- China

- /

- Consumer Durables

- /

- SZSE:002150

Uncovering February 2025's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and fluctuating interest rates, major U.S. stock indexes such as the S&P 500 and Nasdaq Composite are nearing record highs, while small-cap stocks lag behind their larger counterparts. In this environment, identifying promising small-cap opportunities requires a keen eye for companies with strong fundamentals and resilience to economic shifts, making them potential undiscovered gems in today's market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Quemchi | 0.66% | 82.67% | 21.69% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.08% | 22.33% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Jiangsu Tongrun Equipment TechnologyLtd (SZSE:002150)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Tongrun Equipment Technology Co., Ltd specializes in the production and sale of metal tool cabinets in China, with a market capitalization of CN¥4.98 billion.

Operations: Tongrun primarily generates revenue through the production and sale of metal tool cabinets. The company has a market capitalization of approximately CN¥4.98 billion.

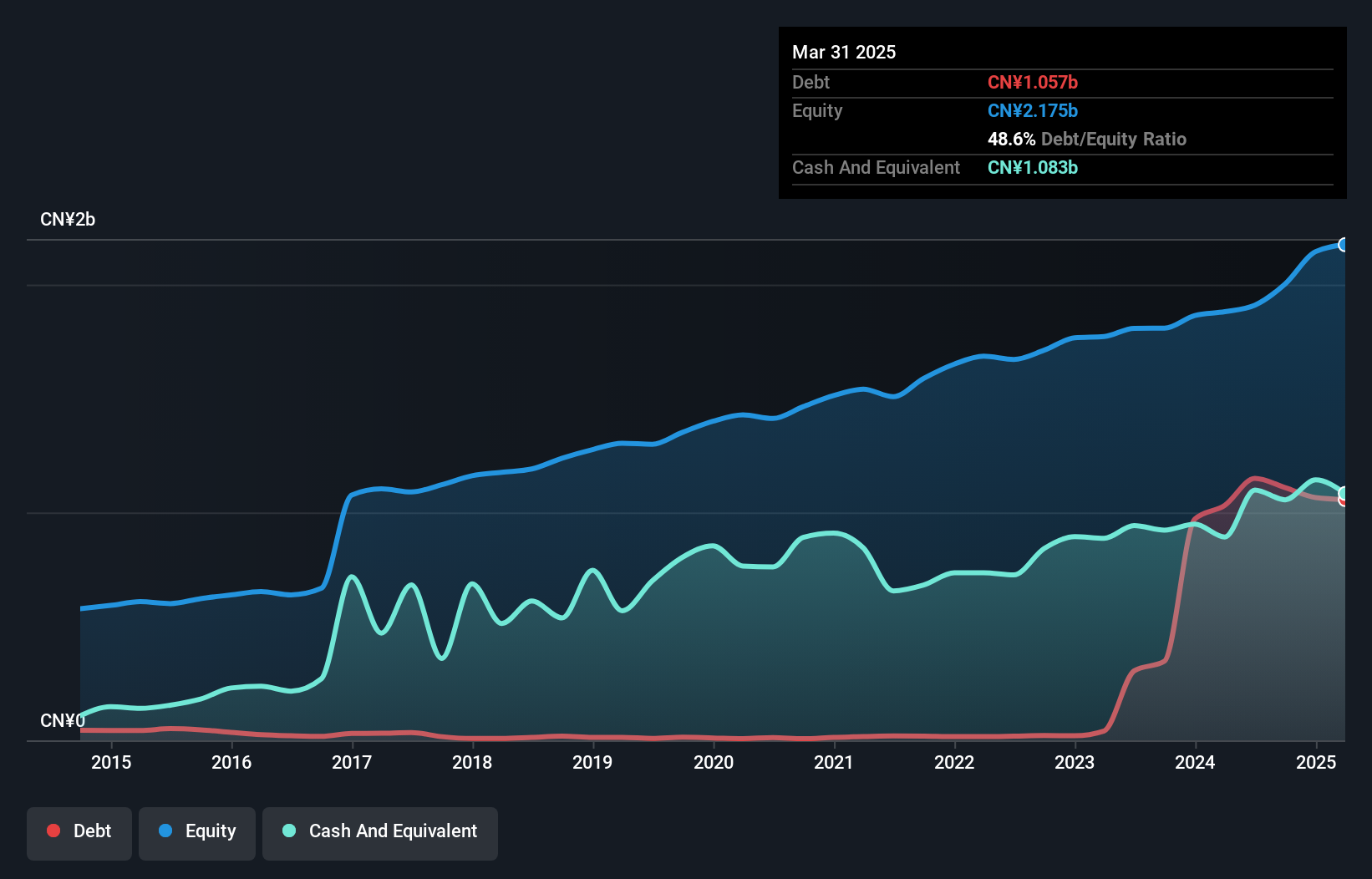

Jiangsu Tongrun Equipment Technology Ltd. seems to be navigating a complex financial landscape, with its debt to equity ratio rising from 1% to 55.4% over the past five years, although the net debt to equity ratio remains satisfactory at 2.7%. The company's interest payments are well covered by EBIT, with an impressive coverage of 11.7 times, indicating robust ability to manage debt obligations. However, despite a significant one-off gain of CN¥222.7 million impacting recent results and earnings growing by 90.8% last year against industry trends, free cash flow is not positive and earnings have declined by 9% annually over five years.

- Click here to discover the nuances of Jiangsu Tongrun Equipment TechnologyLtd with our detailed analytical health report.

Understand Jiangsu Tongrun Equipment TechnologyLtd's track record by examining our Past report.

Ningbo BaoSi Energy Equipment (SZSE:300441)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo BaoSi Energy Equipment Co., Ltd. operates in the research, development, production, and sale of high-end precision mechanical parts and equipment both domestically and internationally, with a market capitalization of CN¥6.24 billion.

Operations: Ningbo BaoSi Energy Equipment generates revenue primarily from its Screw Compressor Division, contributing CN¥1.46 billion. The company's gross profit margin is a key financial metric to consider when evaluating its profitability.

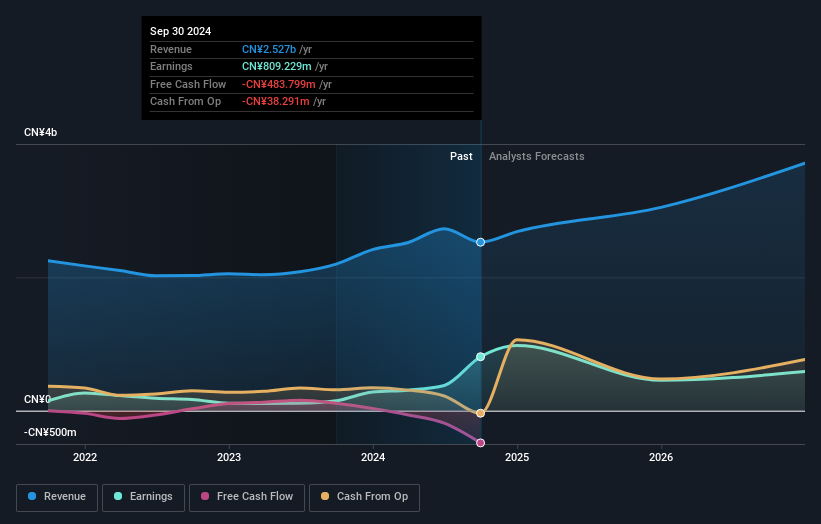

Ningbo BaoSi Energy Equipment, a smaller player in the machinery sector, has seen its earnings soar by 448.9% over the past year, outpacing industry growth. The company's debt management appears robust with a reduction in its debt-to-equity ratio from 40.2% to 4.8% over five years, and it holds more cash than total debt. Trading at a price-to-earnings ratio of 7.7x compared to the CN market's 36.5x suggests good relative value for investors seeking opportunities in this niche sector, although future earnings are projected to decline by an average of 23.1% annually over the next three years.

Test Research (TWSE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Test Research, Inc. operates globally in the design, assembly, manufacture, sale, and maintenance of automated inspection and testing equipment with a market cap of NT$31.06 billion.

Operations: The primary revenue stream for Test Research, Inc. is derived from the design, assembly, manufacture, sale, and maintenance of automated testing equipment, generating NT$6.17 billion. The company's financial performance can be assessed through its net profit margin trends over recent periods.

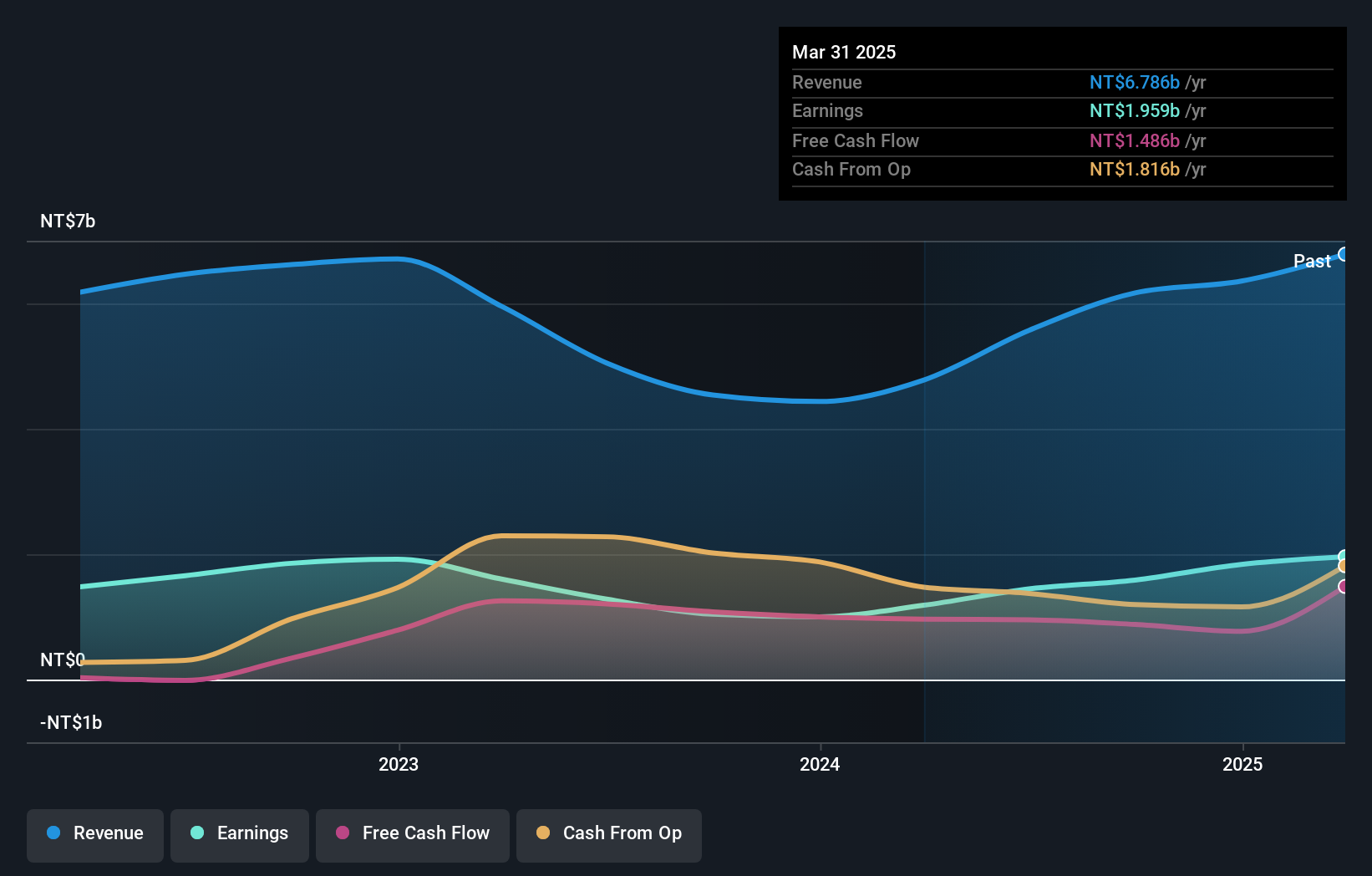

Test Research, a nimble player in the electronics sector, showcases robust financial health with no debt over the past five years. Its earnings growth of 52% last year outpaced the industry's 8%, indicating a strong competitive edge. The company appears to offer good value, reflected in its price-to-earnings ratio of 19.6x compared to the TW market's 21.6x. With high-quality earnings and positive free cash flow, Test Research seems well-positioned for continued performance within its niche market segment without concerns about interest payment coverage due to its debt-free status.

- Dive into the specifics of Test Research here with our thorough health report.

Examine Test Research's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Investigate our full lineup of 4733 Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002150

Jiangsu Tongrun Equipment TechnologyLtd

Engages in the research and development, production, and sales of photovoltaic energy storage equipment, components, and metal products in China.

High growth potential with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion