- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3008

Global Dividend Stocks Yielding Up To 5.2%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed economic signals and shifting monetary policies, investors are increasingly turning their attention to dividend stocks as a potential source of steady income. In the current environment, characterized by fluctuating interest rates and economic uncertainties, dividend stocks yielding up to 5.2% can offer an attractive combination of income and stability for those seeking to balance growth with reliable returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.76% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.21% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.92% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.62% | ★★★★★★ |

| NCD (TSE:4783) | 3.94% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.14% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.66% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

Click here to see the full list of 1302 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

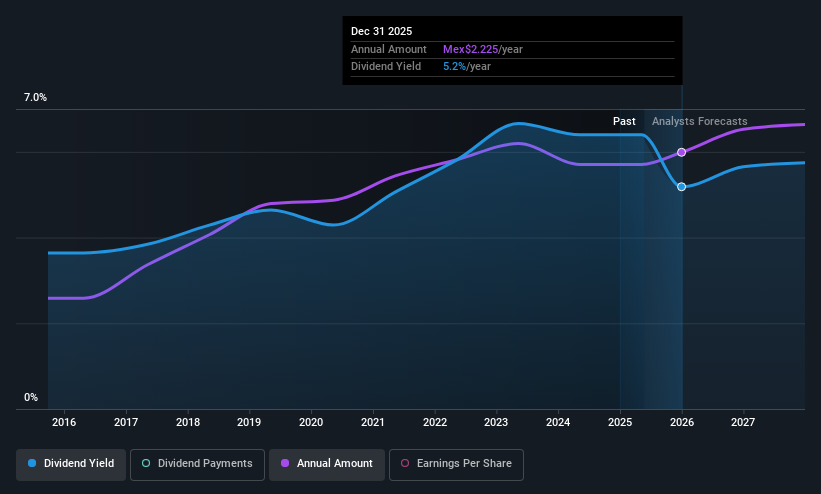

Bolsa Mexicana de Valores. de (BMV:BOLSA A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bolsa Mexicana de Valores, S.A.B. de C.V. operates as the primary stock exchange in Mexico with a market cap of MX$22.29 billion.

Operations: Bolsa Mexicana de Valores, S.A.B. de C.V. generates revenue through its operations as the leading stock exchange in Mexico.

Dividend Yield: 5.3%

Bolsa Mexicana de Valores offers a stable dividend profile with consistent payments over the past decade. While its 5.29% yield is below the top quartile in Mexico, dividends are reliably covered by earnings and cash flows, indicated by payout ratios of 81.2% and 60.1%, respectively. Recent earnings show modest revenue growth to MXN 3.34 billion for nine months ending September 2025, supporting sustainable dividend practices despite slightly lower net income year-over-year.

- Unlock comprehensive insights into our analysis of Bolsa Mexicana de Valores. de stock in this dividend report.

- The valuation report we've compiled suggests that Bolsa Mexicana de Valores. de's current price could be inflated.

SPARX Group (TSE:8739)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SPARX Group Co., Ltd. is a publicly owned asset management holding company with a market cap of ¥59.28 billion.

Operations: SPARX Group Co., Ltd. generates revenue primarily from its Investment Trust and Investment Advisory Business, amounting to ¥17.89 billion.

Dividend Yield: 4.3%

SPARX Group's dividends are well-supported by earnings and cash flows, with payout ratios of 46.1% and 71.4%, respectively. The dividend yield of 4.31% ranks in the top quartile of Japanese payers, reflecting reliable growth over a decade without volatility. Trading below fair value enhances its appeal for income-focused investors. Recent strategic alliances aim to boost corporate value and support sustainable growth, potentially benefiting shareholders through enhanced future prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of SPARX Group.

- Our valuation report unveils the possibility SPARX Group's shares may be trading at a discount.

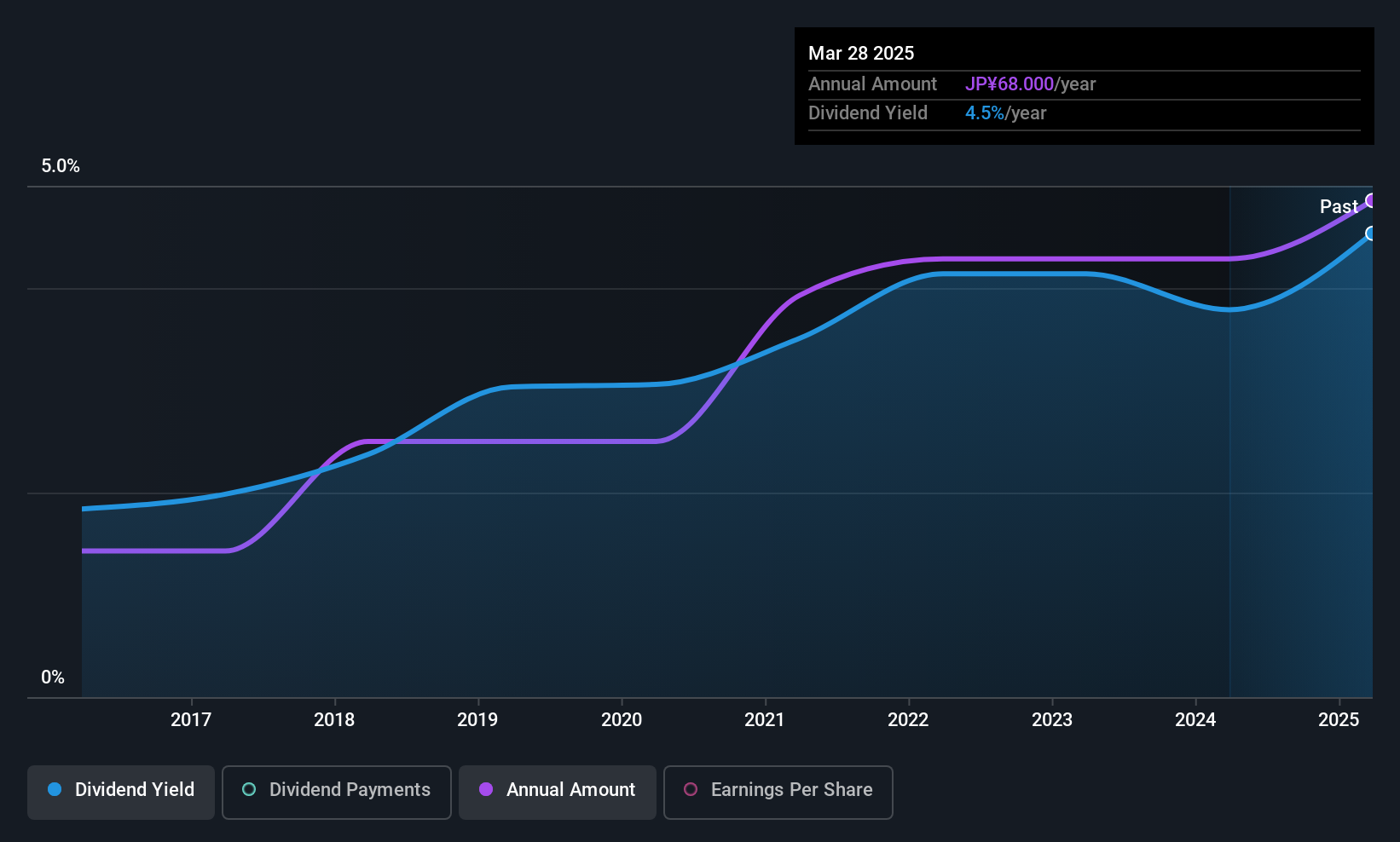

LARGAN PrecisionLtd (TWSE:3008)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LARGAN Precision Co., Ltd, along with its subsidiaries, is engaged in the research, design, manufacture, and sale of precision optical plastic lenses across China, Korea, Vietnam, Japan, and other international markets with a market capitalization of approximately NT$274.94 billion.

Operations: LARGAN Precision Co., Ltd generates revenue primarily from its optical lens segment, amounting to NT$62.14 billion.

Dividend Yield: 4.4%

LARGAN Precision Ltd's dividends are covered by earnings and cash flows, with payout ratios of 49.1% and 68.3%, respectively. However, the dividend track record has been unstable over the past decade, marked by volatility and a lower yield of 4.73% compared to top-tier Taiwanese payers. Despite trading at a significant discount to estimated fair value, recent earnings reports show mixed results with declining sales but improved net income for Q3 2025.

- Navigate through the intricacies of LARGAN PrecisionLtd with our comprehensive dividend report here.

- The analysis detailed in our LARGAN PrecisionLtd valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Gain an insight into the universe of 1302 Top Global Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3008

LARGAN PrecisionLtd

Researches, designs, manufactures, and sells precision optical plastic lenses in China, Korea, Vietnam, Japan, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion