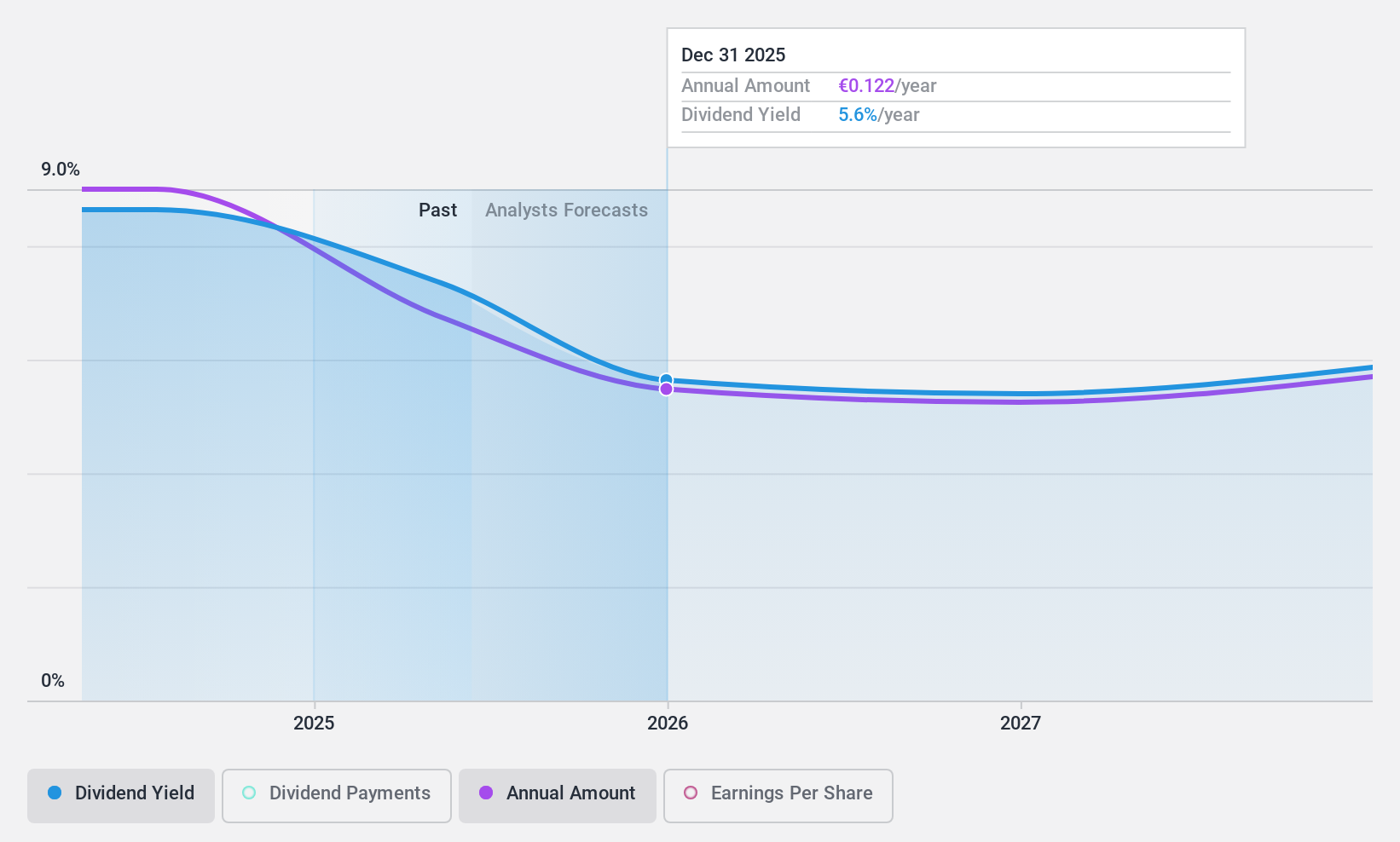

Sogefi (BIT:SGF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sogefi S.p.A. is a company that designs, develops, and produces filtration systems, suspension components, air management products, and engine cooling systems for the automotive industry across Europe, South America, North America, and Asia with a market cap of €244.61 million.

Operations: Sogefi S.p.A.'s revenue is primarily derived from its Suspensions segment, which generated €546.31 million, and its Air and Cooling segment, which contributed €479.15 million.

Dividend Yield: 9.7%

Sogefi's recent inclusion in the S&P Global BMI Index highlights its growing recognition. Despite a drop in quarterly sales and net income, the company reported a significant increase in nine-month earnings to €149.5 million. Though new to dividends, Sogefi's payouts are well-covered by earnings and cash flows, with payout ratios of 33.2% and 39.9%, respectively. Its dividend yield is among Italy's top tier at 9.71%, but future growth remains uncertain amid forecasted earnings declines.

- Navigate through the intricacies of Sogefi with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Sogefi's share price might be too pessimistic.

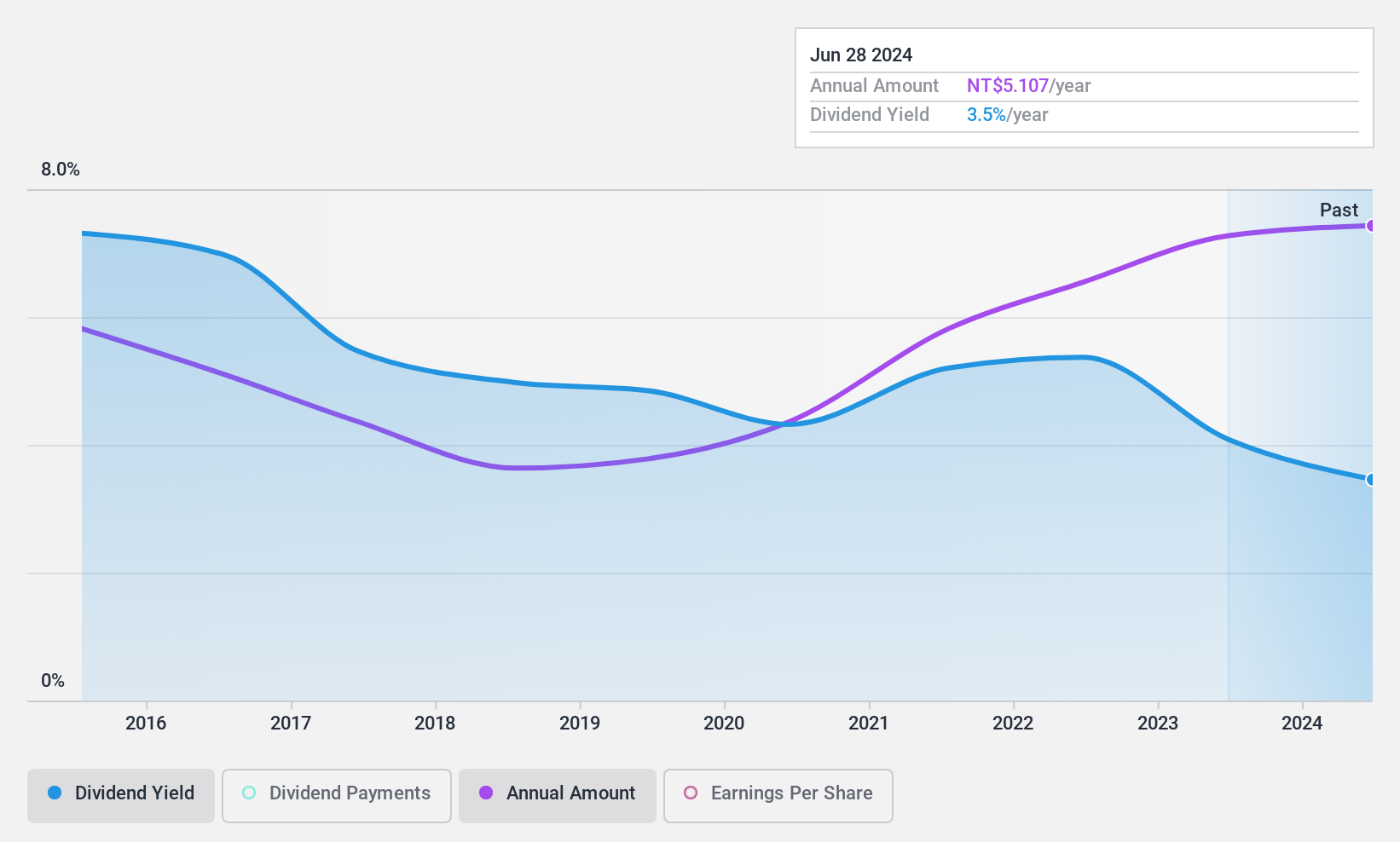

Winmate (TWSE:3416)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Winmate Inc. is involved in the research, development, manufacture, and sales of rugged display equipment and rugged mobile computers globally, with a market cap of NT$12.68 billion.

Operations: Winmate Inc.'s revenue segments include the sale of rugged display equipment and rugged mobile computers across Europe, Asia, the United States, and other international markets.

Dividend Yield: 3.2%

Winmate Inc.'s recent earnings report shows a modest increase in quarterly sales and net income, yet its dividend yield of 3.21% lags behind the top 25% in Taiwan. Despite stable and growing dividends over the past decade, concerns arise as dividends are not well-covered by free cash flows, with a high cash payout ratio of 128.1%. The company is trading below estimated fair value but has diluted shareholders recently, impacting dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Winmate.

- Our comprehensive valuation report raises the possibility that Winmate is priced lower than what may be justified by its financials.

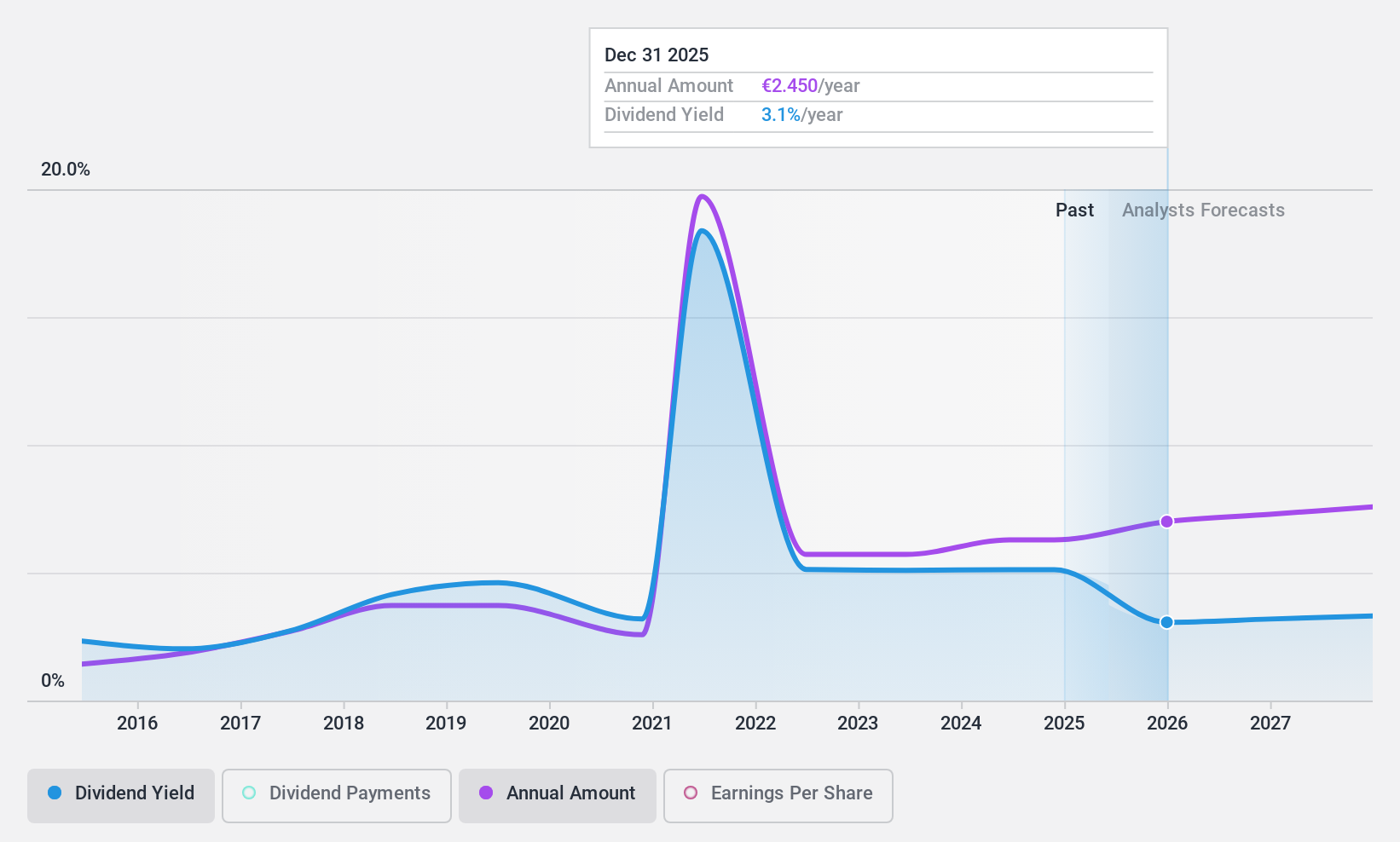

Strabag (WBAG:STR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Strabag SE is a global construction company with a market cap of €4.86 billion.

Operations: Strabag SE generates its revenue from three main segments: North + West (€7.30 billion), South + East (€7.53 billion), and International + Special Divisions (€2.88 billion).

Dividend Yield: 5.3%

Strabag's dividend payments are well-covered by earnings and cash flows, with payout ratios of 35.4% and 39%, respectively. However, the dividends have been volatile over the past decade, making them unreliable despite a history of growth. The stock trades at a good value compared to peers but offers a lower yield (5.35%) than Austria's top dividend payers (6.17%). Recent shareholder dilution further complicates its dividend sustainability outlook.

- Dive into the specifics of Strabag here with our thorough dividend report.

- Our valuation report unveils the possibility Strabag's shares may be trading at a discount.

Summing It All Up

- Gain an insight into the universe of 1936 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WBAG:STR

Strabag

Engages in the construction projects in the fields of transportation infrastructures, building construction, and civil engineering.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives