- Taiwan

- /

- Tech Hardware

- /

- TWSE:3013

High Growth Tech Stocks in Asia for August 2025

Reviewed by Simply Wall St

As global markets face renewed uncertainties due to trade policy shifts and economic data revisions, the Asian tech sector presents intriguing opportunities amidst a backdrop of fluctuating indices and economic indicators. In this environment, identifying high growth tech stocks in Asia involves looking for companies that demonstrate resilience against external pressures, such as tariffs and inflation, while capitalizing on technological advancements and regional market dynamics.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.71% | 35.89% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou DPtech Technologies Co., Ltd., along with its subsidiary, focuses on the research, development, production, and sale of network security and application delivery products across China, Hong Kong, and international markets with a market cap of CN¥11.20 billion.

Operations: DPtech Technologies, through its subsidiary, specializes in network security and application delivery solutions. The company operates primarily in China and Hong Kong while also serving international markets.

Hangzhou DPtech Technologies Ltd., a pivotal entity in Asia's tech landscape, has demonstrated robust growth with an 18.7% increase in earnings over the past year, outpacing the software industry’s average decline of 2%. This growth trajectory is underscored by a significant forecast in earnings growth at 27.3% annually, surpassing the broader Chinese market's expectation of 23.6%. The company also stands out for its commitment to innovation, allocating substantial resources to R&D which is evident from its recent dividend affirmation and changes to company bylaws aimed at fostering greater agility and compliance. Despite a revenue growth forecast (14.3%) that lags behind some high-growth benchmarks, DPtech maintains a competitive edge in the market with projected revenue expansion exceeding the national average (12.6%). These strategic maneuvers not only reflect DPtech’s adaptability but also hint at promising future prospects within an increasingly digital global economy.

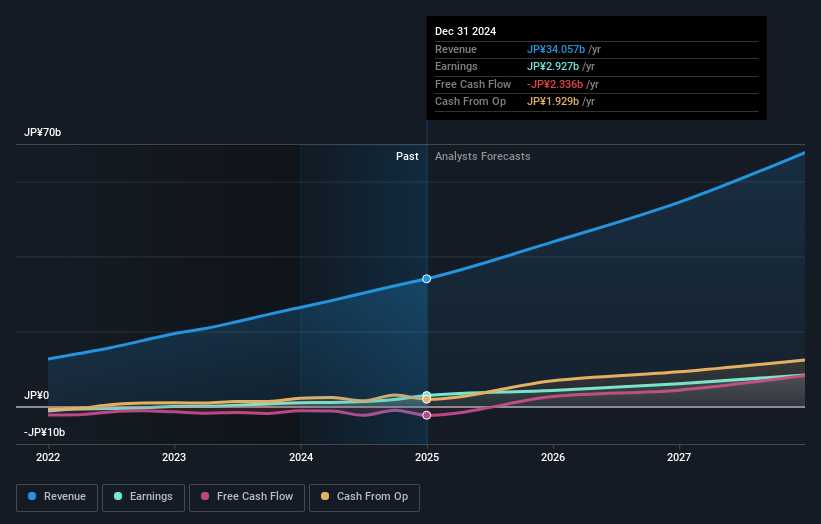

Appier Group (TSE:4180)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Appier Group, Inc. is a software-as-a-service company that offers artificial intelligence platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market capitalization of ¥161.11 billion.

Operations: Appier Group generates revenue primarily through its AI SaaS business, which reported ¥36.04 billion in revenue. The company focuses on leveraging artificial intelligence to assist enterprises in making informed decisions across various markets.

Appier Group, a standout in Asia's tech scene, has demonstrated impressive growth metrics that underscore its potential in high-growth markets. With a notable annual revenue increase of 19.4%, the company surpasses the Japanese market's average of 4.3%. This growth is further complemented by an earnings surge of 29.4% per year, positioning it well above the broader market expectation of 8%. Investing heavily in innovation, Appier allocated significant funds to R&D, ensuring its competitive edge and future relevance in evolving tech landscapes. These strategic efforts highlight not only Appier’s robust financial health but also its commitment to maintaining a leading position through continuous improvement and adaptation to market demands.

- Click here to discover the nuances of Appier Group with our detailed analytical health report.

Gain insights into Appier Group's past trends and performance with our Past report.

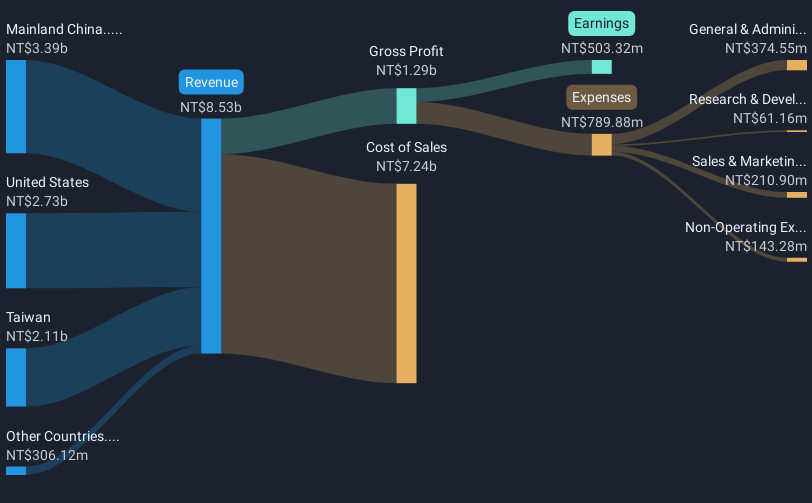

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chenming Electronic Tech. Corp., with a market cap of NT$25.64 billion, operates as an OEM/ODM manufacturer specializing in the research and development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and internationally.

Operations: The company focuses on producing and selling computer and mobile device components, generating NT$10.35 billion in revenue.

Chenming Electronic Tech has shown remarkable growth, with a 31.1% annual increase in revenue, outpacing the Taiwanese market average of 10%. This surge is supported by robust earnings growth of 26.6% per year, significantly above the market expectation of 13.3%. The company’s commitment to innovation is evident from its recent amendment to its Articles of Incorporation and substantial R&D investments, positioning it well for future technological advancements despite a highly volatile share price in recent months.

Seize The Opportunity

- Unlock more gems! Our Asian High Growth Tech and AI Stocks screener has unearthed 163 more companies for you to explore.Click here to unveil our expertly curated list of 166 Asian High Growth Tech and AI Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3013

Chenming Electronic Tech

An OEM/ODM manufacturer, engages in the research and development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds in Taiwan, China, the United States, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives