- China

- /

- Electronic Equipment and Components

- /

- SZSE:300115

Sinocelltech Group And 2 More High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown resilience with the CSI 300 Index and Shanghai Composite Index posting gains, despite ongoing challenges such as China's persistent deflation pressures and a cooling property market. As investors navigate these complex economic landscapes, identifying high-growth tech stocks like Sinocelltech Group can be key to capitalizing on emerging opportunities in the region's dynamic tech sector.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.23% | 29.66% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 30.05% | 37.09% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Sinocelltech Group (SHSE:688520)

Simply Wall St Growth Rating: ★★★★★☆

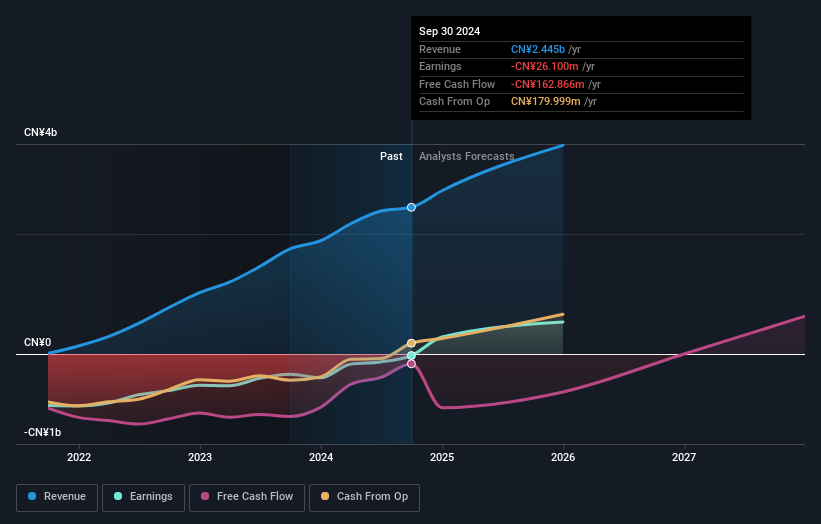

Overview: Sinocelltech Group Limited is a biotech company focused on the research, development, and industrialization of recombinant proteins, monoclonal antibodies, and innovative vaccines in China with a market cap of approximately CN¥36.78 billion.

Operations: The company generates revenue primarily from its Biological Drugs segment, which includes drugs and vaccines, with sales reaching approximately CN¥2.42 billion.

Sinocelltech Group, amidst a dynamic tech landscape in Asia, has shown promising financial agility with a projected annual earnings growth of 47.8%, significantly outpacing the Chinese market's average of 23.4%. Despite recent revenue dips—from CNY 612.5 million to CNY 519.74 million—its strategic maneuvers like the private placement deal for CNY 900 million suggest proactive capital management. The firm’s R&D focus is reflected in its robust innovation pipeline, crucial for maintaining competitiveness in the biotech sector where it recently turned profitable, highlighting its resilience and adaptability in a challenging industry environment.

- Take a closer look at Sinocelltech Group's potential here in our health report.

Examine Sinocelltech Group's past performance report to understand how it has performed in the past.

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

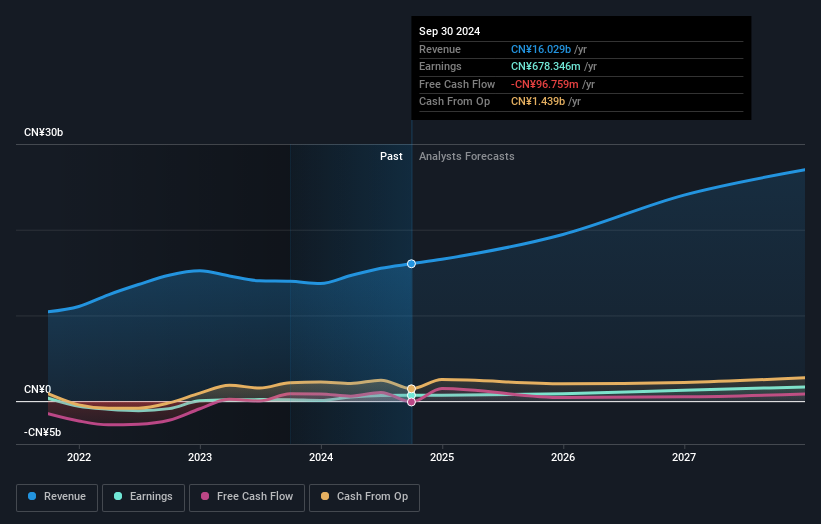

Overview: Shenzhen Everwin Precision Technology Co., Ltd. operates in the precision manufacturing industry and has a market capitalization of CN¥29.60 billion.

Operations: Everwin Precision Technology focuses on precision manufacturing, generating revenue primarily through its specialized production capabilities. The company's operations are reflected in its market capitalization of CN¥29.60 billion, indicating its scale within the industry.

Shenzhen Everwin Precision Technology has demonstrated robust growth metrics, outpacing the electronics industry with a 33.8% increase in earnings over the past year compared to the industry's average of 2.9%. This performance is underscored by a significant R&D commitment, evident from its latest quarterly report showing a revenue jump to CNY 4.39 billion from CNY 3.94 billion year-over-year, coupled with an R&D expense ratio that aligns with leading tech innovators in Asia. Despite facing challenges like a decrease in net income to CNY 174.87 million from CNY 309.21 million, the company's aggressive growth strategy and recent dividend affirmations suggest confidence in its financial health and future prospects.

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★☆☆

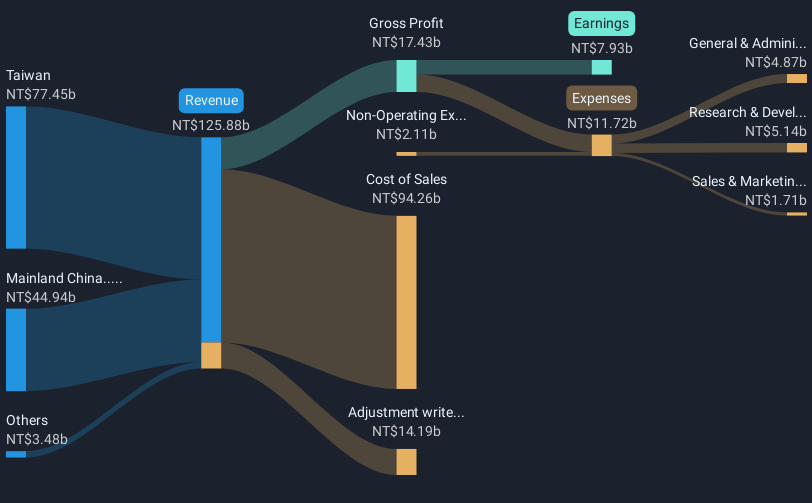

Overview: Unimicron Technology Corp. is involved in the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market cap of NT$204.08 billion.

Operations: Unimicron Technology Corp. generates revenue primarily from the sale of printed circuit boards and electronic products, with significant contributions from Taiwan (NT$83.34 billion) and Mainland China (NT$49.14 billion).

Unimicron Technology, a key player in Asia's tech sector, is navigating a landscape marked by intense innovation and competition. Recently, the company showcased its strategic initiatives at multiple industry forums, signaling robust engagement with market trends and investor interests. Financially, Unimicron is on an upward trajectory with a notable 12.3% annual revenue growth and an impressive forecast of 51.6% earnings growth per year. Their commitment to innovation is evident from their R&D spending which stands at 5% of their total revenue, aligning them closely with tech leaders in the region who prioritize reinvestment in development to spur further growth.

- Click to explore a detailed breakdown of our findings in Unimicron Technology's health report.

Evaluate Unimicron Technology's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 479 Asian High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300115

Shenzhen Everwin Precision Technology

Shenzhen Everwin Precision Technology Co., Ltd.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives