- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3036

Results: WT Microelectronics Co., Ltd. Exceeded Expectations And The Consensus Has Updated Its Estimates

WT Microelectronics Co., Ltd. (TWSE:3036) just released its second-quarter report and things are looking bullish. The company beat expectations with revenues of NT$244b arriving 3.5% ahead of forecasts. Statutory earnings per share (EPS) were NT$1.70, 8.5% ahead of estimates. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

View our latest analysis for WT Microelectronics

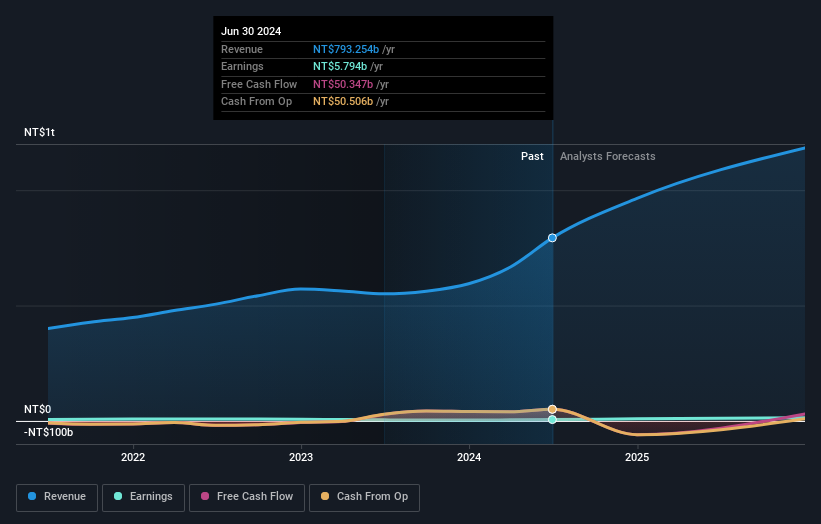

Following the latest results, WT Microelectronics' three analysts are now forecasting revenues of NT$964.3b in 2024. This would be a huge 22% improvement in revenue compared to the last 12 months. Per-share earnings are expected to leap 40% to NT$7.25. Yet prior to the latest earnings, the analysts had been anticipated revenues of NT$949.7b and earnings per share (EPS) of NT$7.33 in 2024. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

The consensus price target fell 18% to NT$140, suggesting that the analysts might have been a bit enthusiastic in their previous valuation - or they were expecting the company to provide stronger guidance in the quarterly results. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic WT Microelectronics analyst has a price target of NT$170 per share, while the most pessimistic values it at NT$100.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the WT Microelectronics' past performance and to peers in the same industry. It's clear from the latest estimates that WT Microelectronics' rate of growth is expected to accelerate meaningfully, with the forecast 48% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 17% p.a. over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that WT Microelectronics is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of WT Microelectronics' future valuation.

With that in mind, we wouldn't be too quick to come to a conclusion on WT Microelectronics. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple WT Microelectronics analysts - going out to 2025, and you can see them free on our platform here.

Plus, you should also learn about the 2 warning signs we've spotted with WT Microelectronics .

Valuation is complex, but we're here to simplify it.

Discover if WT Microelectronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3036

WT Microelectronics

Develops and sells electronic and communication components in the United States, Taiwan, China, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Circle Internet Group (CRCL): The Programmable Dollar Powerhouse – Post-IPO Momentum and Stablecoin Dominance.

TTM Technologies (TTMI): The Backbone of the AI Tsunami and Defense Modernization.

Bloom Energy Corp (BE): The AI "Bridge-to-Power" – Scaling to 2GW Capacity for the Next-Gen Data Center.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026