- Taiwan

- /

- Trade Distributors

- /

- TPEX:3537

3 Dividend Stocks Yielding Up To 6.9% To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, driven by investor optimism. With this backdrop of economic shifts and broad market rallies, it’s an opportune time to consider dividend stocks that offer attractive yields. In today’s environment, a good dividend stock not only provides steady income but also has the potential for capital appreciation. Here are three dividend stocks yielding up to 6.9% that could help boost your portfolio amidst these dynamic market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.88% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.29% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.01% | ★★★★★★ |

| Kondotec (TSE:7438) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.44% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.20% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

Click here to see the full list of 2075 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

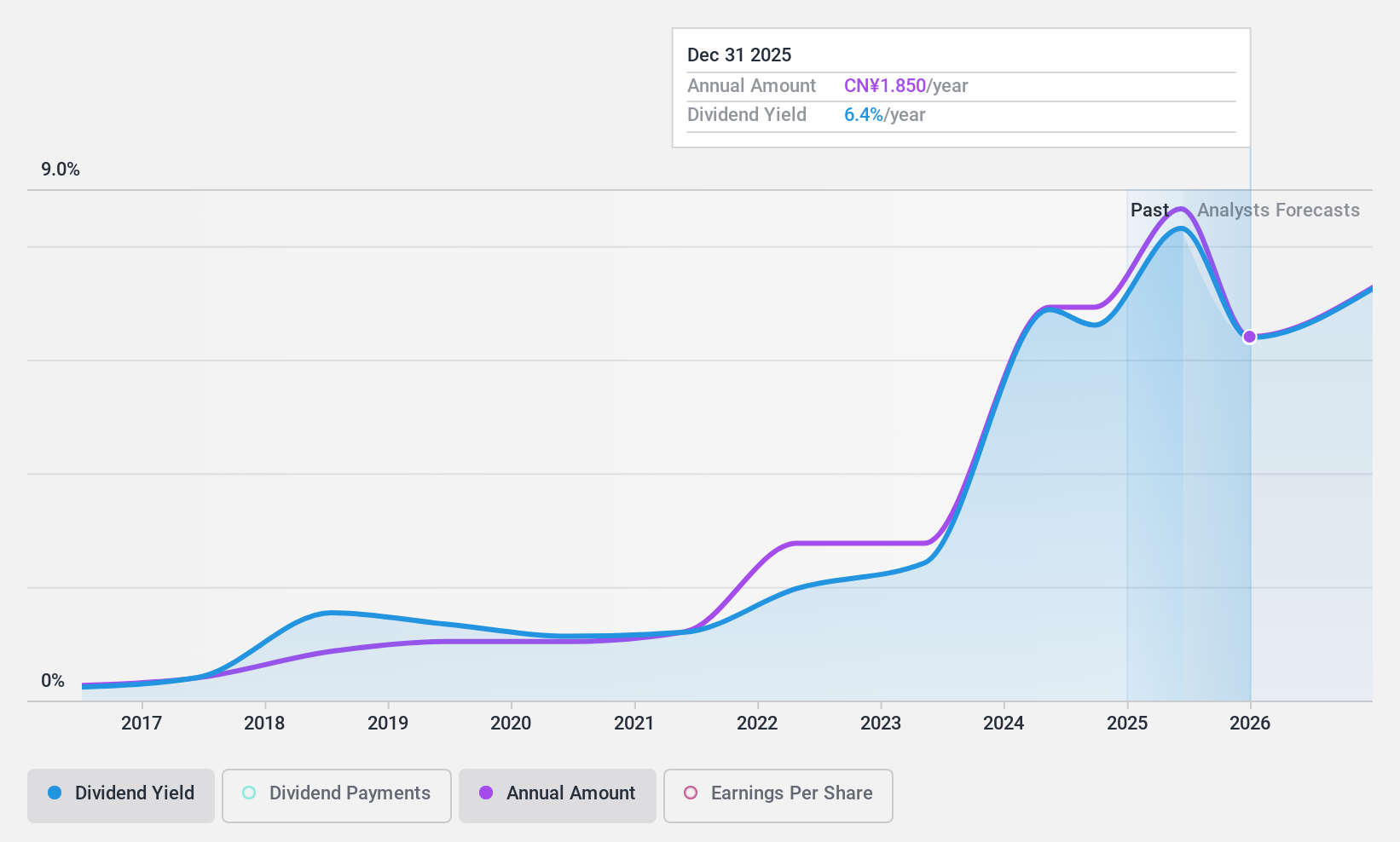

Shandong Wit Dyne HealthLtd (SZSE:000915)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shandong Wit Dyne Health Co., Ltd. operates in the pharmaceutical industry in China and has a market cap of CN¥6.30 billion.

Operations: Shandong Wit Dyne Health Co., Ltd. generates revenue from its pharmaceutical business in China.

Dividend Yield: 7.0%

Shandong Wit Dyne Health Ltd. offers a dividend yield of 6.96%, placing it in the top 25% of dividend payers in China. Despite stable and growing dividends over the past decade, its high payout ratio (98.1%) indicates that dividends are not well covered by earnings, though they are better supported by cash flows (49.3%). Recent affirmations include an interim cash dividend of CNY 5 per 10 shares for 2024, with payment on September 27, 2024.

- Get an in-depth perspective on Shandong Wit Dyne HealthLtd's performance by reading our dividend report here.

- Our valuation report unveils the possibility Shandong Wit Dyne HealthLtd's shares may be trading at a discount.

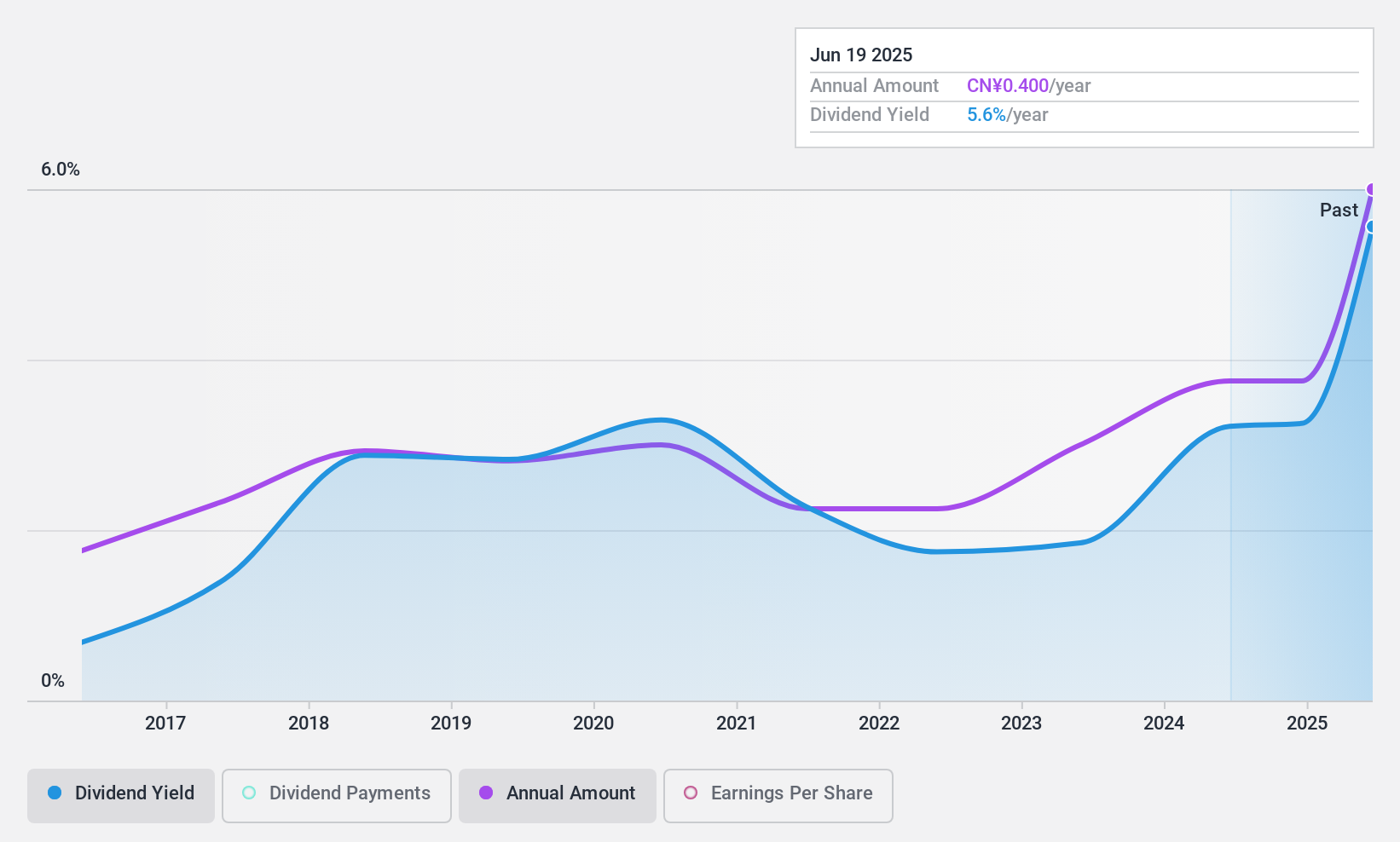

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. engages in the research, development, production, and sale of bathroom products and accessories worldwide with a market cap of CN¥2.88 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd. generates revenue primarily from Smart Toilets and Covers (CN¥1.41 billion), Water Tanks and Accessories (CN¥643.59 million), and Same Floor Drainage System Products (CN¥191.70 million).

Dividend Yield: 3.3%

Xiamen R&T Plumbing Technology Ltd. has a dividend yield of 3.29%, placing it in the top 25% of Chinese dividend payers. The company's dividends are covered by earnings (52.5% payout ratio) and cash flows (54.1% cash payout ratio). However, its dividend history is less stable, with payments only made for eight years and experiencing volatility. Recent half-year results showed increased revenue to CNY 1.14 billion but a decline in net income to CNY 90.97 million compared to last year’s figures.

- Unlock comprehensive insights into our analysis of Xiamen R&T Plumbing TechnologyLtd stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Xiamen R&T Plumbing TechnologyLtd shares in the market.

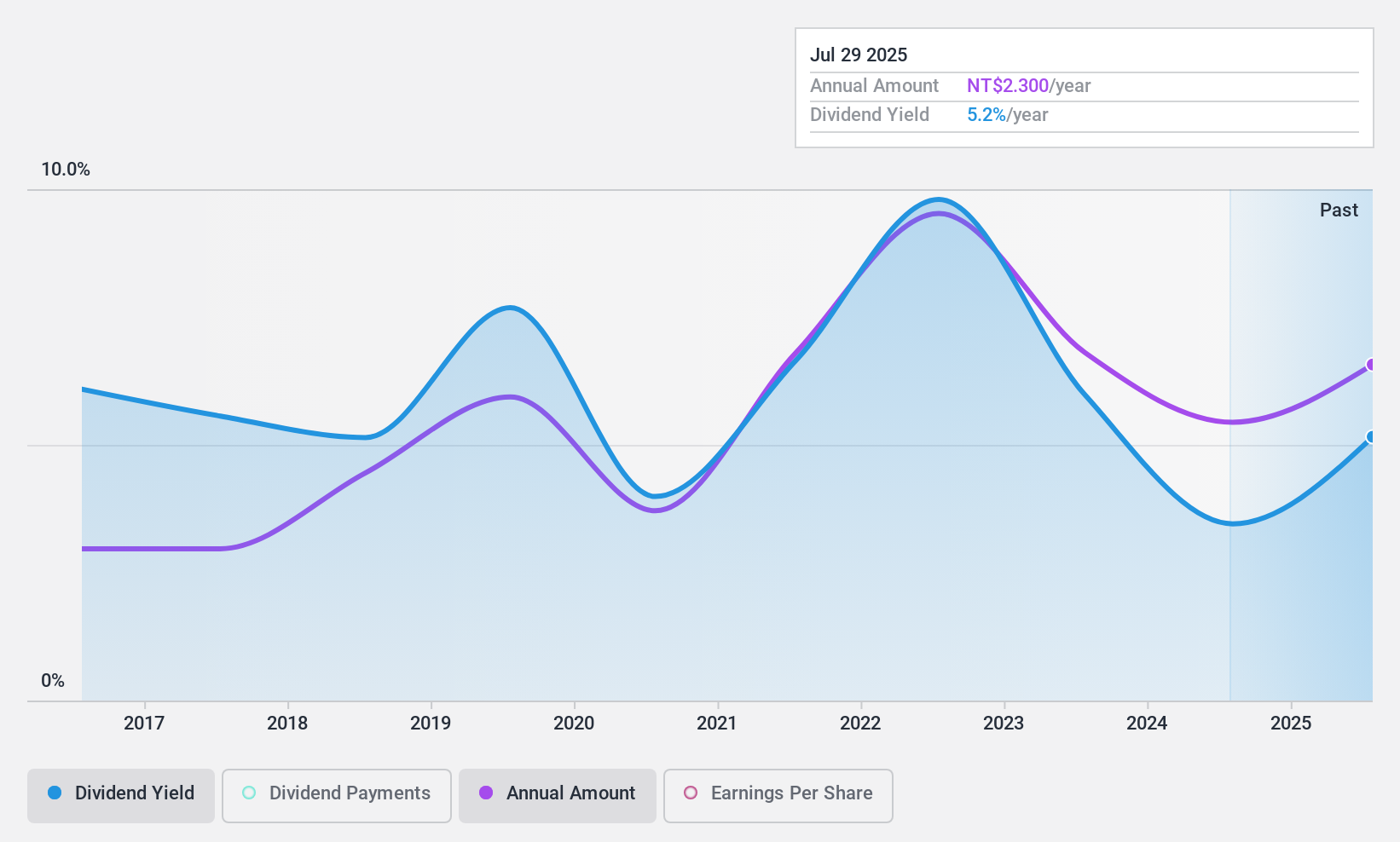

Podak (TPEX:3537)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Podak Co., LTD. operates as a sales agent in Taiwan and China, with a market cap of NT$3.49 billion.

Operations: Podak Co., LTD. generates revenue from its B3 Department (NT$662.72 million) and Department B1 (NT$1.59 billion).

Dividend Yield: 3.1%

Podak reported Q2 2024 earnings with sales of TWD 686.89 million and net income of TWD 50.51 million, showing year-over-year growth. The company’s dividend yield of 3.07% is below the top quartile in Taiwan, and its dividend history has been volatile over the past decade despite recent increases. With a payout ratio of 54.1%, dividends are covered by earnings but less so by cash flows (86.5%). The stock's price-to-earnings ratio is favorable at 17.6x compared to the market average.

- Click to explore a detailed breakdown of our findings in Podak's dividend report.

- Our valuation report here indicates Podak may be overvalued.

Seize The Opportunity

- Investigate our full lineup of 2075 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3537

Podak

Operates as a sales agent in Taiwan, Mainland China, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives