As global markets navigate the complexities of tariff uncertainties and mixed economic indicators, investors are keenly observing the performance of indices like the S&P 500, which showed resilience despite recent declines. Amidst this backdrop, identifying promising stocks often involves seeking companies with robust fundamentals that can weather economic fluctuations and capitalize on emerging opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Riyadh Cement | NA | 1.82% | -1.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Taiyo KagakuLtd | 0.73% | 4.83% | -2.64% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Nestlé Pakistan | 40.95% | 14.04% | 17.18% | ★★★★★☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

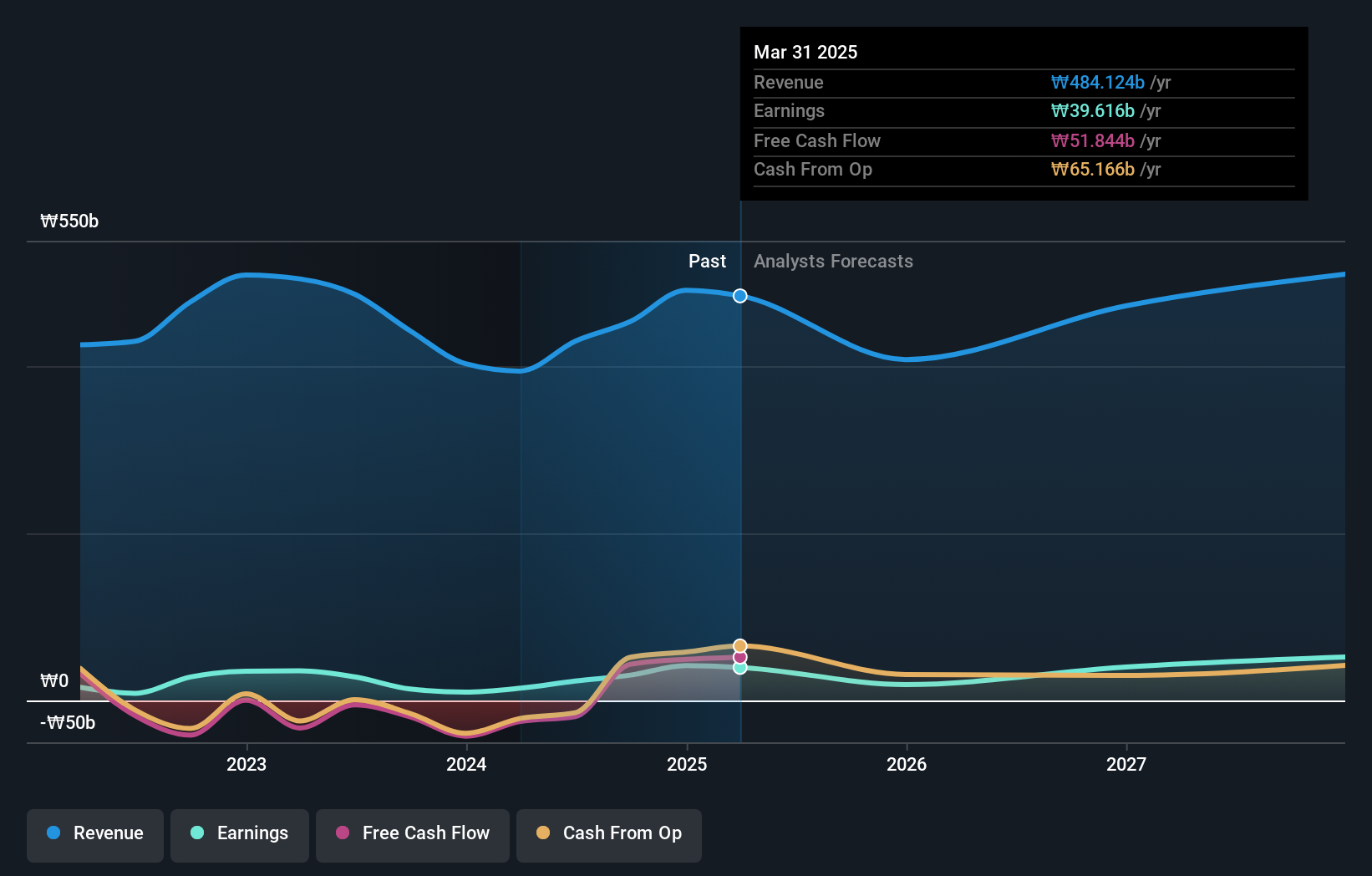

ZeusLtd (KOSDAQ:A079370)

Simply Wall St Value Rating: ★★★★★★

Overview: Zeus Co., Ltd. offers comprehensive solutions in the semiconductor, robot, and display sectors both domestically and internationally, with a market cap of ₩423.07 billion.

Operations: Zeus Co., Ltd. generates revenue primarily from its Equipment Division, which contributes ₩477.92 billion, and the Valve segment, adding ₩23.54 billion.

ZeusLtd, a smaller player in the market, has shown impressive financial momentum with earnings growth of 120.7% over the past year, outpacing the semiconductor industry’s 7.4%. The company is trading at a good value, being 17.9% below its estimated fair value and boasts high-quality earnings. Over five years, ZeusLtd reduced its debt to equity ratio from 40.9% to 32%, indicating improved financial health. Recent activities include repurchasing shares worth KRW 173.81 million and reporting a significant increase in net income for Q3 at KRW 11,477 million compared to KRW 4,312 million last year.

- Click here and access our complete health analysis report to understand the dynamics of ZeusLtd.

Gain insights into ZeusLtd's historical performance by reviewing our past performance report.

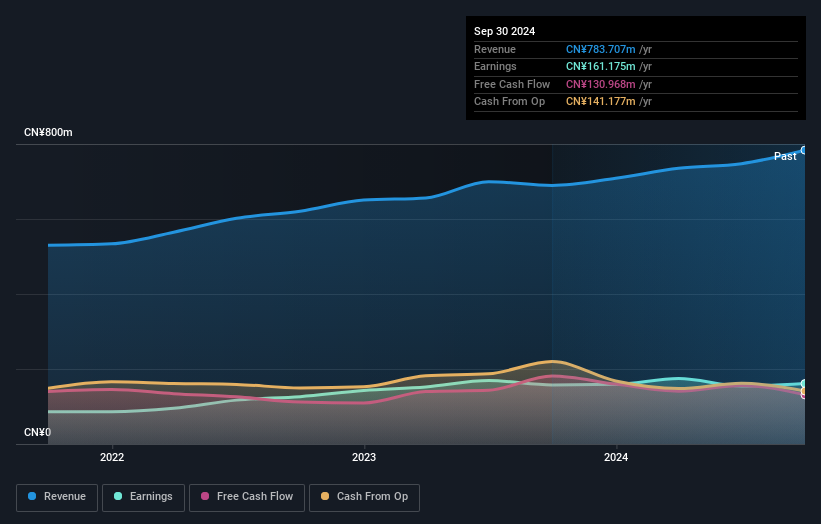

JDM JingDaMachine (Ningbo)Ltd (SHSE:603088)

Simply Wall St Value Rating: ★★★★★★

Overview: JDM JingDaMachine (Ningbo) Co. Ltd specializes in the production and sale of precision stamping parts both domestically in China and internationally, with a market capitalization of approximately CN¥4.25 billion.

Operations: JDM JingDaMachine generates revenue primarily from its Metal Forming Machine Tool Manufacturing segment, which accounted for CN¥783.71 million. The company's financial performance is reflected in its net profit margin trends, offering insights into profitability dynamics.

JDM JingDaMachine, a nimble player in the machinery sector, showcases promising attributes with its earnings growth of 2.2% outpacing the industry average of -0.06%. This company is debt-free and has maintained this status for over five years, reinforcing financial stability. Its price-to-earnings ratio stands at 27.6x, offering better value compared to the broader CN market's 37.1x. Despite recent share price volatility, JDM's high-quality earnings and positive free cash flow position it well within its niche market. The absence of debt also means interest coverage isn't an issue, suggesting a solid footing for future endeavors.

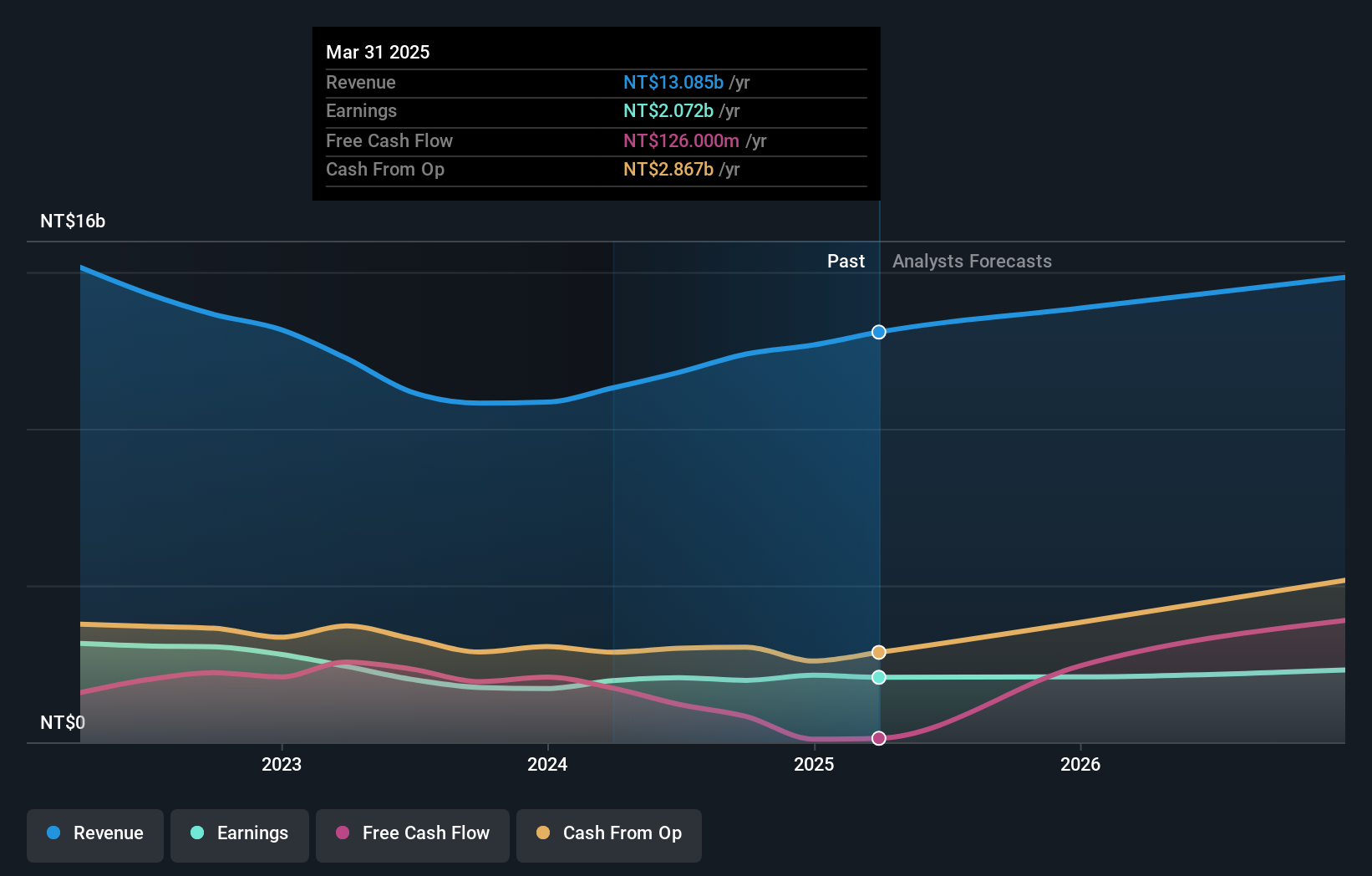

TXC (TWSE:3042)

Simply Wall St Value Rating: ★★★★★★

Overview: TXC Corporation is involved in the research, design, development, production, and sale of crystal and oscillator products both in Taiwan and internationally with a market capitalization of approximately NT$34.30 billion.

Operations: The company's primary revenue stream is from its Quartz Components Department, contributing NT$12.37 billion, while the Real Estate Development Department adds NT$13.33 million.

TXC, a promising player in the electronics sector, has demonstrated impressive earnings growth of 13% over the past year, surpassing the industry's 6.6%. Despite a dip in quarterly net income to TWD 513.92 million from TWD 598.26 million last year, their nine-month figures show an increase to TWD 1.57 billion from TWD 1.31 billion previously. Trading at an attractive valuation of about 11% below its estimated fair value, TXC's debt-to-equity ratio has improved significantly from 24.8% to 19% over five years, indicating prudent financial management and potential for continued growth in a competitive market landscape.

Taking Advantage

- Embark on your investment journey to our 4710 Undiscovered Gems With Strong Fundamentals selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603088

JDM JingDaMachine (Ningbo)Ltd

Produces and sells precision stamping parts in China and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives