- Taiwan

- /

- Tech Hardware

- /

- TWSE:3013

Investors Appear Satisfied With Chenming Electronic Tech. Corp.'s (TWSE:3013) Prospects As Shares Rocket 48%

Chenming Electronic Tech. Corp. (TWSE:3013) shares have continued their recent momentum with a 48% gain in the last month alone. The last month tops off a massive increase of 233% in the last year.

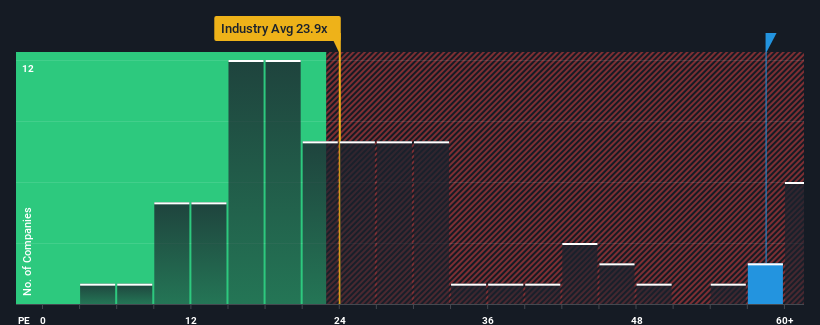

After such a large jump in price, given close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 22x, you may consider Chenming Electronic Tech as a stock to avoid entirely with its 58.4x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Chenming Electronic Tech recently, which is pleasing to see. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Chenming Electronic Tech

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Chenming Electronic Tech's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 10%. The latest three year period has also seen an excellent 222% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Chenming Electronic Tech is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Chenming Electronic Tech's P/E

Chenming Electronic Tech's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Chenming Electronic Tech maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Chenming Electronic Tech.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3013

Chenming Electronic Tech

An OEM/ODM manufacturer, engages in the research and development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds in Taiwan, China, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion