- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2429

Shareholders have faith in loss-making Abonmax (TWSE:2429) as stock climbs 24% in past week, taking three-year gain to 265%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. To wit, the Abonmax Co., Ltd (TWSE:2429) share price has flown 184% in the last three years. That sort of return is as solid as granite. It's also up 53% in about a month.

Since the stock has added NT$770m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Abonmax

Abonmax wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Abonmax actually saw its revenue drop by 37% per year over three years. So we wouldn't have expected the share price to gain 42% per year, but it has. It's a good reminder that expectations about the future, not the past history, always impact share prices.

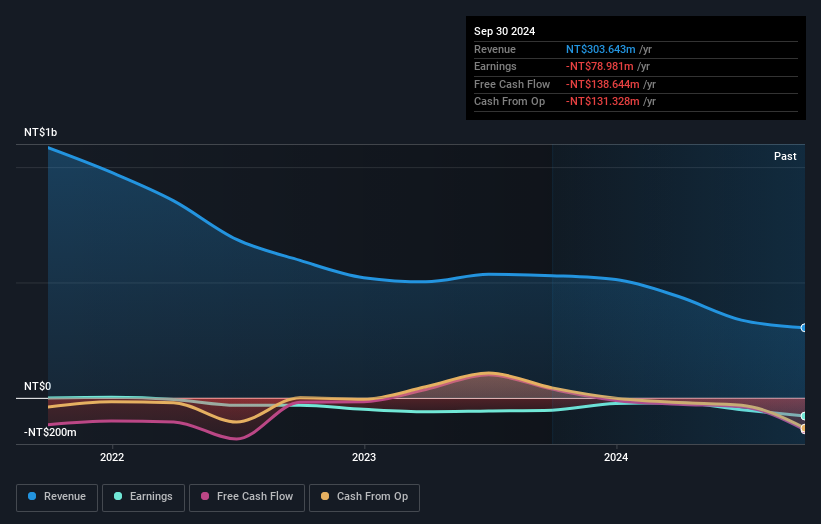

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Abonmax's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Abonmax's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Abonmax hasn't been paying dividends, but its TSR of 265% exceeds its share price return of 184%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's good to see that Abonmax has rewarded shareholders with a total shareholder return of 180% in the last twelve months. That's better than the annualised return of 23% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Abonmax better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with Abonmax .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2429

Abonmax

An integrated optoelectronic display company, engages in the production and sale of electronic components and appliances, and audio-visual electronic products in Taiwan, China, and internationally.

Flawless balance sheet very low.

Market Insights

Community Narratives