- Taiwan

- /

- Tech Hardware

- /

- TWSE:2498

Further weakness as HTC (TWSE:2498) drops 13% this week, taking one-year losses to 27%

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in HTC Corporation (TWSE:2498) have tasted that bitter downside in the last year, as the share price dropped 27%. That's disappointing when you consider the market returned 23%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 2.8% in three years. More recently, the share price has dropped a further 21% in a month. But this could be related to poor market conditions -- stocks are down 13% in the same time.

If the past week is anything to go by, investor sentiment for HTC isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for HTC

HTC isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

HTC's revenue didn't grow at all in the last year. In fact, it fell 5.7%. That's not what investors generally want to see. Shareholders have seen the share price drop 27% in that time. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

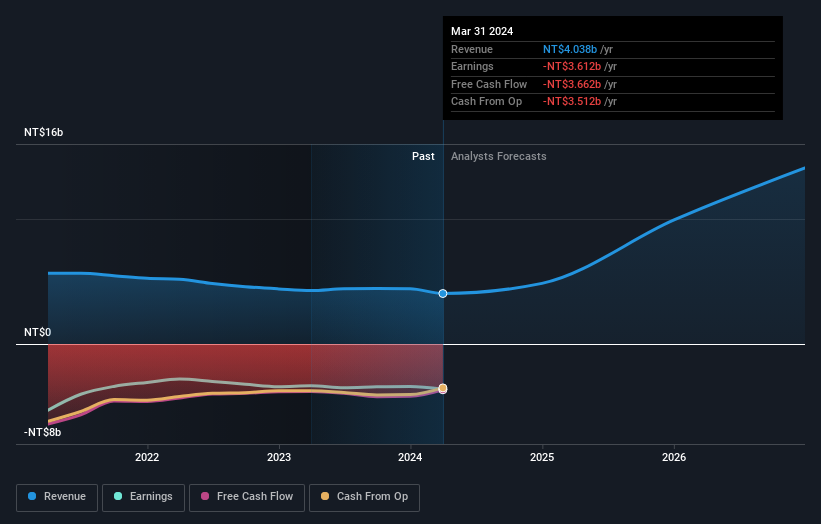

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on HTC's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in HTC had a tough year, with a total loss of 27%, against a market gain of about 23%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HTC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2498

HTC

Designs, manufactures, assembles, processes, and sells smart mobile and virtual reality devices in Taiwan and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives