- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2368

Market Cool On Gold Circuit Electronics Ltd.'s (TWSE:2368) Earnings Pushing Shares 27% Lower

Gold Circuit Electronics Ltd. (TWSE:2368) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 79% in the last year.

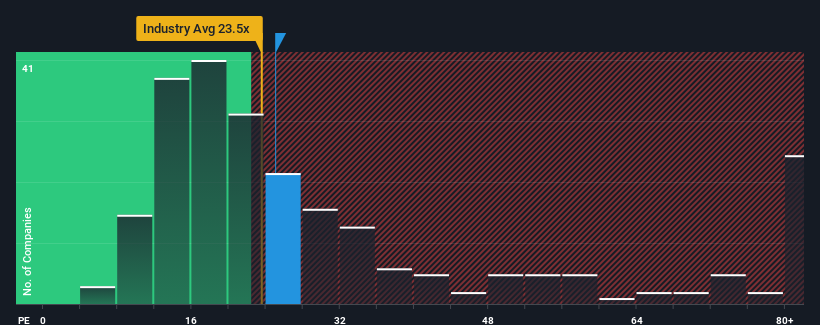

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Gold Circuit Electronics' P/E ratio of 25x, since the median price-to-earnings (or "P/E") ratio in Taiwan is also close to 23x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, Gold Circuit Electronics has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

See our latest analysis for Gold Circuit Electronics

Does Growth Match The P/E?

Gold Circuit Electronics' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. Even so, admirably EPS has lifted 71% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 75% during the coming year according to the nine analysts following the company. With the market only predicted to deliver 26%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Gold Circuit Electronics' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Following Gold Circuit Electronics' share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Gold Circuit Electronics' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Gold Circuit Electronics that you should be aware of.

You might be able to find a better investment than Gold Circuit Electronics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2368

Gold Circuit Electronics

Designs, manufactures, processes, and distributes printed circuit boards in Taiwan.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives