Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2409

Those who invested in AUO (TWSE:2409) five years ago are up 119%

The main point of investing for the long term is to make money. Furthermore, you'd generally like to see the share price rise faster than the market. Unfortunately for shareholders, while the AUO Corporation (TWSE:2409) share price is up 59% in the last five years, that's less than the market return. Zooming in, the stock is actually down 1.9% in the last year.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for AUO

AUO wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years AUO saw its revenue shrink by 2.4% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 10% per year over that time. That's pretty decent given the top line decline, and lack of profits. Of course, a closer look at the bottom line - and any available analyst forecasts - could reveal an opportunity (if they point to future growth).

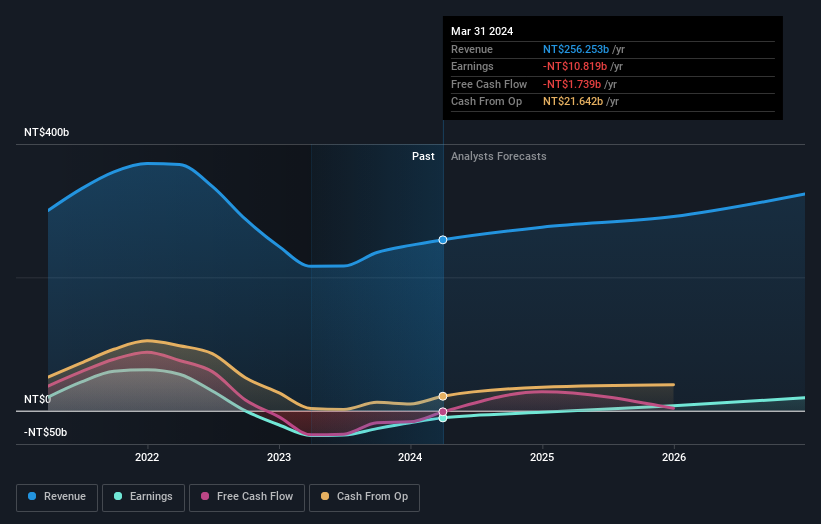

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

AUO is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of AUO, it has a TSR of 119% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

AUO shareholders gained a total return of 2.1% during the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 17% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether AUO is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether AUO is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2409

AUO

Researches, develops, produces, and sells thin film transistor liquid crystal displays (TFT-LCDs) and other flat panel displays for various applications.

Fair value with moderate growth potential.