- Taiwan

- /

- Communications

- /

- TWSE:3138

Auden Techno's (TWSE:3138) Anemic Earnings Might Be Worse Than You Think

A lackluster earnings announcement from Auden Techno Corp. (TWSE:3138) last week didn't sink the stock price. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

View our latest analysis for Auden Techno

Zooming In On Auden Techno's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

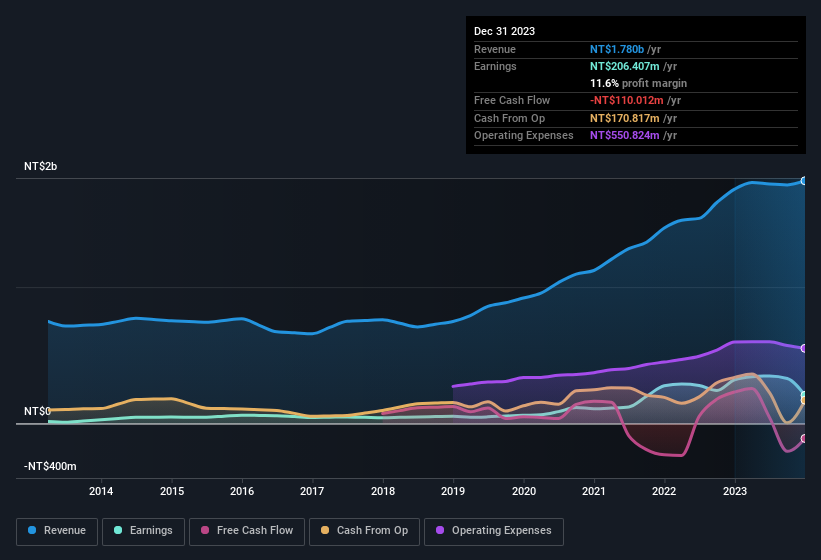

Over the twelve months to December 2023, Auden Techno recorded an accrual ratio of 0.34. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Even though it reported a profit of NT$206.4m, a look at free cash flow indicates it actually burnt through NT$110m in the last year. It's worth noting that Auden Techno generated positive FCF of NT$231m a year ago, so at least they've done it in the past. Unfortunately for shareholders, the company has also been issuing new shares, diluting their share of future earnings.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Auden Techno.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. Auden Techno expanded the number of shares on issue by 7.7% over the last year. Therefore, each share now receives a smaller portion of profit. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Auden Techno's EPS by clicking here.

A Look At The Impact Of Auden Techno's Dilution On Its Earnings Per Share (EPS)

Auden Techno has improved its profit over the last three years, with an annualized gain of 91% in that time. In comparison, earnings per share only gained 68% over the same period. Net profit actually dropped by 36% in the last year. But the EPS result was even worse, with the company recording a decline of 36%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If Auden Techno's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Our Take On Auden Techno's Profit Performance

In conclusion, Auden Techno has weak cashflow relative to earnings, which indicates lower quality earnings, and the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). Considering all this we'd argue Auden Techno's profits probably give an overly generous impression of its sustainable level of profitability. If you want to do dive deeper into Auden Techno, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 4 warning signs for Auden Techno (of which 1 is significant!) you should know about.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3138

Auden Techno

Engages in the design, manufacture, and sale of wireless communications in Taiwan, Mainland China, and internationally.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion