- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:5243

Exploring High Growth Tech Stocks In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with small-cap indices like the Russell 2000 hitting record intraday highs, investor sentiment is being shaped by domestic policy shifts and geopolitical developments. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that can capitalize on technological advancements and maintain resilience amidst economic fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Chenming Electronic Tech (TWSE:3013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chenming Electronic Tech. Corp., with a market cap of NT$29.03 billion, operates as an OEM/ODM manufacturer specializing in the research, development, manufacturing, and sale of computer and server cases, server chassis, mobile device components, and molds across Taiwan, China, the United States, and other international markets.

Operations: The company's primary revenue stream comes from the production and sales of computer and mobile device components, generating NT$8.53 billion. Chenming Electronic Tech. Corp.'s operations span Taiwan, China, the United States, and other international markets.

Chenming Electronic Tech's recent financial performance underscores its robust position in the tech sector, with a notable increase in sales to TWD 2.66 billion from TWD 1.77 billion year-over-year and a doubling of net income to TWD 164.48 million. This surge aligns with an earnings growth forecast of 105% annually, significantly outpacing the broader Taiwanese market's expectations of 19.2%. The company has also committed to future growth through strategic initiatives like its recent TWD 570.05 million convertible bond offering, aimed at financing further expansion and innovation in high-demand tech segments. Despite facing shareholder dilution this past year, Chenming Electronic Tech continues to demonstrate strong revenue growth projected at 58% annually—three times faster than the market average of around 20%. These figures reflect not only the company’s ability to scale effectively but also its adeptness at capitalizing on emerging tech trends that could shape industry standards moving forward. With ongoing investments in R&D and expansion strategies well underway, Chenming is poised for sustained growth amidst a rapidly evolving technological landscape.

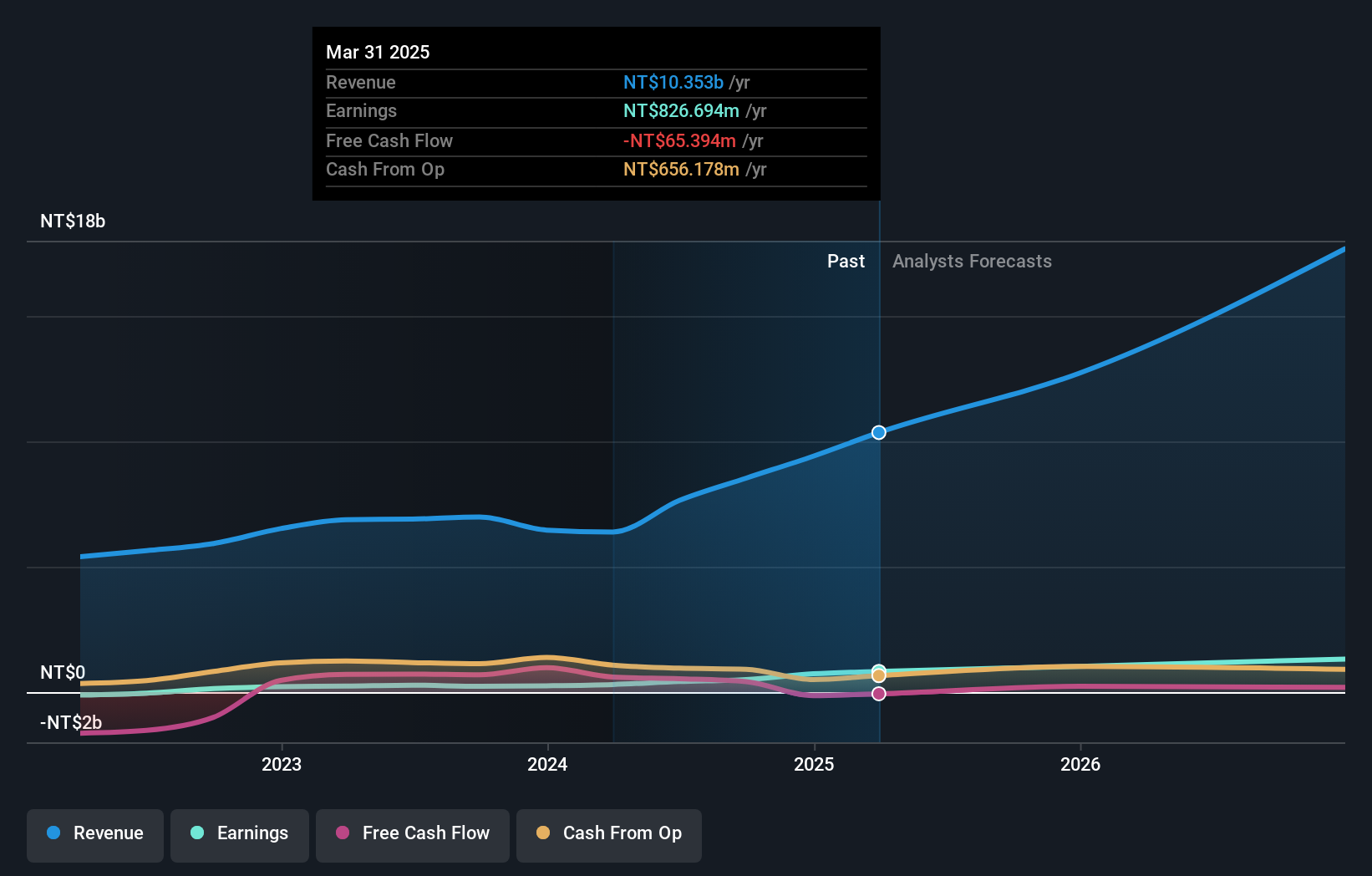

Eson Precision Ind (TWSE:5243)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eson Precision Ind. Co., Ltd. is engaged in the production and sale of molds and consumer electronic components both in Taiwan and internationally, with a market cap of NT$11.53 billion.

Operations: Eson Precision Ind. Co., Ltd. generates revenue primarily from its mold, plastic, and metal products segment, which accounts for NT$12.14 billion. The company operates in both domestic and international markets, focusing on the production of molds and consumer electronic components.

With a robust commitment to innovation, Eson Precision Ind. has recently established a Committee for Sustainable Development, signaling a strategic pivot towards long-term corporate sustainability. This move complements their financial growth; in the latest quarter, sales surged to TWD 3.39 billion from TWD 2.73 billion year-over-year, with net income also climbing to TWD 162.43 million from TWD 140.75 million. Notably, their revenue is forecasted to grow at an annual rate of 21.1%, outpacing the broader Taiwanese market's average of 12.1%. Despite some volatility in earnings—showing a decline over the past year—the company's forward-looking initiatives and above-market growth projections position it intriguingly for future developments in high-tech sectors.

- Click here to discover the nuances of Eson Precision Ind with our detailed analytical health report.

Explore historical data to track Eson Precision Ind's performance over time in our Past section.

Arizon RFID Technology (Cayman) (TWSE:6863)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arizon RFID Technology (Cayman) Co., Ltd. is engaged in the design, development, manufacturing, and trading of radio-frequency identification systems across Taiwan, China, and international markets with a market capitalization of NT$16.13 billion.

Operations: Arizon RFID Technology (Cayman) focuses on the design, development, manufacturing, and trading of radio-frequency identification systems. The company operates across Taiwan, China, and international markets.

Arizon RFID Technology (Cayman) demonstrates a compelling growth trajectory with a notable increase in both sales and net income, as evidenced by recent quarterly figures where sales more than doubled to TWD 1.15 billion from TWD 655.27 million year over year, and net income surged to TWD 171.09 million from TWD 86.96 million. This performance is underpinned by robust R&D investments, aligning with industry trends towards advanced RFID solutions for diverse applications such as inventory management and asset tracking. The company's earnings are expected to grow by an impressive 22% annually, outpacing the broader market's forecast of 19.2%, reflecting its strategic focus on innovation and market expansion in high-tech sectors.

Where To Now?

- Dive into all 1284 of the High Growth Tech and AI Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eson Precision Ind might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5243

Eson Precision Ind

Produces and sells molds, consumer electronic components, and other products in Taiwan and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives