- South Korea

- /

- Biotech

- /

- KOSE:A068270

High Growth Tech Stocks In Asia For July 2025

Reviewed by Simply Wall St

Amidst a backdrop of global market fluctuations, Asian tech stocks have been capturing attention as the region's indices show resilience despite new U.S. tariffs on key trading partners like South Korea and Japan. With growth stocks modestly outperforming value counterparts, investors are keenly observing how Asia's high-growth tech sector navigates these challenges, focusing on companies that demonstrate robust adaptability and innovation in this dynamic environment.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Fositek | 29.03% | 36.06% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| PharmaResearch | 26.50% | 29.34% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Celltrion (KOSE:A068270)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Celltrion, Inc. is a biopharmaceutical company that focuses on developing, producing, and selling therapeutic proteins for oncology treatments, with a market cap of ₩39.45 trillion.

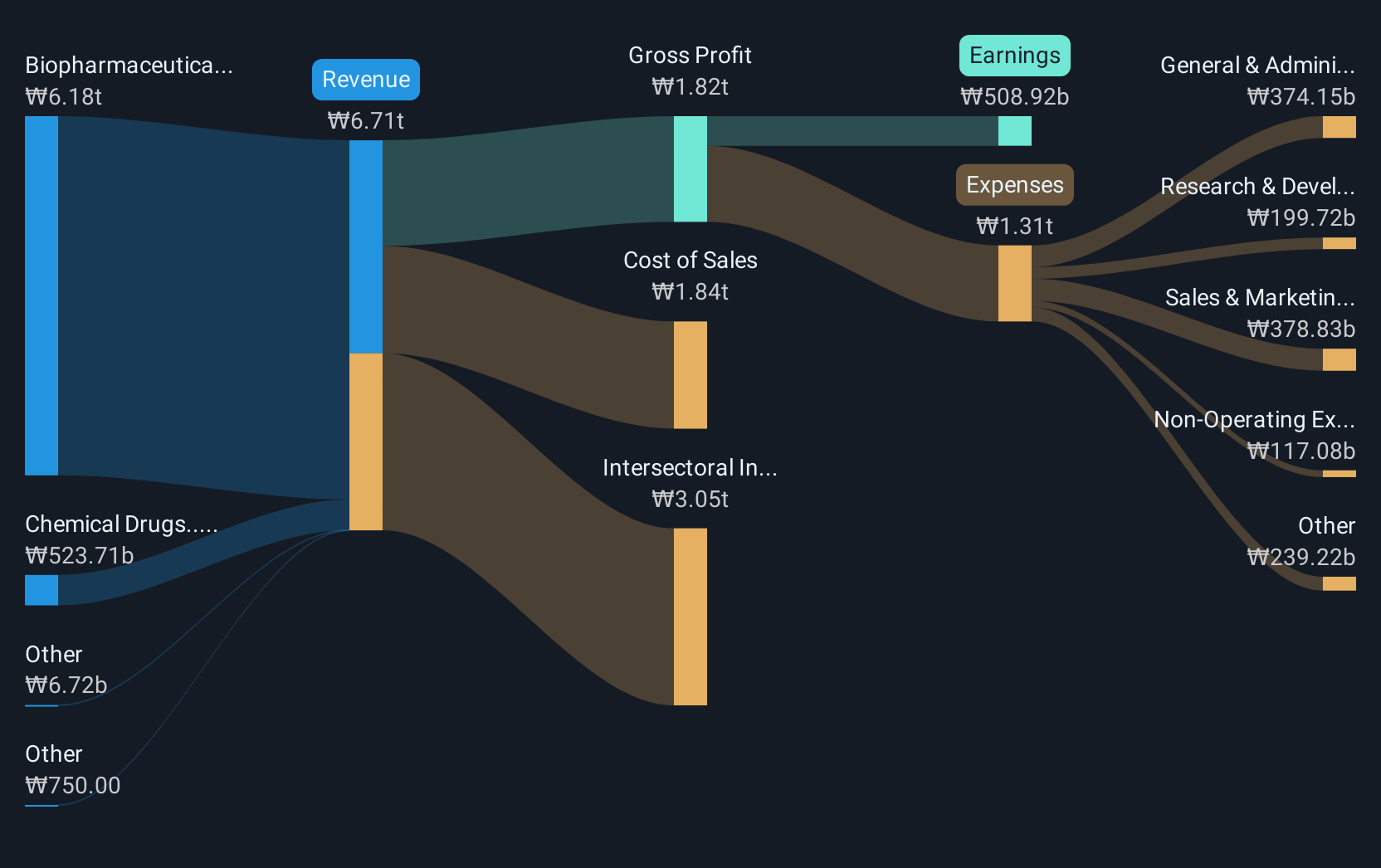

Operations: The company generates revenue primarily from its biopharmaceutical segment, which accounts for ₩6.18 trillion, with additional contributions from chemical drugs at ₩523.71 billion.

Celltrion, a key player in the biotechnology sector, has demonstrated robust financial and operational growth, underpinned by strategic expansions and product approvals. With an annualized revenue growth of 15.3% and earnings surging by 27.1% per year, the company's aggressive R&D investments have fostered innovation and market expansion—particularly evident in its recent FDA approval of STEQEYMA for pediatric use. Additionally, Celltrion's commitment to enhancing shareholder value is reflected in its recent share repurchase activities totaling KRW 99,999.93 million. This strategy not only stabilizes its stock price but also aligns with its long-term vision to cement a strong foothold in global markets through strategic headquarters expansion in the UK and continuous product pipeline development across various therapeutic areas.

- Click here and access our complete health analysis report to understand the dynamics of Celltrion.

Review our historical performance report to gain insights into Celltrion's's past performance.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming, operating across Mainland China, Hong Kong, Europe, and other international markets with a market capitalization of approximately HK$51.53 billion.

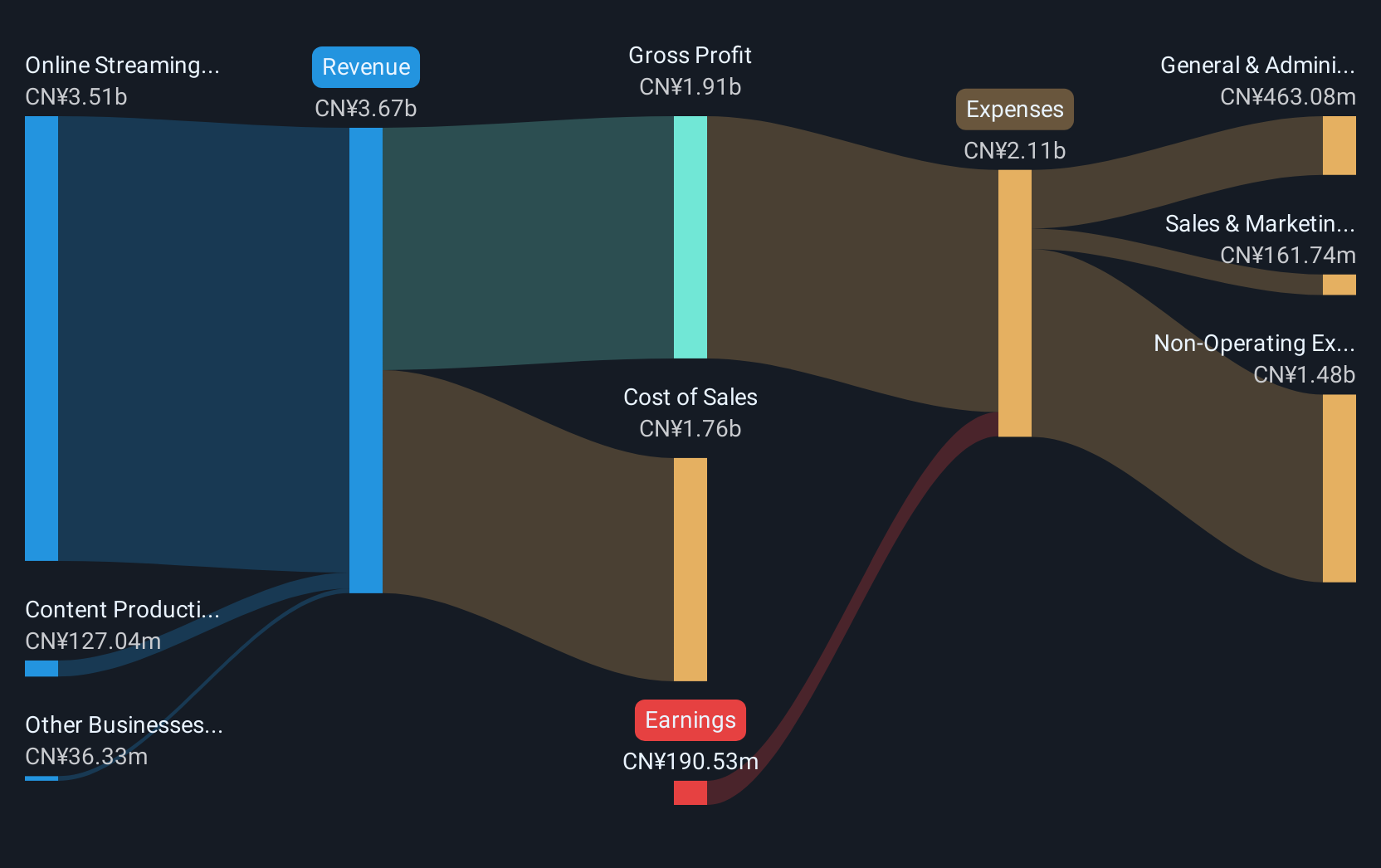

Operations: The company's primary revenue streams are derived from its online streaming and gaming businesses, generating CN¥3.51 billion, and content production business contributing CN¥127.04 million.

China Ruyi Holdings is navigating the competitive tech landscape with significant strides in growth and innovation. With a projected annual revenue increase of 17.7% and earnings expected to surge by 48.65%, the company outpaces the Hong Kong market's average growth rate of 8.1%. This performance is underpinned by strategic initiatives, including a robust R&D focus which aligns with industry trends towards enhanced technological capabilities. Recent events like their active participation at the Macquarie Asia Conference highlight their commitment to expanding their market presence, further solidifying their potential in high-growth sectors within Asia despite current unprofitability challenges.

- Get an in-depth perspective on China Ruyi Holdings' performance by reading our health report here.

Examine China Ruyi Holdings' past performance report to understand how it has performed in the past.

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WT Microelectronics Co., Ltd. operates in the development and sale of electronic and communication components across Taiwan, China, and international markets, with a market capitalization of NT$149.69 billion.

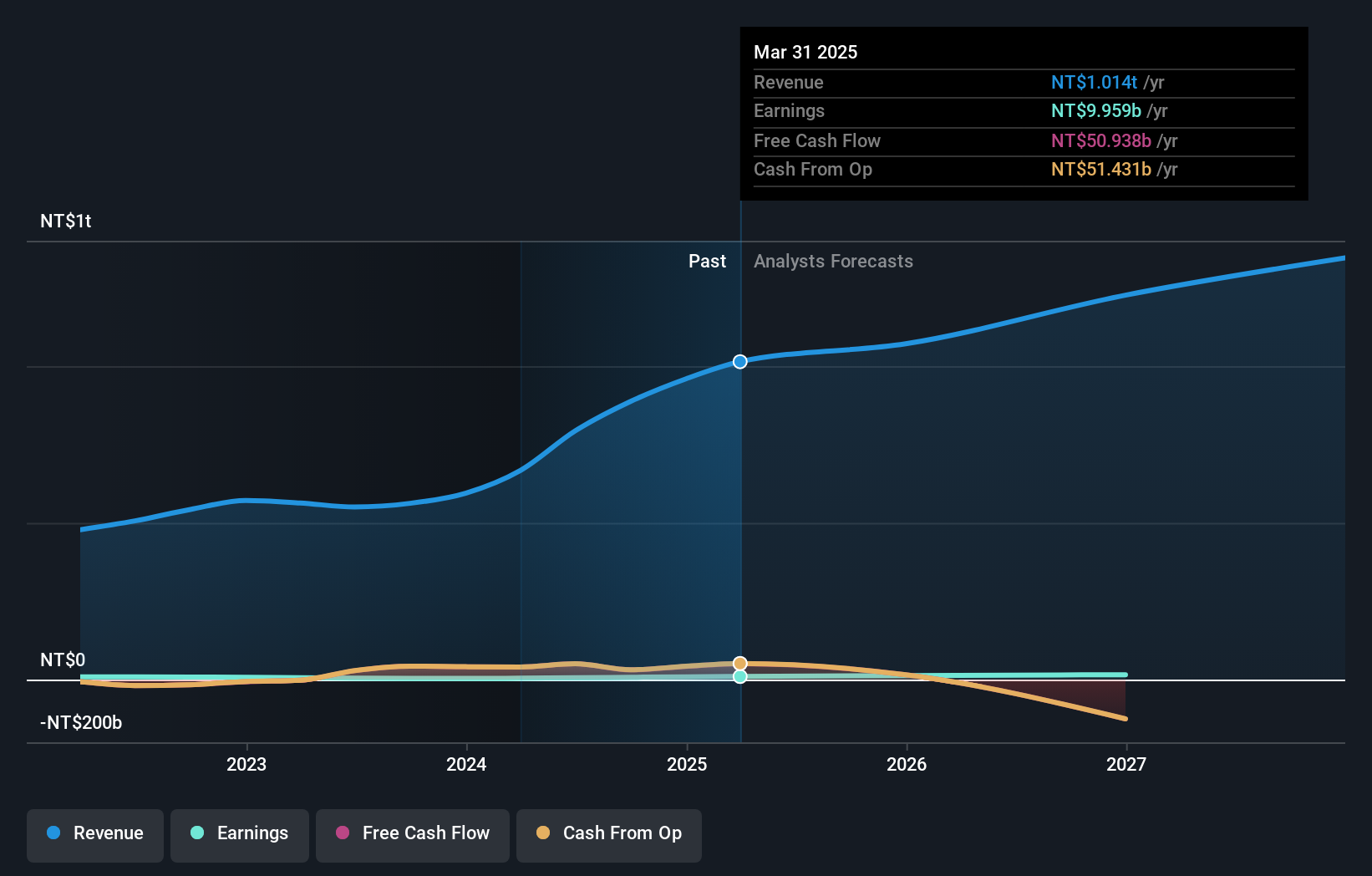

Operations: The company generates revenue primarily through the wholesale of electronic components, amounting to NT$1.01 trillion. It operates in various markets, including Taiwan and China.

WT Microelectronics is demonstrating robust growth in Asia's tech sector, with earnings growth outpacing the industry at 116.1% over the past year compared to the electronic industry's 14.2%. This surge is supported by a notable increase in sales, as evidenced by a recent 23% year-over-year rise to TWD 443.8 billion from January to May 2025. The company also maintains a strong commitment to innovation, as reflected in its significant R&D investments that align with its strategic expansion goals and recent executive enhancements aimed at bolstering governance and operational efficiency.

Taking Advantage

- Discover the full array of 481 Asian High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A068270

Celltrion

A biopharmaceutical company, engages in the development, production, and sale of various therapeutic proteins for the treatment of oncology diseases.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives