High Insider Ownership Growth Companies To Watch In September 2024

Reviewed by Simply Wall St

As global markets celebrate the Federal Reserve's first rate cut in over four years, U.S. stocks have surged to new highs, reflecting broad investor optimism. This positive market sentiment sets a promising backdrop for identifying growth companies with high insider ownership, which can be a strong indicator of confidence and alignment between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.3% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

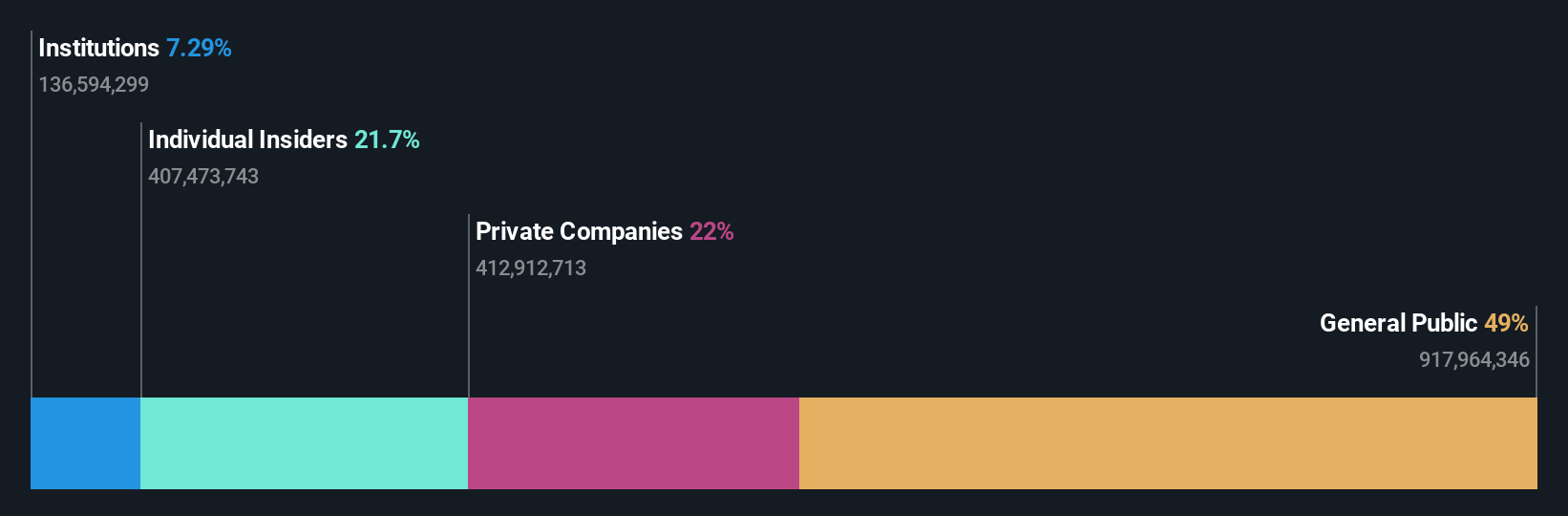

Zhejiang Huace Film & TV (SZSE:300133)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Huace Film & TV Co., Ltd. engages in the production, distribution, and derivative of film and television dramas in China and internationally, with a market cap of CN¥9.78 billion.

Operations: Revenue segments for Zhejiang Huace Film & TV Co., Ltd. include the production, distribution, and derivative of film and television dramas in China and internationally.

Insider Ownership: 21.8%

Zhejiang Huace Film & TV demonstrates significant growth potential, with earnings forecasted to grow 32% annually and revenue expected to increase by 24.4% per year, outpacing the Chinese market. However, recent financial results show a decline in sales and net income compared to the previous year. The company has a volatile share price and an unstable dividend track record. No substantial insider trading activity was reported over the past three months.

- Navigate through the intricacies of Zhejiang Huace Film & TV with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Zhejiang Huace Film & TV is trading beyond its estimated value.

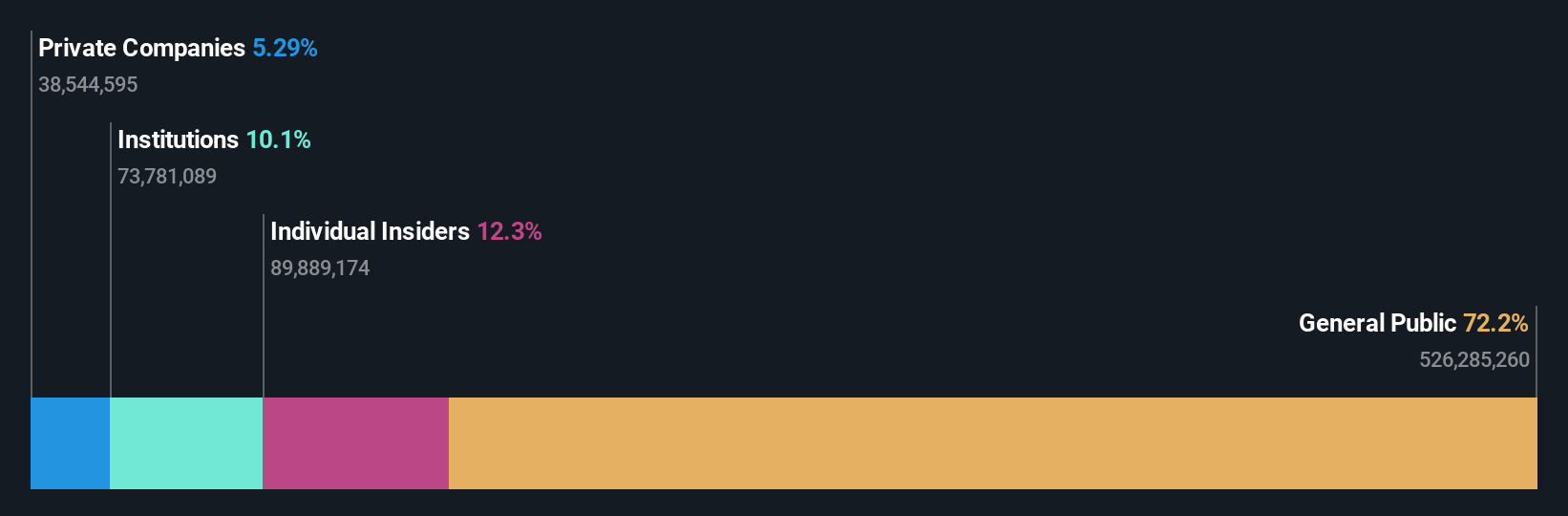

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing industry in China and has a market cap of approximately CN¥12.73 billion.

Operations: The company generates revenue through its digital publishing business in China.

Insider Ownership: 12.4%

COL Group Ltd. is forecasted to achieve profitability within the next three years, with earnings expected to grow 66.91% annually and revenue projected to increase by 20.6% per year, surpassing market growth rates. Despite recent financial challenges, including a net loss of CNY 150.09 million for H1 2024 and declining sales, the company has authorized a share buyback program worth up to CNY 30 million aimed at reducing capital. The stock has exhibited high volatility recently but shows substantial long-term growth potential due to high insider ownership and positive future profit forecasts.

- Dive into the specifics of COL GroupLtd here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, COL GroupLtd's share price might be too optimistic.

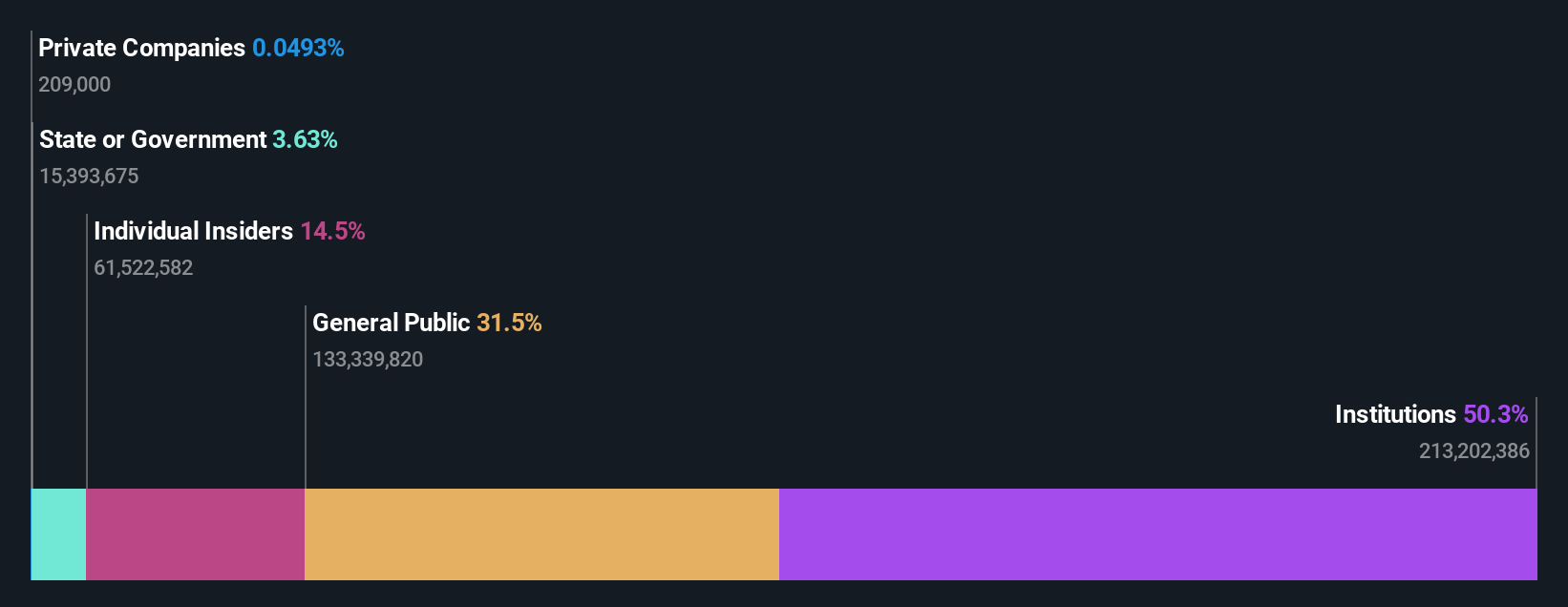

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. designs, assembles, manufactures, sells, repairs, and maintains a variety of software and hardware products for computers and peripherals as well as electronic test instruments and power supplies across Taiwan, China, the United States, and internationally with a market cap of NT$162.92 billion.

Operations: Revenue segments for Chroma ATE Inc. include NT$29.52 billion from the Measuring Instruments Business and NT$1.58 billion from Automated Transport Engineering.

Insider Ownership: 14.5%

Chroma ATE Inc. has shown strong financial performance with Q2 2024 revenue at TWD 5.52 billion and net income of TWD 1.41 billion, reflecting significant year-over-year growth. The company's earnings are forecasted to grow by 21.42% annually, outpacing the Taiwan market average. While its dividend track record is unstable, Chroma ATE's high insider ownership aligns management interests with shareholders and supports long-term growth potential despite recent share price volatility.

- Click here to discover the nuances of Chroma ATE with our detailed analytical future growth report.

- Our valuation report unveils the possibility Chroma ATE's shares may be trading at a premium.

Make It Happen

- Get an in-depth perspective on all 1519 Fast Growing Companies With High Insider Ownership by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300364

High growth potential with mediocre balance sheet.