- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3037

Asian Market Value Stock Picks With Estimated Discounted Valuations

Reviewed by Simply Wall St

Amidst a backdrop of rising stock markets in Japan and China, driven by political stability and technological strength, the Asian market presents intriguing opportunities for investors seeking value. Identifying undervalued stocks requires a keen eye on discounted valuations relative to intrinsic worth, especially as economic conditions evolve across the region.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.82 | CN¥74.70 | 49.4% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31100.00 | ₩62000.48 | 49.8% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.38 | CN¥87.67 | 49.4% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.45 | CN¥26.41 | 49.1% |

| NexTone (TSE:7094) | ¥2261.00 | ¥4510.16 | 49.9% |

| Lotes (TWSE:3533) | NT$1435.00 | NT$2830.51 | 49.3% |

| Insource (TSE:6200) | ¥924.00 | ¥1806.54 | 48.9% |

| CURVES HOLDINGS (TSE:7085) | ¥786.00 | ¥1544.80 | 49.1% |

| Andes Technology (TWSE:6533) | NT$271.50 | NT$531.80 | 48.9% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.30 | CN¥54.23 | 49.7% |

We'll examine a selection from our screener results.

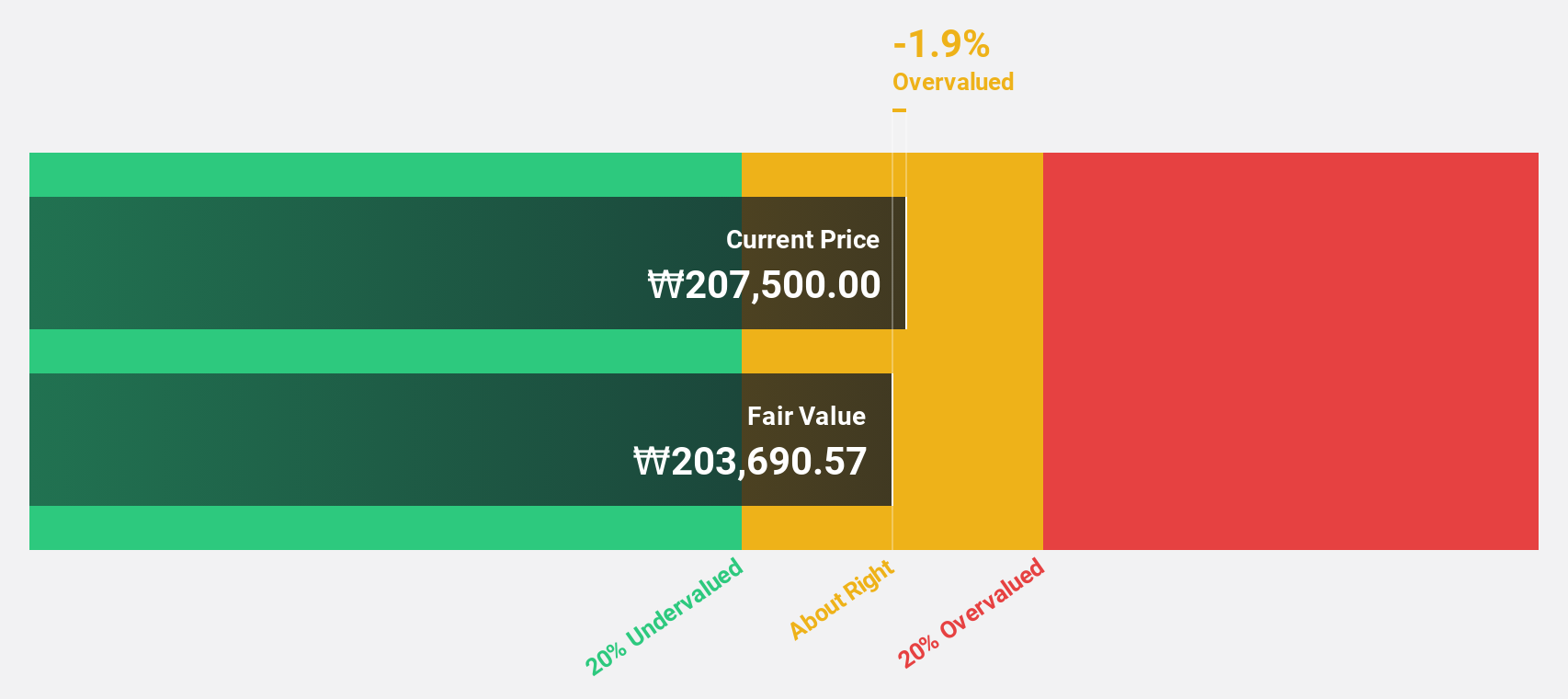

NCSOFT (KOSE:A036570)

Overview: NCSOFT Corporation, along with its subsidiaries, develops and publishes online games across Korea, Japan, Taiwan, the United States of America, Europe, and Canada with a market cap of ₩4.13 trillion.

Operations: The company generates its revenue primarily from online games and game services, amounting to ₩1.55 trillion.

Estimated Discount To Fair Value: 25%

NCSOFT is trading 25% below its estimated fair value of ₩284,157.93, indicating it may be undervalued based on cash flows. Despite a net loss in the recent quarter, earnings are forecast to grow significantly at 79.99% annually, with expected profitability in three years surpassing average market growth. However, revenue growth of 13.2% per year is slower than desired and return on equity remains low at a forecasted 8.2%.

- Our growth report here indicates NCSOFT may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in NCSOFT's balance sheet health report.

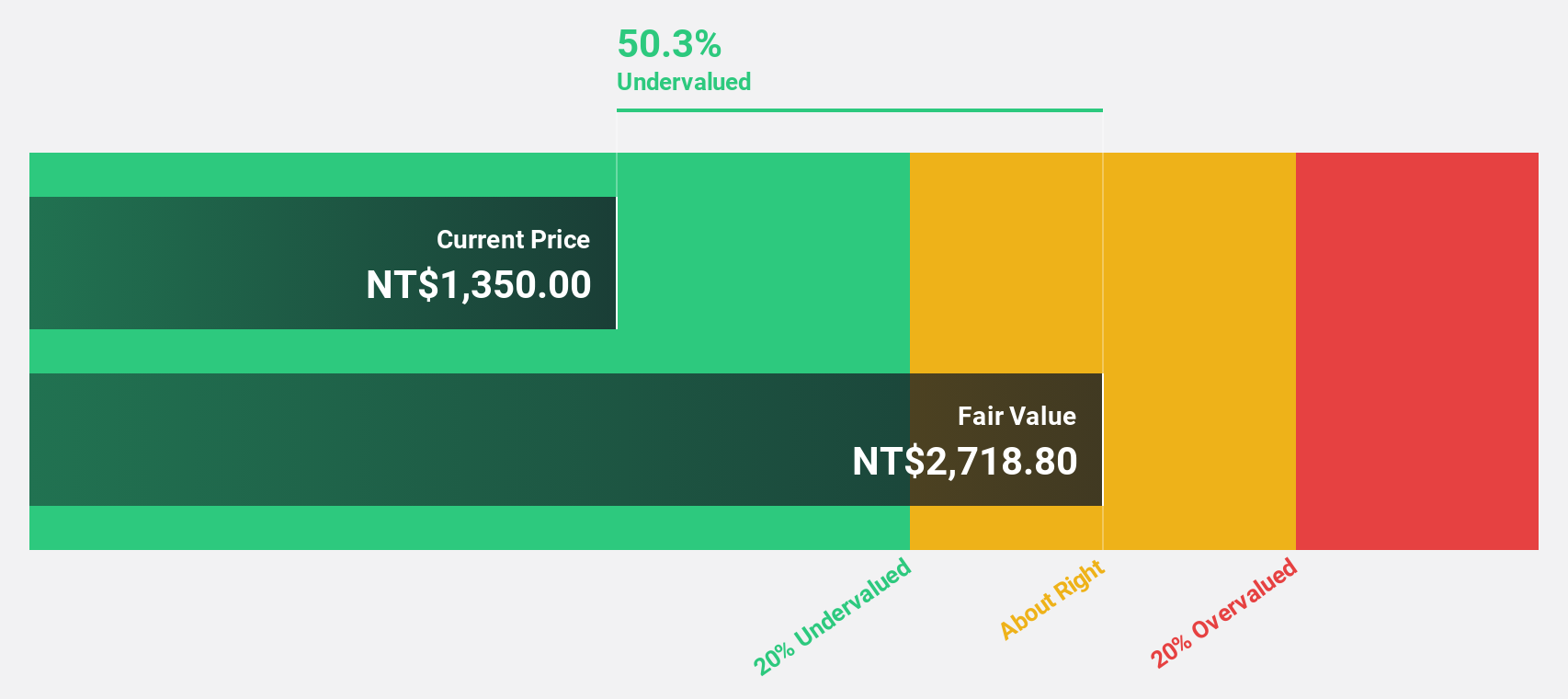

Unimicron Technology (TWSE:3037)

Overview: Unimicron Technology Corp. is involved in the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market cap of approximately NT$249.94 billion.

Operations: The company's revenue is primarily derived from Taiwan (NT$87.78 billion) and Mainland China (NT$50.33 billion).

Estimated Discount To Fair Value: 40.3%

Unimicron Technology is trading at NT$163.5, which is 40.3% below its estimated fair value of NT$273.94, highlighting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 69.49% annually, outpacing the Taiwan market's growth rate of 19%. Despite this, recent earnings reports show a substantial drop in net income and profit margins compared to last year, with high share price volatility also noted over the past three months.

- Insights from our recent growth report point to a promising forecast for Unimicron Technology's business outlook.

- Get an in-depth perspective on Unimicron Technology's balance sheet by reading our health report here.

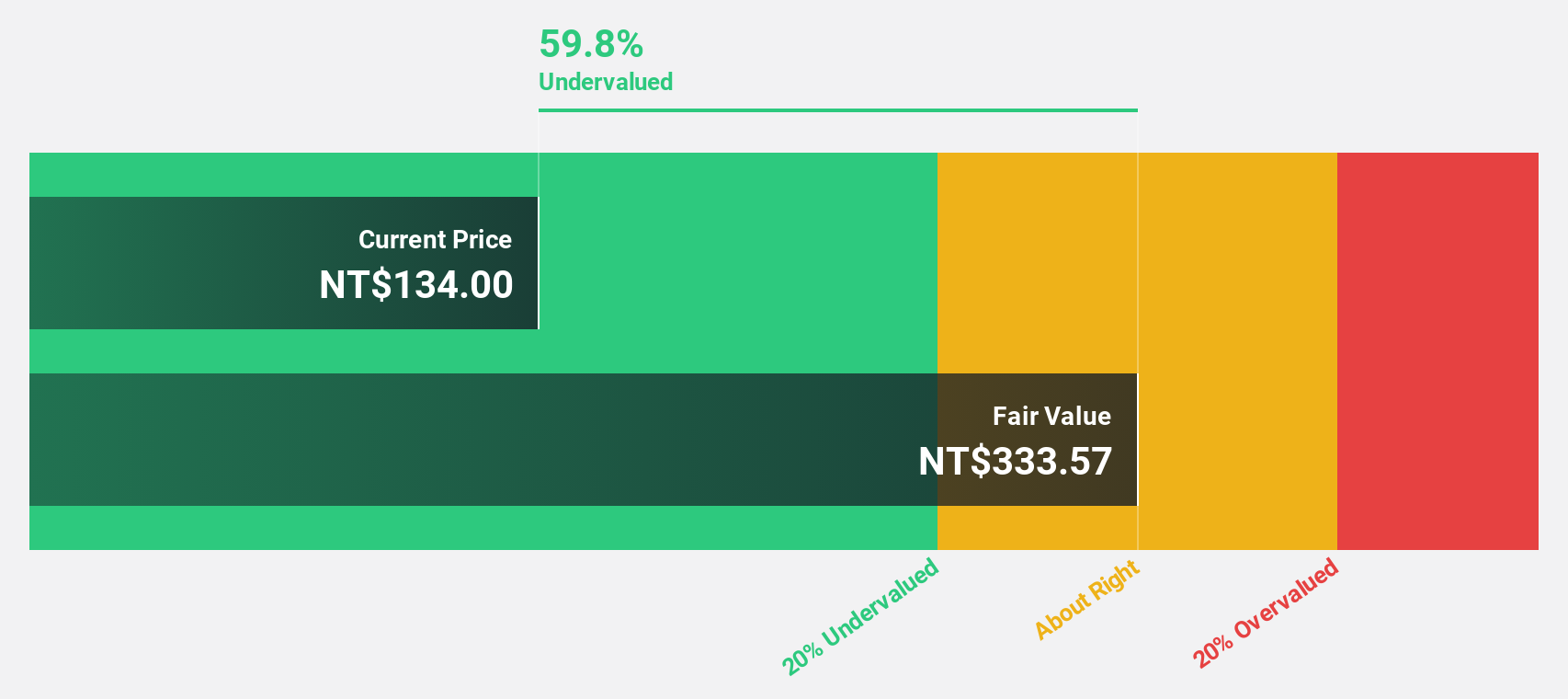

Lotes (TWSE:3533)

Overview: Lotes Co., Ltd. designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally with a market cap of NT$160.62 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$32.47 billion.

Estimated Discount To Fair Value: 49.3%

Lotes Co., Ltd. is trading at NT$1,435, significantly below its estimated fair value of NT$2,830.51, suggesting potential undervaluation based on cash flows. While earnings are forecast to grow 23.46% annually—faster than the Taiwan market's 19%—recent reports show a decline in net income and earnings per share compared to last year. Despite this setback, analysts agree on a potential stock price rise by 22%, with strong relative value versus peers and industry benchmarks.

- Upon reviewing our latest growth report, Lotes' projected financial performance appears quite optimistic.

- Dive into the specifics of Lotes here with our thorough financial health report.

Turning Ideas Into Actions

- Discover the full array of 269 Undervalued Asian Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3037

Unimicron Technology

Engages in the development, manufacturing, processing, and sale of printed circuit boards, electrical equipment, electronic products, and testing and burn-in systems for integrated circuit products worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives