- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2383

Exploring Three High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

Amidst global market fluctuations and geopolitical tensions, Asian tech markets have shown resilience, with indices like the Shanghai Composite and CSI 300 posting gains due to hopes for more stimulus in China. In this environment, identifying high-growth tech stocks involves assessing their adaptability to economic shifts and technological advancements that align with current market trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Fositek | 28.51% | 35.31% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Digiwin (SZSE:300378)

Simply Wall St Growth Rating: ★★★★☆☆

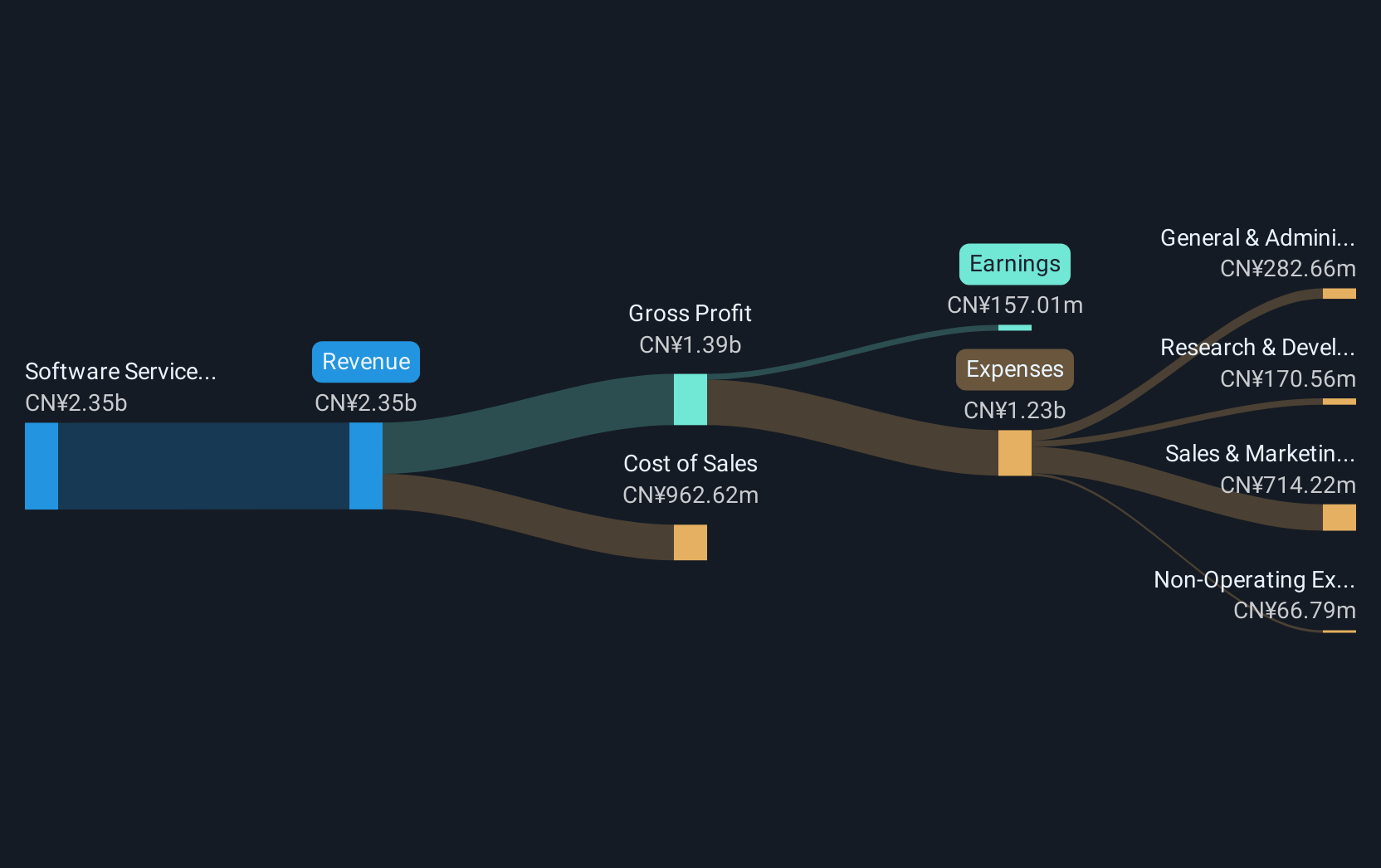

Overview: Digiwin Co., Ltd. offers industry-specific software solutions across Mainland China and internationally, with a market cap of CN¥10.52 billion.

Operations: Digiwin Co., Ltd. generates revenue primarily through its software services segment, which contributes CN¥2.35 billion.

Digiwin, amid a backdrop of robust tech growth in Asia, showcases promising financial trajectories with its revenue and earnings forecast to outpace the Chinese market at 15.3% and 28.5% annually, respectively. Despite recent adjustments in dividend policies reflecting CNY 0.30 per ten shares, the firm's commitment to innovation is evident from its R&D investments aligning closely with revenue growth trends. This strategic focus not only underscores Digiwin’s adaptability in a competitive landscape but also enhances its potential for sustained expansion in software solutions across diverse sectors.

- Click to explore a detailed breakdown of our findings in Digiwin's health report.

Explore historical data to track Digiwin's performance over time in our Past section.

iSoftStone Information Technology (Group) (SZSE:301236)

Simply Wall St Growth Rating: ★★★★☆☆

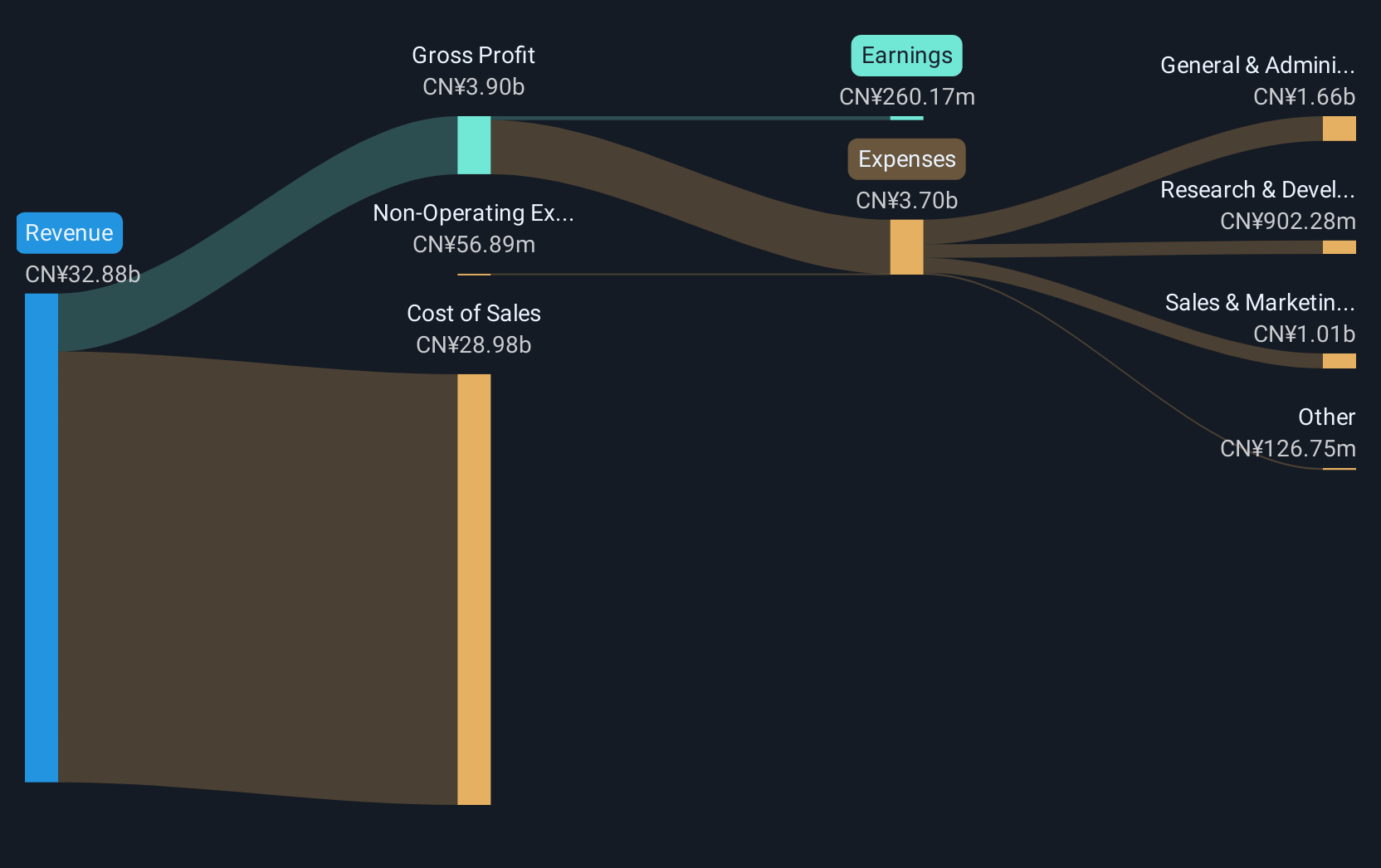

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a company with a market cap of CN¥50.94 billion, focusing on providing IT consulting and software development services.

Operations: The company generates revenue primarily through IT consulting and software development services, with a market capitalization of CN¥50.94 billion.

iSoftStone Information Technology (Group) Co., Ltd. is carving a niche in the global tech landscape with its strategic expansion and innovation-driven approach, evidenced by the launch of iSoftStone Digital at the Global Digital Economy Conference. This move is part of their Going Global Expansion2.0 strategy, marking a significant step in enhancing their international presence across key markets such as Southeast Asia and North America. Financially, iSoftStone has demonstrated robust growth with a 13.1% annual increase in revenue and an impressive 37.3% surge in earnings growth year-over-year, outpacing general market trends significantly. The company's commitment to R&D is underscored by substantial investments that align closely with these growth figures, ensuring sustained innovation and competitive edge in intelligent products and services for both domestic and global clients.

Elite Material (TWSE:2383)

Simply Wall St Growth Rating: ★★★★☆☆

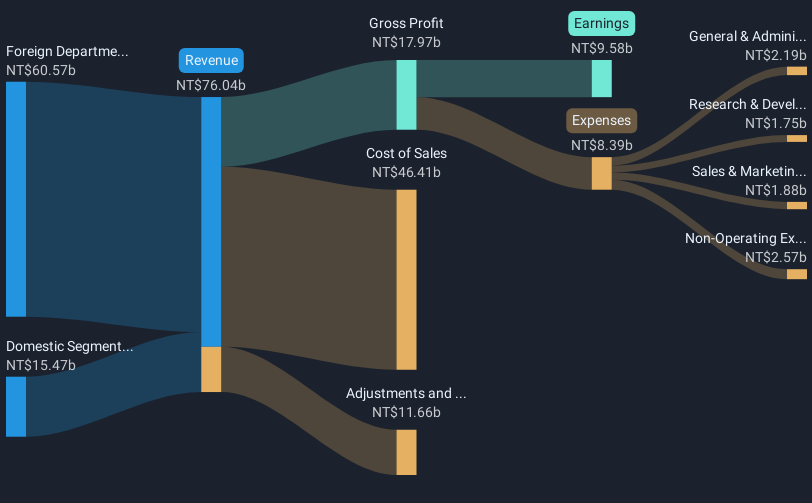

Overview: Elite Material Co., Ltd. specializes in the production and sale of copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components across Taiwan, China, and international markets with a market cap of NT$326.31 billion.

Operations: The company generates revenue primarily from its foreign departments, contributing NT$69.60 billion, while the domestic segment adds NT$16.17 billion. Its operations focus on copper clad laminates and electronic-industrial specialty chemicals.

Elite Material Co., Ltd. has demonstrated a robust trajectory in the tech sector, with significant presentations at various investment forums signaling strong investor relations and market confidence. The company's recent financial performance underscores this growth, reporting a substantial increase in sales to TWD 21.68 billion, up from TWD 12.9 billion year-over-year, and a net income rise to TWD 3.47 billion from TWD 1.98 billion. These figures reflect an earnings growth of 58.4% over the past year, outstripping the electronic industry's average of 14.2%. This financial uptrend is complemented by strategic executive changes aimed at bolstering governance and future growth prospects.

- Click here to discover the nuances of Elite Material with our detailed analytical health report.

Assess Elite Material's past performance with our detailed historical performance reports.

Taking Advantage

- Access the full spectrum of 480 Asian High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elite Material might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2383

Elite Material

Engages in the production and sale of copper clad laminates, electronic-industrial specialty chemical and raw materials, and electronic components in Taiwan, China, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives