As of early July 2025, global markets are experiencing a notable upswing, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs for the second consecutive week, driven by robust job growth and positive trade developments. In this context of rising market sentiment and economic resilience, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation capabilities, adaptability to evolving market trends, and potential for sustained revenue expansion in the dynamic technology sector.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.26% | 44.76% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Shenzhen Fortune Trend Technology (SHSE:688318)

Simply Wall St Growth Rating: ★★★★★☆

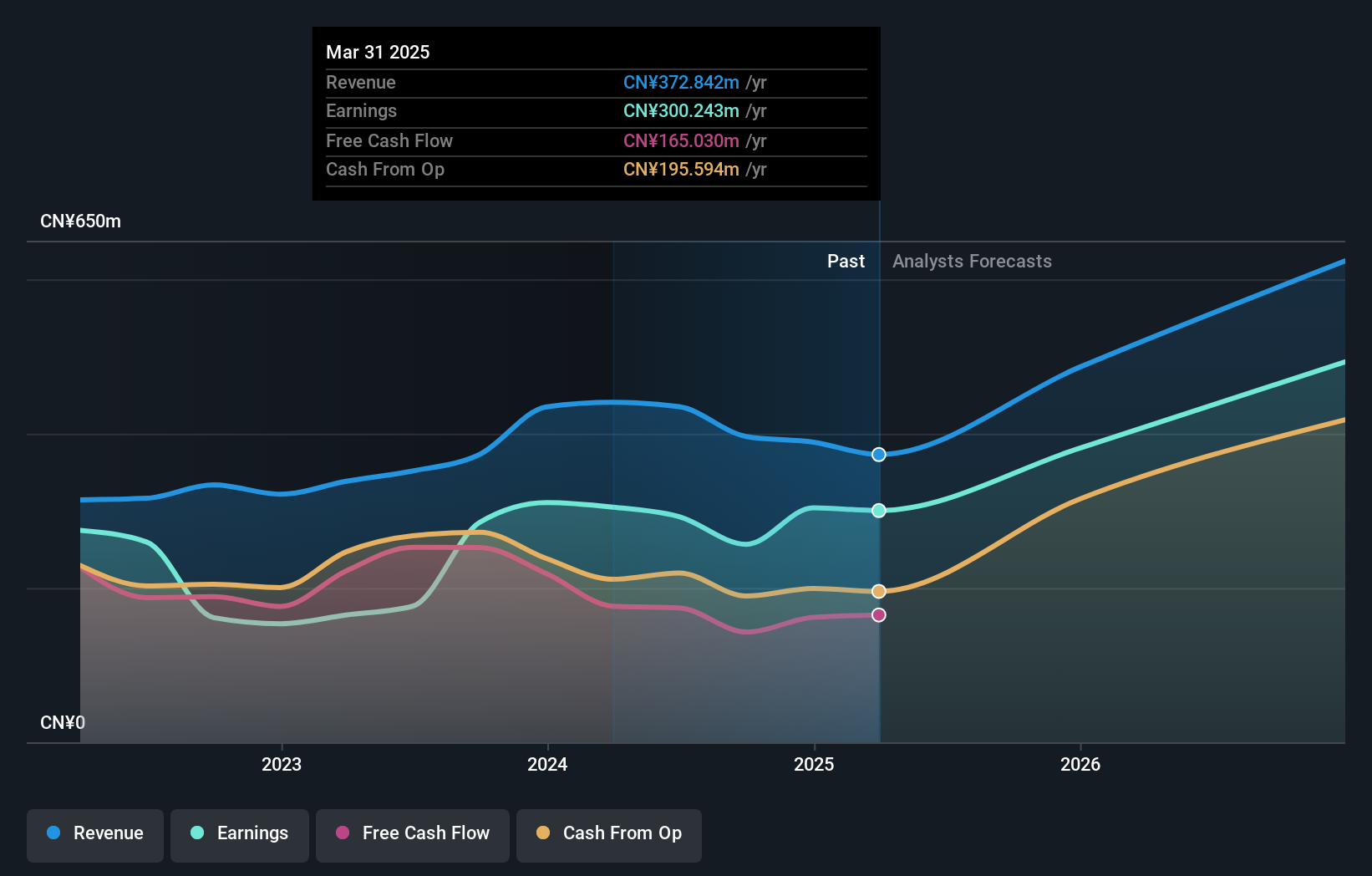

Overview: Shenzhen Fortune Trend Technology Co., Ltd. is a company with a market cap of CN¥27.78 billion, engaged in providing technology solutions and services.

Operations: The company generates revenue primarily from technology solutions and services, contributing significantly to its financial performance. The net profit margin stands at 35%, indicating efficient cost management relative to its income.

Shenzhen Fortune Trend Technology, amidst a volatile market, has shown promising growth metrics that outpace industry averages. With an annual revenue growth forecast at 28.9% and earnings expected to surge by 28.1% per year, the company is strategically positioned above many of its peers in the tech sector. Recent corporate activities including a stock split suggest proactive management in enhancing shareholder value. Moreover, significant R&D investments underline its commitment to innovation, crucial for sustaining long-term growth in the competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Fortune Trend Technology.

Learn about Shenzhen Fortune Trend Technology's historical performance.

ALSO Holding (SWX:ALSN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ALSO Holding AG, with a market cap of CHF3.32 billion, operates as a technology services provider for the ICT industry across Switzerland, Germany, the Netherlands, Poland, and internationally.

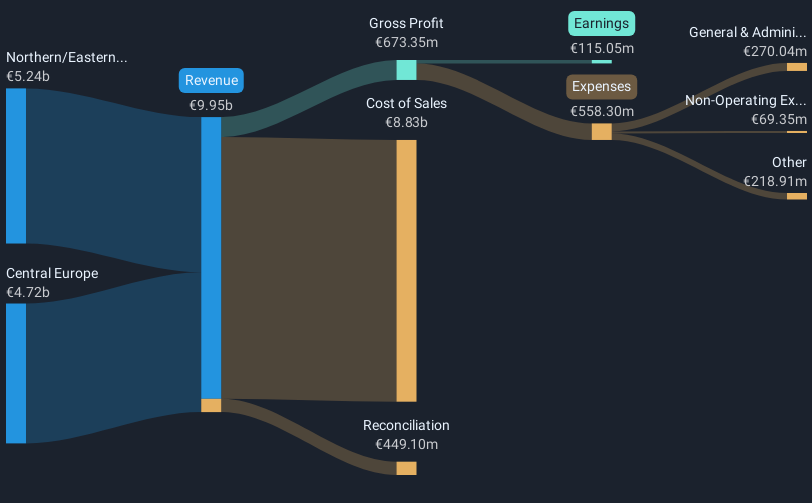

Operations: The company generates revenue primarily from its operations in Central Europe (€4.72 billion) and Northern/Eastern Europe (€5.24 billion). It provides technology services within the ICT industry across several regions, focusing on these major European markets.

ALSO Holding, navigating through a tech landscape where annual revenue and earnings growth are forecasted at 8.8% and 20.9% respectively, underscores its robust position in the market compared to the slower Swiss average of 3.9%. The company's recent launch of cybersecurity products for SMBs via its partner CYE reflects a strategic pivot towards securing emerging IT environments, crucial as the European cybersecurity market is poised to expand significantly. This move not only capitalizes on growing security demands but also enhances ALSO's offerings in over 32 countries, demonstrating a proactive adaptation to market needs while fostering growth in a high-stakes industry.

- Click here to discover the nuances of ALSO Holding with our detailed analytical health report.

Gain insights into ALSO Holding's historical performance by reviewing our past performance report.

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★☆☆

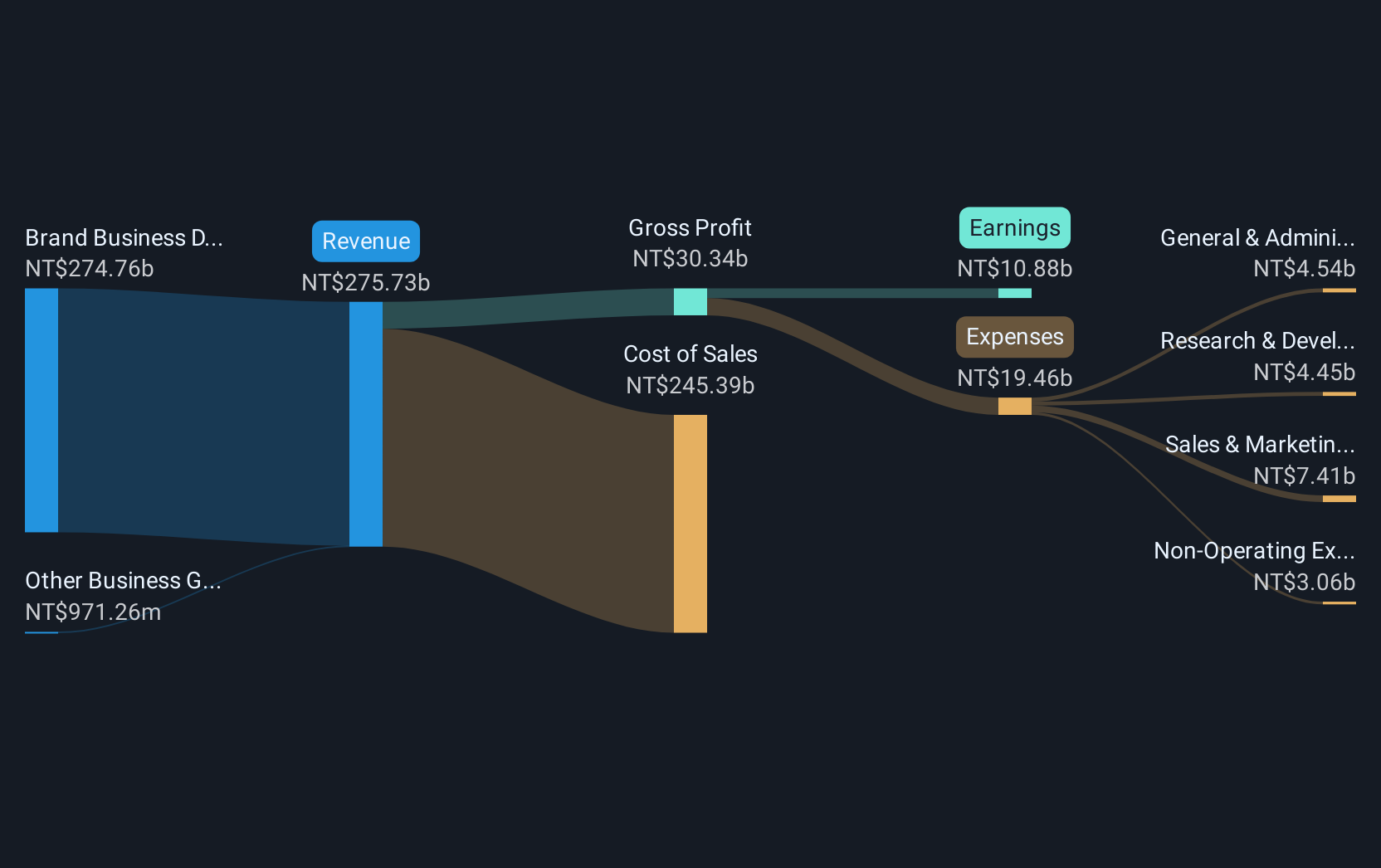

Overview: Giga-Byte Technology Co., Ltd. is a company that, along with its subsidiaries, engages in the manufacturing, processing, and trading of computer peripherals and component parts across Taiwan, Europe, the United States, Canada, China, and other international markets with a market capitalization of NT$186.23 billion.

Operations: The Brand Business Division is the primary revenue driver for Giga-Byte Technology, generating NT$274.76 billion, while the Other Business Group contributes NT$971.26 million.

Giga-Byte Technology stands out with a robust 89.5% earnings growth over the past year, significantly surpassing the tech industry's average of 12.3%. This performance is underpinned by strategic leadership appointments and innovative product launches, such as the AI-centric GIGAPOD at COMPUTEX 2025, which showcases their commitment to evolving computing solutions. The company's R&D expenditure aligns with its forward-looking approach, maintaining a dynamic balance between immediate financial outcomes and long-term technological advancements. With revenue and earnings forecasted to grow annually at 14.6% and 16.9%, respectively, Giga-Byte is poised to capitalize on expanding market demands while continuing to innovate in high-density computing and AI applications.

- Delve into the full analysis health report here for a deeper understanding of Giga-Byte Technology.

Gain insights into Giga-Byte Technology's past trends and performance with our Past report.

Seize The Opportunity

- Get an in-depth perspective on all 743 Global High Growth Tech and AI Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688318

Shenzhen Fortune Trend Technology

Shenzhen Fortune Trend Technology Co., Ltd.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives