As global markets experience fluctuations with U.S. stock indexes nearing record highs and inflation concerns impacting rate expectations, investors are keenly observing the performance of high-growth tech stocks, particularly as small-cap stocks have recently lagged behind larger indices like the S&P 500. In this environment, identifying promising tech stocks often involves looking for companies that demonstrate robust innovation potential and adaptability to shifting economic conditions while maintaining a sustainable growth trajectory.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

BioGaia (OM:BIOG B)

Simply Wall St Growth Rating: ★★★★☆☆

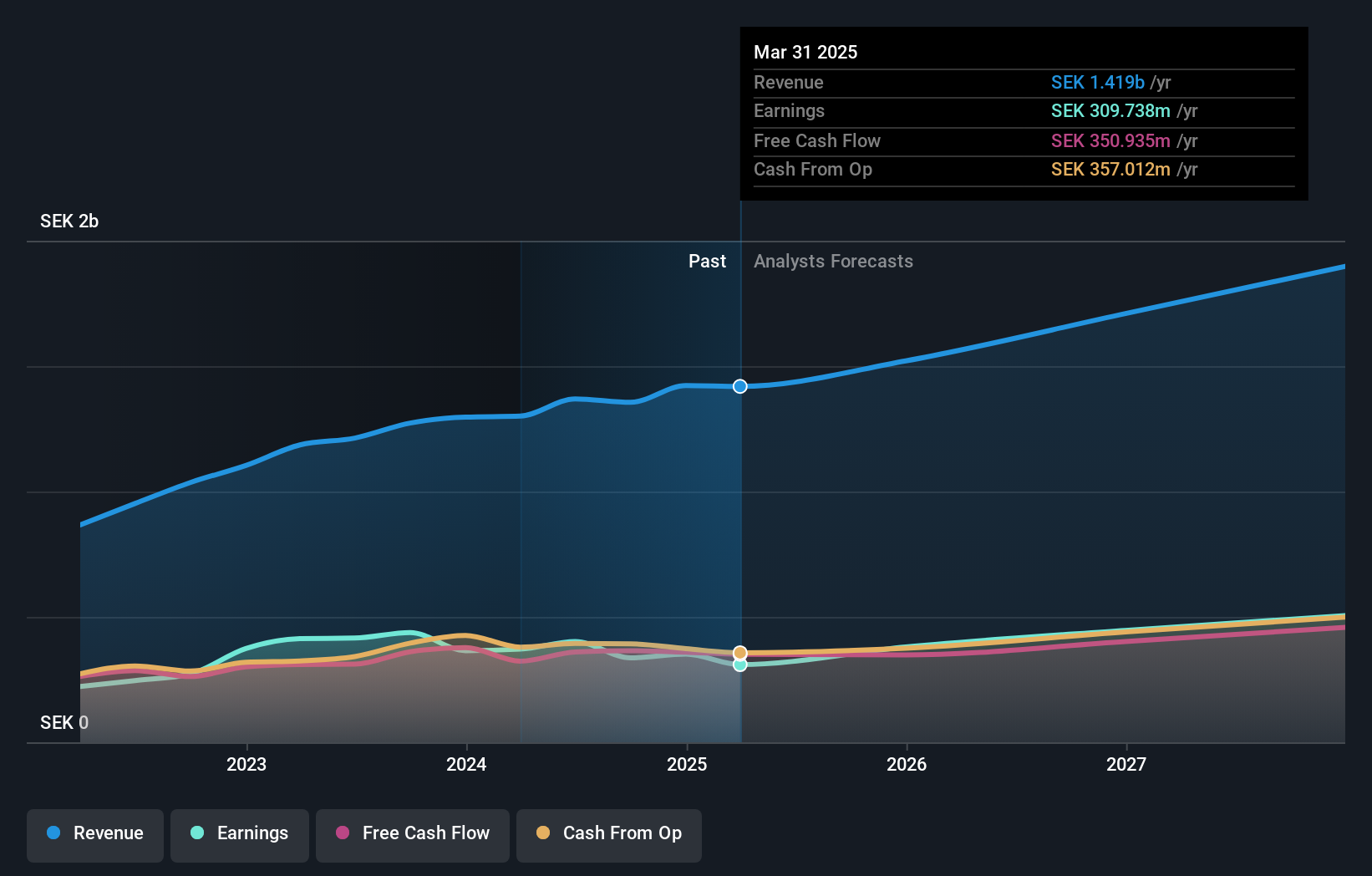

Overview: BioGaia AB (publ) is a healthcare company that specializes in providing probiotic products globally, with a market capitalization of approximately SEK13.16 billion.

Operations: The company generates revenue primarily through its Pediatrics and Adult Health segments, with Pediatrics contributing SEK1.09 billion and Adult Health adding SEK321.29 million.

BioGaia has demonstrated resilience and adaptability in the competitive biotech landscape, with a notable 9.9% annual revenue growth outpacing the Swedish market's 1.1%. The company's strategic focus on R&D is evident from its recent product launches, such as BioGaia® Gastrus® PURE ACTION, tailored for individuals with sensitive stomachs and backed by rigorous clinical trials. This innovation not only expands its product line but also taps into a growing health-conscious consumer base, reflecting BioGaia's commitment to scientific validation and market responsiveness. Moreover, with an anticipated earnings growth of 13.9% annually, BioGaia is positioning itself strongly within the industry despite a slight dip in past earnings performance.

- Dive into the specifics of BioGaia here with our thorough health report.

Evaluate BioGaia's historical performance by accessing our past performance report.

TianJin 712 Communication & Broadcasting (SHSE:603712)

Simply Wall St Growth Rating: ★★★★★☆

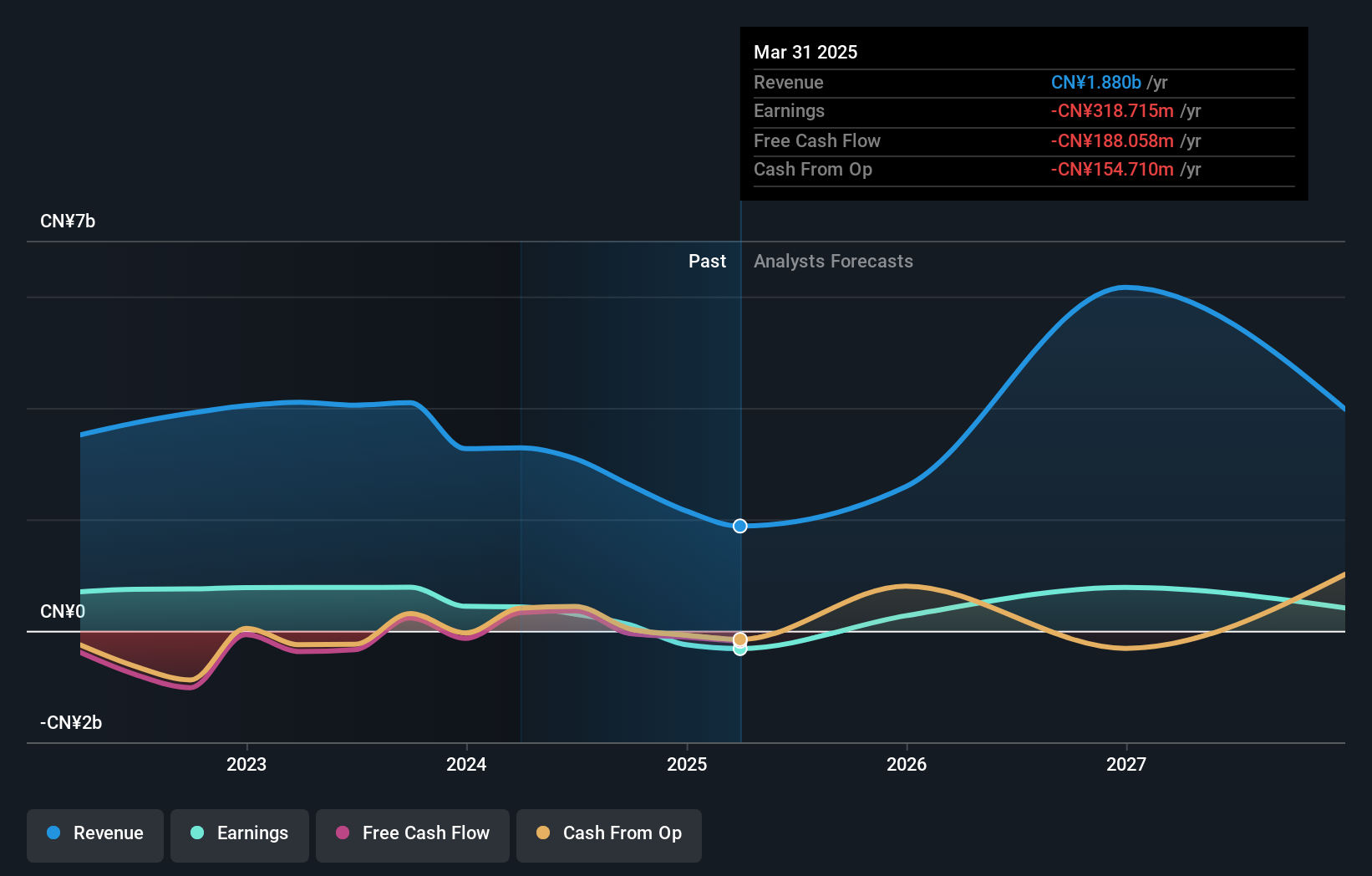

Overview: TianJin 712 Communication & Broadcasting Co., Ltd. operates in the communication and broadcasting industry, with a market capitalization of CN¥13.56 billion.

Operations: TianJin 712 engages in the communication and broadcasting sector, focusing on providing solutions and services within this industry. The company generates revenue through various segments, although specific segment details are not provided.

TianJin 712 Communication & Broadcasting is navigating the competitive tech landscape with a robust growth trajectory, evidenced by its revenue and earnings forecasts. With an annual revenue growth rate of 30.7%, significantly outpacing the Chinese market average of 13.3%, and an expected earnings increase of 53.8% per year, the company is poised for substantial expansion. However, it's crucial to note that past financial results have been affected by a one-off gain of CN¥56.3M, which may skew perceptions of ongoing profitability. The firm's commitment to innovation could be inferred from its R&D investments, aligning with industry trends towards enhanced communication solutions, although specific R&D figures were not disclosed in the provided data.

- Click to explore a detailed breakdown of our findings in TianJin 712 Communication & Broadcasting's health report.

Learn about TianJin 712 Communication & Broadcasting's historical performance.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

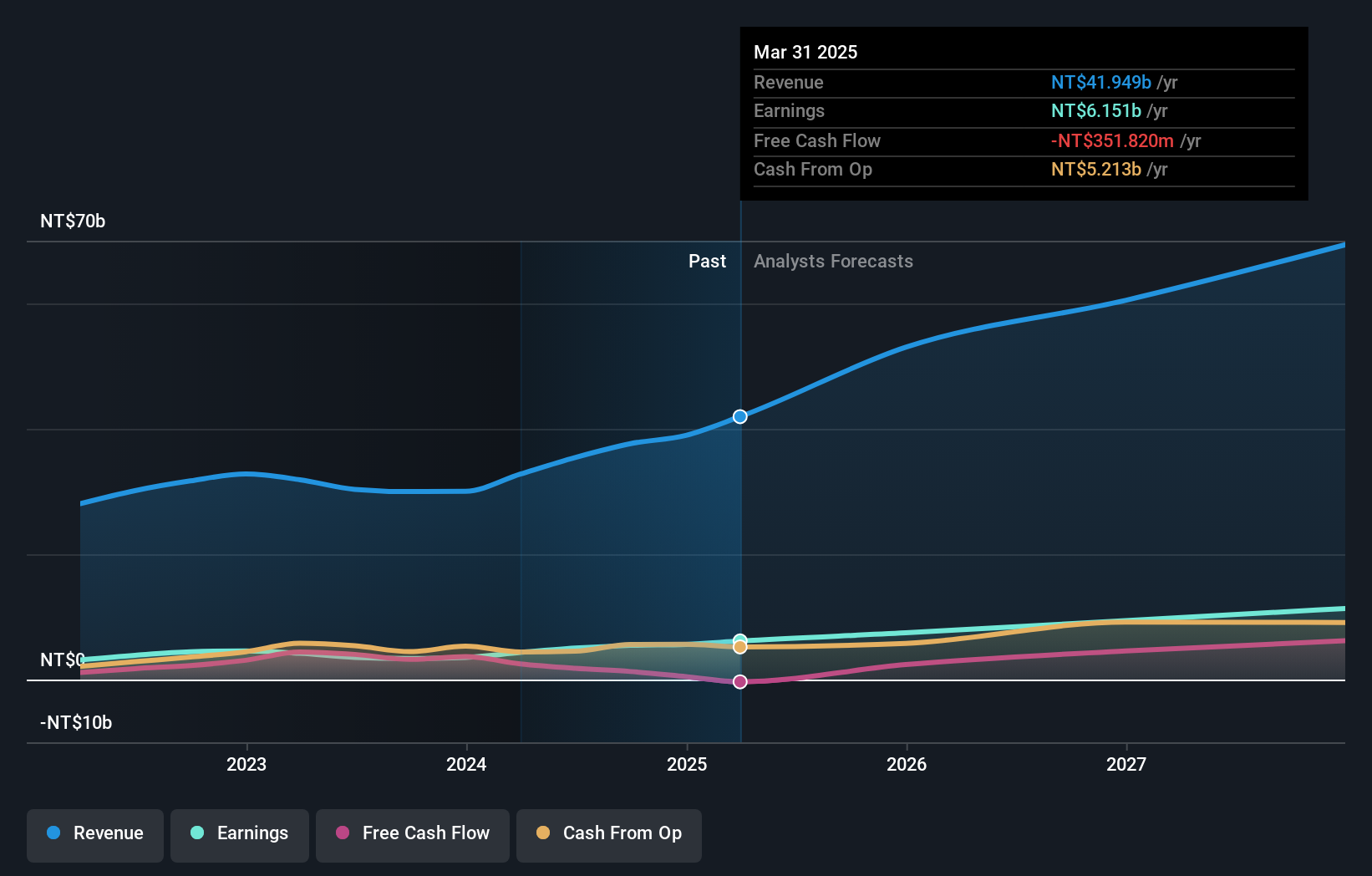

Overview: Gold Circuit Electronics Ltd. is a Taiwan-based company specializing in the design, manufacture, processing, and distribution of multilayer printed circuit boards with a market capitalization of NT$109.50 billion.

Operations: The company focuses on the design, manufacture, processing, and distribution of multilayer printed circuit boards, generating NT$37.63 billion from this segment.

Gold Circuit Electronics has demonstrated a robust growth pattern, with earnings surging by 62.3% over the past year, significantly outstripping the electronic industry's average of 7.8%. This performance is anchored in a solid revenue increase forecast at 16.2% annually, surpassing Taiwan's market average growth of 11.3%. At the recent J.P. Morgan Taiwan CEO-CFO Conference, the firm showcased its strategic initiatives aimed at sustaining this momentum. Notably, its R&D commitment is mirrored in an anticipated high Return on Equity of 29.3% in three years' time, underscoring a strong reinvestment back into technological advancements and innovation that could further secure its competitive edge in the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Gold Circuit Electronics.

Assess Gold Circuit Electronics' past performance with our detailed historical performance reports.

Seize The Opportunity

- Dive into all 1207 of the High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioGaia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOG B

BioGaia

A healthcare company, develops, manufactures, markets and sells probiotic products for gut, oral, and immune health in Europe, the Middle East, Africa, the United States, the Asia-Pacific, Australia, and New Zealand.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives