- New Zealand

- /

- Healthcare Services

- /

- NZSE:RYM

Global Market Highlights 3 Stocks Priced Below Estimated Intrinsic Value

Reviewed by Simply Wall St

Amid easing trade tensions and better-than-expected earnings reports, global markets have shown resilience, with major indices like the S&P 500 and Nasdaq Composite experiencing notable gains. As investors navigate this optimistic yet uncertain landscape, identifying stocks priced below their estimated intrinsic value can offer potential opportunities for those seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lingbao Gold Group (SEHK:3330) | HK$9.09 | HK$18.05 | 49.6% |

| Renesas Electronics (TSE:6723) | ¥1712.50 | ¥3424.65 | 50% |

| Rheinmetall (XTRA:RHM) | €1645.00 | €3281.01 | 49.9% |

| Truecaller (OM:TRUE B) | SEK74.95 | SEK149.31 | 49.8% |

| BAWAG Group (WBAG:BG) | €97.00 | €190.65 | 49.1% |

| Integrated System Credit Consulting Fintech (BIT:ISC) | €1.56 | €3.10 | 49.6% |

| dormakaba Holding (SWX:DOKA) | CHF704.00 | CHF1396.69 | 49.6% |

| Innovent Biologics (SEHK:1801) | HK$54.30 | HK$108.54 | 50% |

| Yuhan (KOSE:A000100) | ₩110000.00 | ₩219128.89 | 49.8% |

| Expert.ai (BIT:EXAI) | €1.32 | €2.60 | 49.3% |

Let's dive into some prime choices out of the screener.

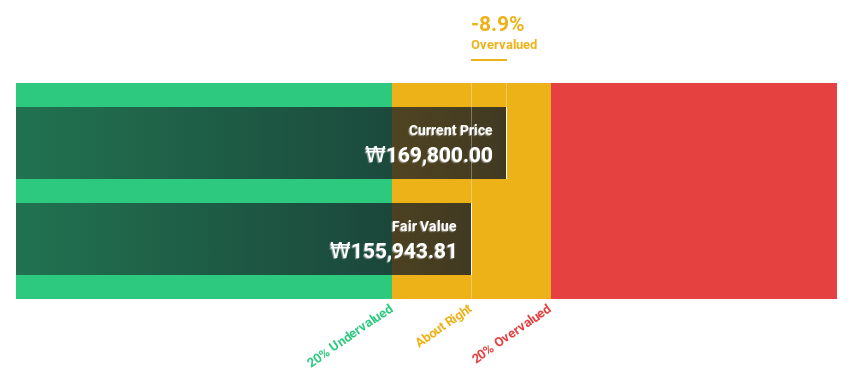

HD HYUNDAI Marine SolutionLTD (KOSE:A443060)

Overview: HD Hyundai Marine Solution Co., Ltd. offers integrated engineering-based services for Hyundai brand ships and has a market cap of ₩6.86 trillion.

Operations: Revenue Segments (in millions of ₩):

Estimated Discount To Fair Value: 41.1%

HD HYUNDAI Marine Solution LTD is trading at ₩158,800, significantly below its estimated fair value of ₩269,749.22. The company exhibits strong cash flow potential with earnings projected to grow 20.54% annually and revenue expected to increase by 14% per year, outpacing the KR market's growth rate of 7.4%. Despite a recent dividend payout and upcoming earnings call on April 24, the stock remains undervalued based on discounted cash flow analysis.

- Upon reviewing our latest growth report, HD HYUNDAI Marine SolutionLTD's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of HD HYUNDAI Marine SolutionLTD.

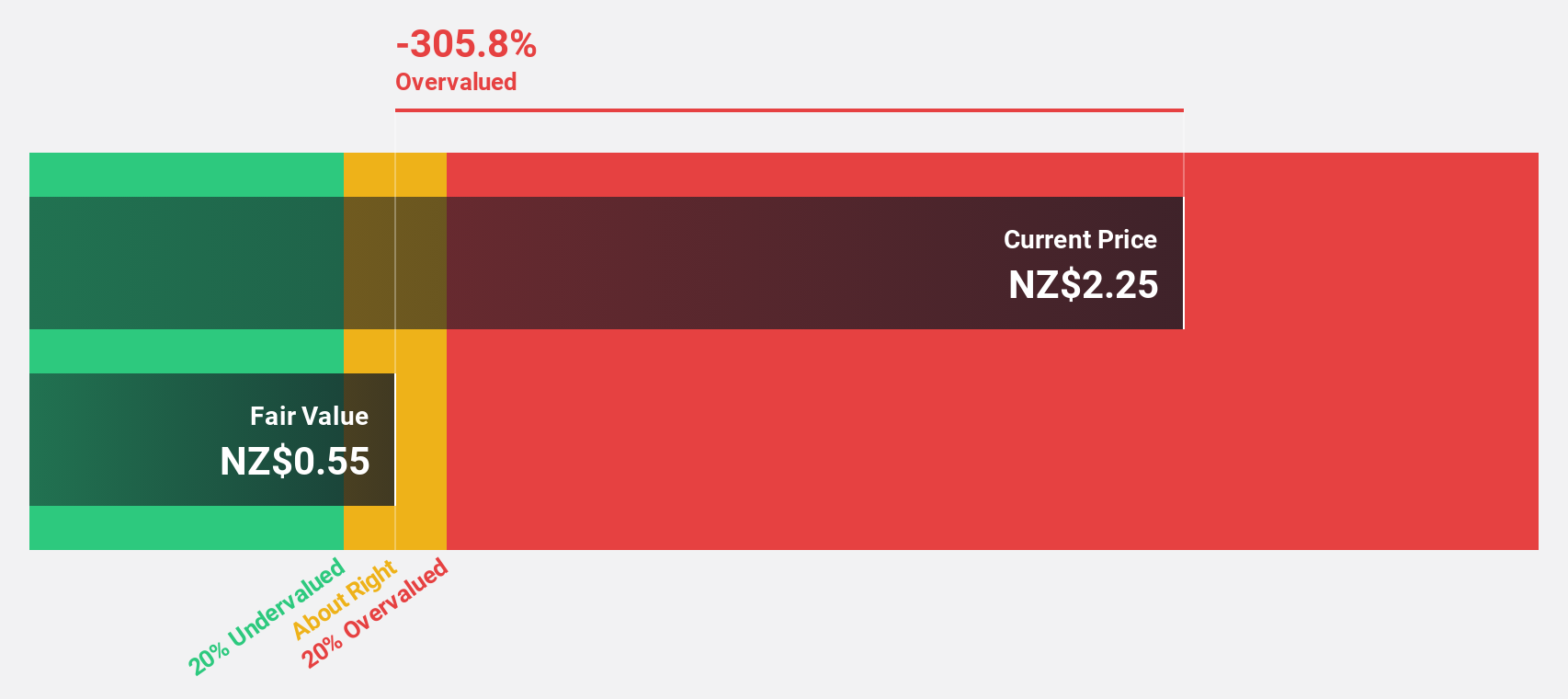

Ryman Healthcare (NZSE:RYM)

Overview: Ryman Healthcare Limited develops, owns, and operates integrated retirement villages, rest homes, and hospitals for elderly people in New Zealand and Australia, with a market cap of NZ$2.46 billion.

Operations: The company generates revenue of NZ$720.35 million from its integrated retirement villages for older people in New Zealand and Australia.

Estimated Discount To Fair Value: 43.8%

Ryman Healthcare is trading at NZ$2.45, significantly below its estimated fair value of NZ$4.36, despite recent follow-on equity offerings totaling over NZ$1 billion aimed at resetting its balance sheet. The company faces high debt levels and shareholder dilution but forecasts indicate revenue growth of 7.6% annually, outpacing the New Zealand market's 4.6%. Earnings are projected to grow by 43.92% per year, supporting its undervaluation based on cash flow analysis.

- Our comprehensive growth report raises the possibility that Ryman Healthcare is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Ryman Healthcare stock in this financial health report.

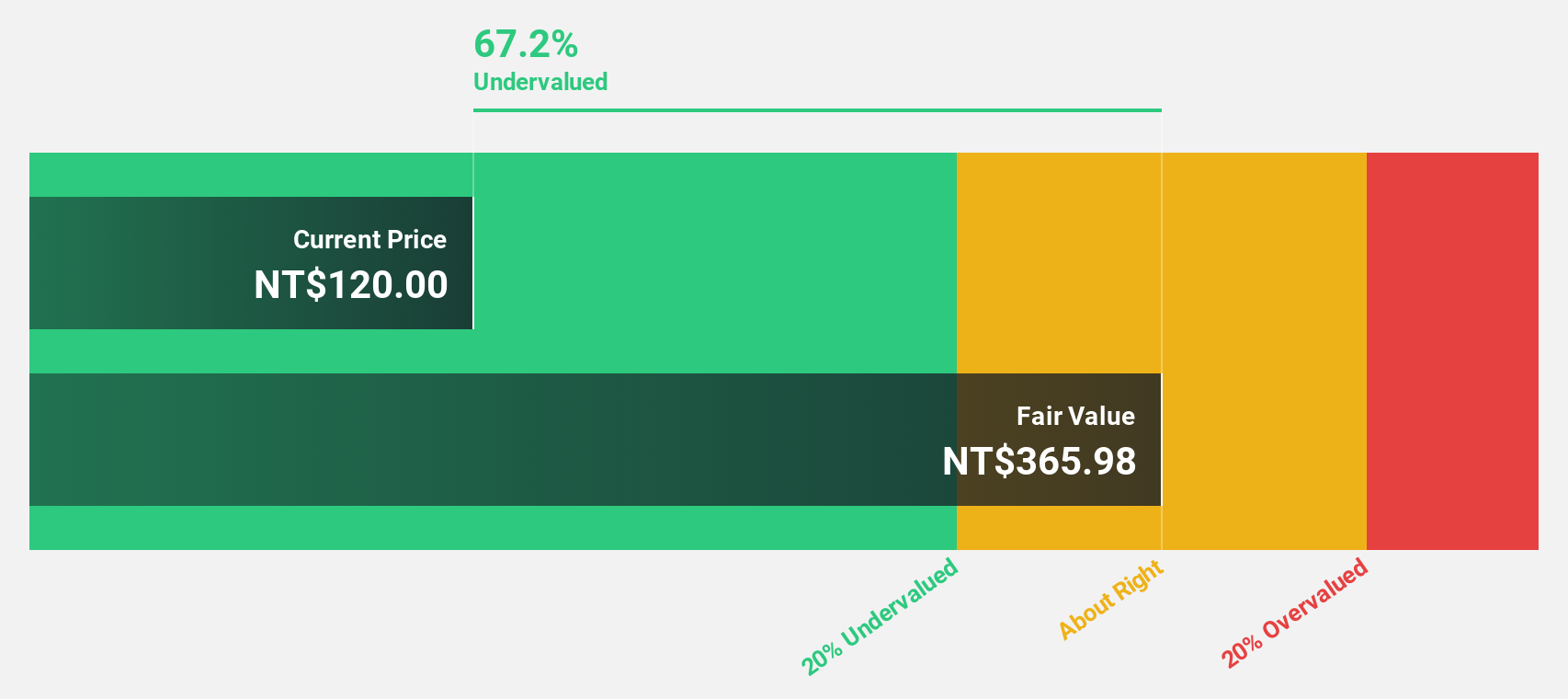

Wistron (TWSE:3231)

Overview: Wistron Corporation, along with its subsidiaries, designs, manufactures, and sells information technology products globally, with a market cap of NT$315.39 billion.

Operations: The company's revenue from Research and Development and Manufacturing Services Operations amounts to NT$1.02 trillion.

Estimated Discount To Fair Value: 25.6%

Wistron is trading at NT$106, well below its estimated fair value of NT$142.5, with earnings projected to grow significantly over the next three years. Despite a volatile share price and a dividend not fully covered by free cash flows, Wistron's revenue growth is expected to outpace the Taiwan market. Recent strategic expansions include establishing subsidiaries in Vietnam and the USA, enhancing its position in AI technologies through collaborations with NVIDIA.

- According our earnings growth report, there's an indication that Wistron might be ready to expand.

- Take a closer look at Wistron's balance sheet health here in our report.

Taking Advantage

- Navigate through the entire inventory of 453 Undervalued Global Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:RYM

Ryman Healthcare

Develops, owns, and operates integrated retirement villages, rest homes, and hospitals for the older people in New Zealand and Australia.

Reasonable growth potential with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)