- Hong Kong

- /

- Electrical

- /

- SEHK:580

Sun.King Technology Group And 2 Other Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, U.S. stocks experienced declines, with smaller-cap indexes feeling the brunt of the downturn. Amidst these challenges, investors are increasingly seeking opportunities in overlooked sectors that may offer resilience and growth potential despite broader market volatility. Identifying promising stocks often involves looking beyond immediate market sentiment to find companies with strong fundamentals and innovative strategies that can thrive even in uncertain economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.27% | -7.65% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Sun.King Technology Group (SEHK:580)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sun.King Technology Group Limited is an investment holding company that manufactures and trades power electronic components for sectors such as power transmission, electrified transportation, and industrial applications in China, with a market cap of approximately HK$2.19 billion.

Operations: The company's primary revenue stream is derived from the manufacturing and trading of power electronic components, generating CN¥1.25 billion.

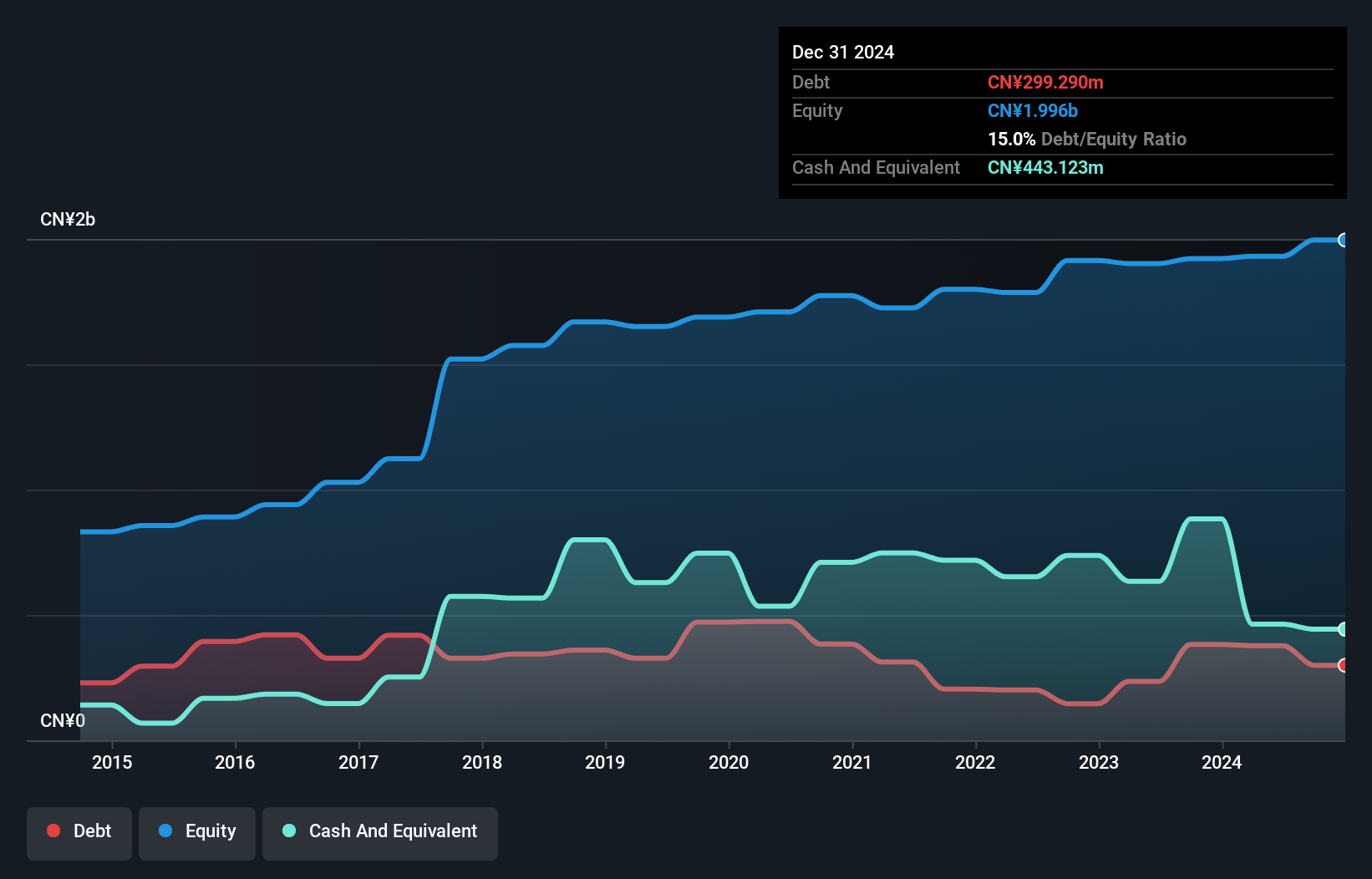

Sun.King Technology Group, a small-cap player in the electrical sector, showcases a mixed financial landscape. Over the past year, its earnings surged by 184.9%, outpacing the industry average of 7.7%. Despite this impressive growth, earnings have declined by an average of 45.5% annually over five years. The company's debt to equity ratio has slightly improved from 19.8% to 19.6%, and interest payments are well covered with EBIT at 7.9 times coverage, suggesting solid financial management despite negative free cash flow trends recently observed in its reports. Recent board changes include Ms. Zhang Ling's resignation as non-executive director in October 2024.

Infortrend Technology (TWSE:2495)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Infortrend Technology, Inc. specializes in the research, development, manufacture, and sale of disk array control systems and storage solutions across various international markets, with a market capitalization of approximately NT$8.97 billion.

Operations: Infortrend Technology generates revenue primarily from its head office, contributing NT$1.27 billion, with additional income from its subsidiaries in China and the USA at NT$114.87 million and NT$106.22 million respectively. The net profit margin shows notable variability over recent periods, reflecting changes in operational efficiency and market conditions.

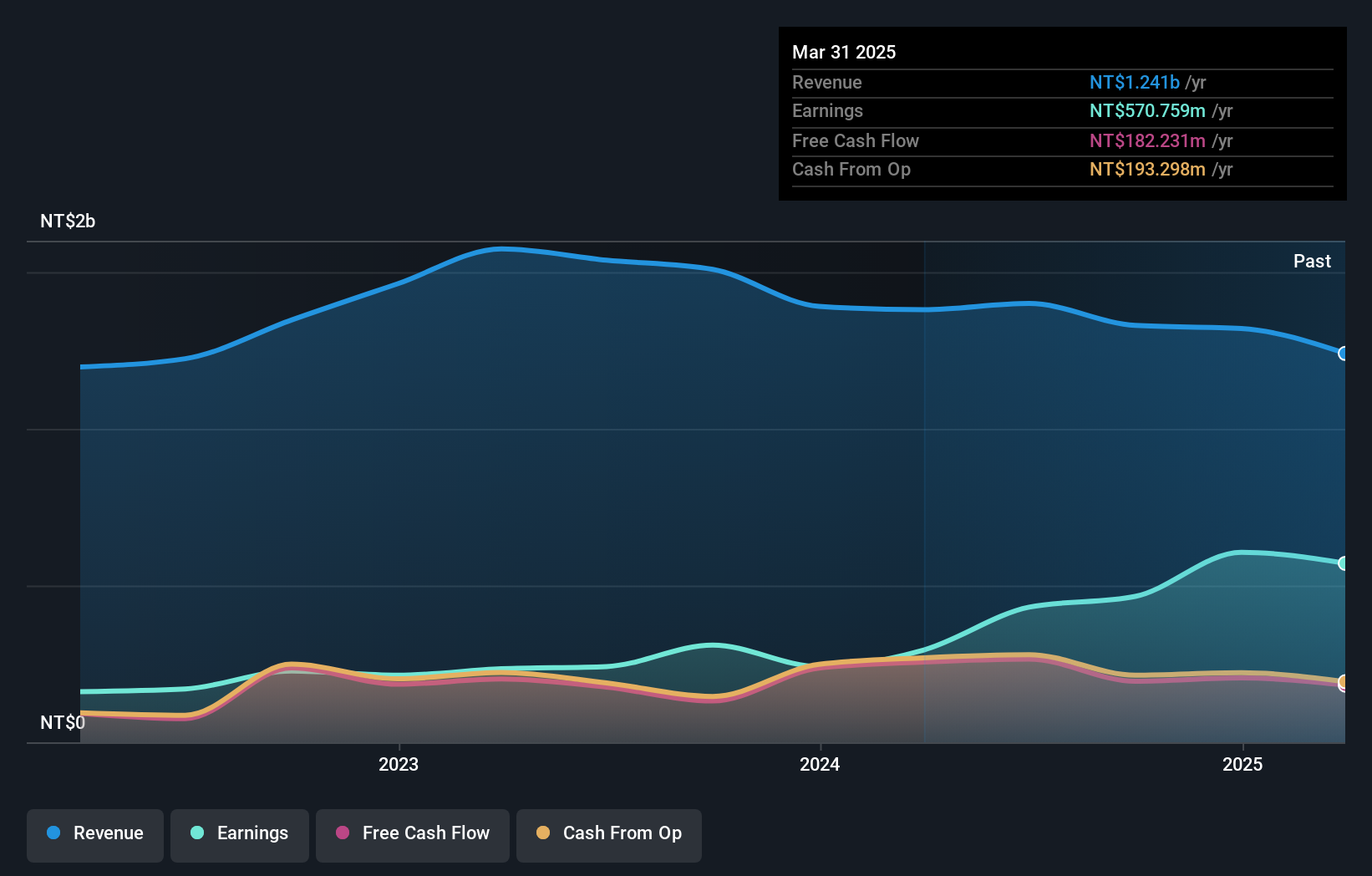

Infortrend Technology, a compact player in the tech sector, has shown impressive earnings growth of 50.1% over the past year, outpacing the industry's 11.4%. Despite a volatile share price recently, its debt-to-equity ratio has risen from 17% to 42.8% over five years. The company is valued attractively with a price-to-earnings ratio of 19.3x below the Taiwan market average of 20.8x and boasts more cash than total debt, ensuring financial stability. Recent product innovations like their EonStor GS 5000U storage solution demonstrate their commitment to advancing AI capabilities and meeting high-performance demands in various industries.

Apaq Technology (TWSE:6449)

Simply Wall St Value Rating: ★★★★★★

Overview: Apaq Technology Co., Ltd. and its subsidiaries focus on the research, development, manufacturing, and sales of electronic components in China and Taiwan, with a market cap of NT$13.11 billion.

Operations: Apaq Technology generates revenue primarily from electronic components and parts, totaling NT$3.28 billion. The company has a market capitalization of NT$13.11 billion.

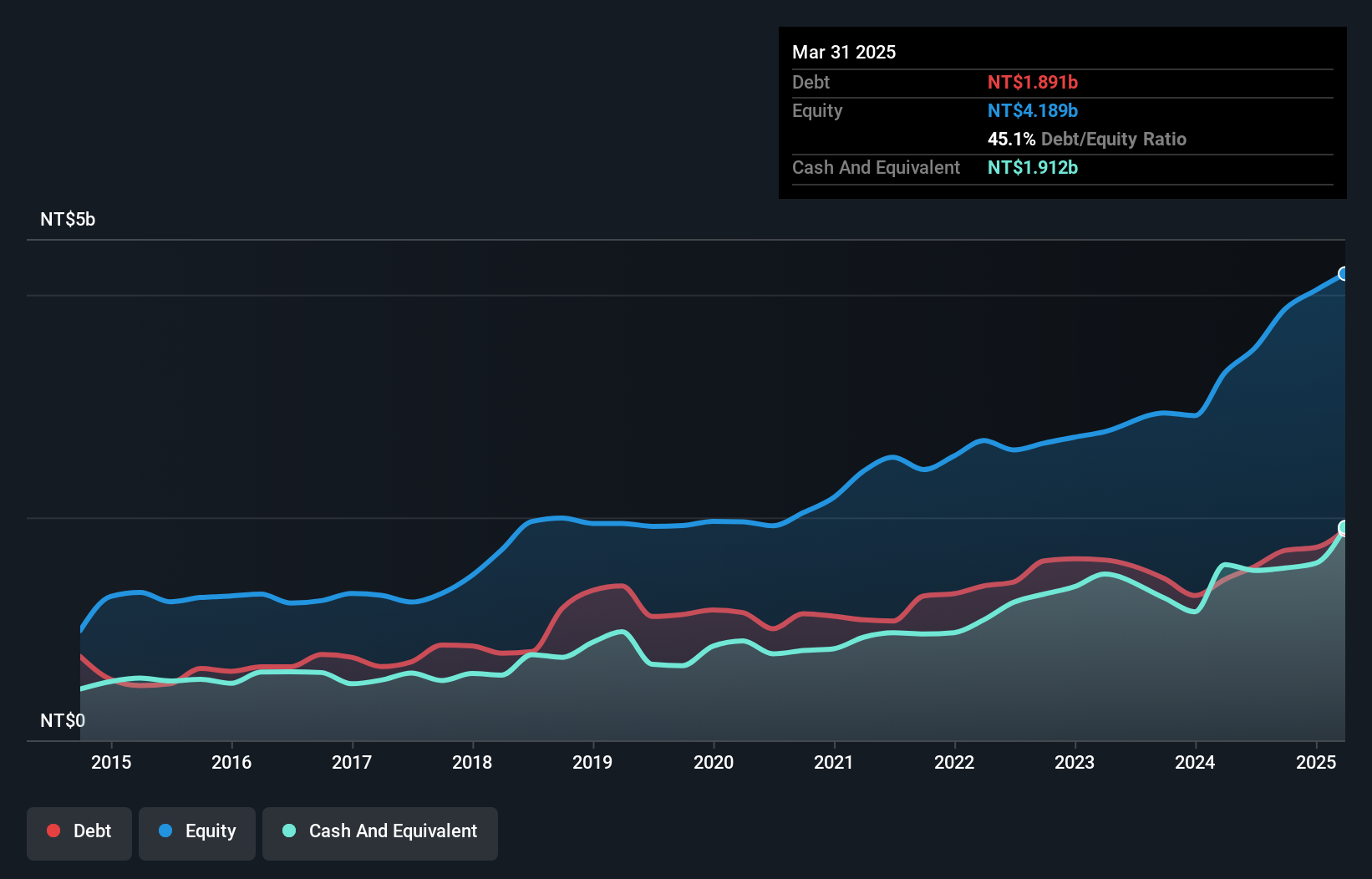

Apaq Technology, a nimble player in the electronics sector, has shown robust earnings growth of 39.9% over the past year, significantly outpacing the industry's 6.6%. The company appears to have managed its debt effectively, reducing its debt-to-equity ratio from 58.6% to 44% over five years while maintaining satisfactory net debt levels at 4.1%. Despite recent share price volatility, Apaq's high-quality earnings and positive free cash flow provide a solid foundation for future endeavors. Recent reports indicate sales reached TWD 921 million in Q3 with net income slightly lower at TWD 117 million compared to last year’s figures.

- Click to explore a detailed breakdown of our findings in Apaq Technology's health report.

Gain insights into Apaq Technology's past trends and performance with our Past report.

Seize The Opportunity

- Reveal the 4633 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:580

Sun.King Technology Group

An investment holding company, manufactures and trades in power electronic components for use in power transmission and distribution, electrified transportation, industrial, and other sectors in the People’s Republic of China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion