- Taiwan

- /

- Tech Hardware

- /

- TWSE:3054

LIWANLI Innovation (TWSE:3054) delivers shareholders 17% return over 1 year, surging 13% in the last week alone

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if you choose that path, you're going to buy some stocks that fall short of the market. Over the last year the LIWANLI Innovation Co., Ltd. (TWSE:3054) share price is up 17%, but that's less than the broader market return. Unfortunately the longer term returns are not so good, with the stock falling 12% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for LIWANLI Innovation

LIWANLI Innovation wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

LIWANLI Innovation grew its revenue by 100% last year. That's a head and shoulders above most loss-making companies. Let's face it the 17% share price gain in that time is underwhelming compared to the growth. It could be that the market is missing what growth investor Matt Joass calls 'the hidden power of inflection points'. It could be that the stock was previously over-hyped, or that losses are causing concern for the market, but this could be an opportunity.

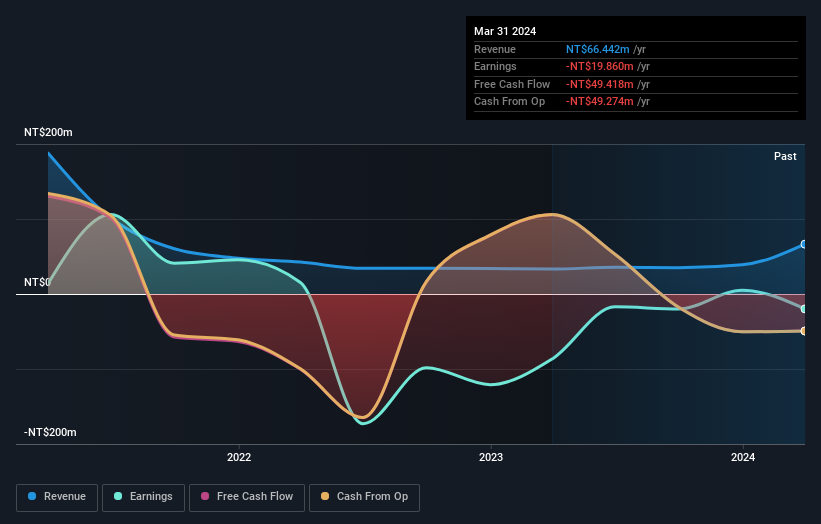

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on LIWANLI Innovation's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

LIWANLI Innovation provided a TSR of 17% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 1.5% endured over half a decade. So this might be a sign the business has turned its fortunes around. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with LIWANLI Innovation (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3054

Flawless balance sheet low.