- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

High Growth Tech And 2 Other Promising Stocks To Watch

Reviewed by Simply Wall St

As global markets grapple with economic slowdown concerns and a volatile labor market, the S&P 500 Index recently experienced its steepest weekly drop in 18 months. Despite these challenges, certain sectors continue to show promise, particularly high-growth tech stocks that have the potential to outperform even in uncertain times. Identifying a good stock in this environment often involves looking for companies with robust growth prospects, strong fundamentals, and resilience against broader market volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

| Travere Therapeutics | 26.68% | 68.81% | ★★★★★★ |

| UTI | 114.97% | 134.59% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Asia Vital Components (TWSE:3017)

Simply Wall St Growth Rating: ★★★★★★

Overview: Asia Vital Components Co., Ltd. specializes in providing thermal solutions globally and has a market cap of approximately NT$199.70 billion.

Operations: The company generates revenue primarily through its Overseas Operating Department (NT$66.65 billion) and Integrated Management Division (NT$48.87 billion), focusing on thermal solutions worldwide. The market cap stands at approximately NT$199.70 billion.

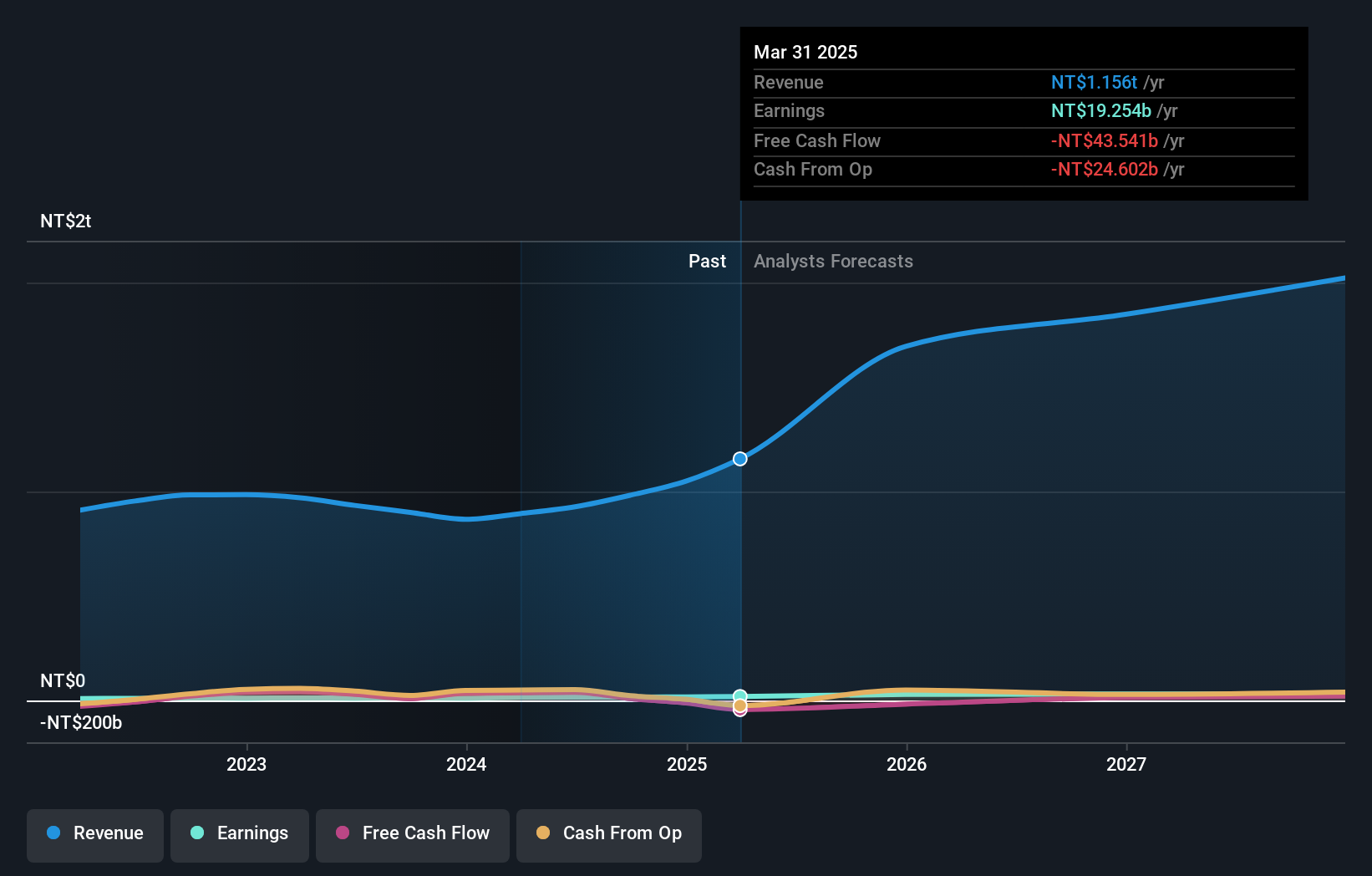

Asia Vital Components has shown impressive growth, with earnings increasing by 45.9% over the past year and a forecasted annual profit growth of 28.5%. Their revenue is expected to grow at an annual rate of 23.2%, outpacing the industry average significantly. Recent earnings reports highlight a strong performance with Q2 sales reaching TWD 16,483.86 million and net income at TWD 1,947.26 million, up from TWD 14,870.89 million and TWD 1,201.43 million respectively in the previous year. The company’s commitment to innovation is evident from its substantial R&D investments aimed at enhancing product offerings in high-demand sectors like AI and software solutions; this strategic focus could drive future growth further. Additionally, Asia Vital Components has expanded its production capabilities by increasing plant size from five to eight stories with updated construction costs of RMB 127 million—an indication of their proactive approach to scaling operations efficiently amidst rising demand.

- Delve into the full analysis health report here for a deeper understanding of Asia Vital Components.

Gain insights into Asia Vital Components' past trends and performance with our Past report.

Wistron (TWSE:3231)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wistron Corporation, along with its subsidiaries, designs, manufactures, and sells information technology products globally and has a market cap of approximately NT$271.27 billion.

Operations: Wistron Corporation generates revenue primarily through its Research and Development and Manufacturing Services Operations, amounting to NT$890.35 billion. The company operates in Taiwan, Asia, and internationally.

Wistron Corporation has shown strong financial performance, with earnings growing by 42.6% over the past year and an expected annual profit growth of 22.3%. Revenue is forecasted to grow at 15.8% per year, outpacing the Taiwan market's average of 11.6%. Their recent partnership with Zettabyte to build Taiwan's first Hyperscale AI Data Center highlights their commitment to innovation in AI computing, aligning with NVIDIA's advanced platforms. This strategic move could significantly enhance Taiwan’s AI infrastructure and global competitiveness.

- Navigate through the intricacies of Wistron with our comprehensive health report here.

Explore historical data to track Wistron's performance over time in our Past section.

Wiwynn (TWSE:6669)

Simply Wall St Growth Rating: ★★★★★★

Overview: Wiwynn Corporation manufactures and sells servers and storage products for cloud infrastructure and hyperscale data centers globally, with a market cap of NT$288.49 billion.

Operations: Wiwynn Corporation generates revenue primarily from the sale of computer hardware, amounting to NT$258.48 billion. The company's operations span the United States, Europe, Asia, and other international markets.

Wiwynn's revenue is forecasted to grow 31.5% annually, significantly outpacing the Taiwan market's average of 11.6%. Their recent Q2 earnings report showcased a net income increase to TWD 4.69 billion from TWD 2.62 billion year-over-year, reflecting strong operational performance. With substantial R&D expenses contributing to innovation, Wiwynn spent TWD 6.20 billion on new infrastructure projects in July 2024, indicating robust investment in future growth areas like AI and data centers.

- Click here to discover the nuances of Wiwynn with our detailed analytical health report.

Review our historical performance report to gain insights into Wiwynn's's past performance.

Seize The Opportunity

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1282 more companies for you to explore.Click here to unveil our expertly curated list of 1285 High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Community Narratives