- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

High Growth Tech Stocks In Asia For July 2025

Reviewed by Simply Wall St

As global markets experience a surge propelled by favorable trade deals and record highs in key indices, the Asian tech sector is capturing attention with its potential for high growth amid these dynamic economic conditions. In this environment, identifying promising stocks involves looking at companies that can leverage technological advancements and adapt to evolving market demands, particularly those benefiting from improved international trade relations.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 30.51% | 37.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 22.58% | 23.53% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

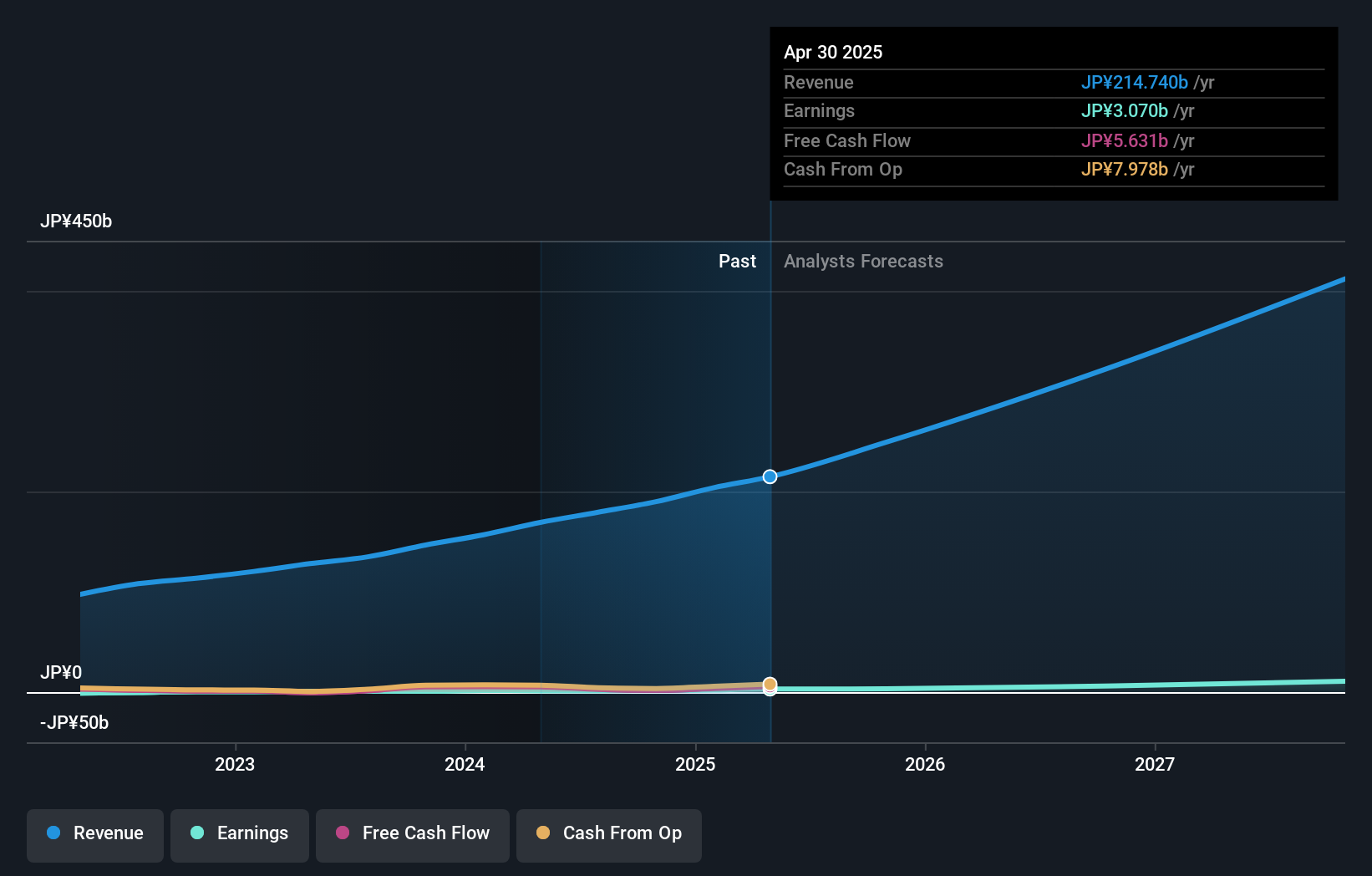

GA technologies (TSE:3491)

Simply Wall St Growth Rating: ★★★★★☆

Overview: GA technologies Co., Ltd. operates a real estate brokerage platform with a market capitalization of ¥82.88 billion.

Operations: The company generates revenue primarily through its RENOSY Marketplace, contributing ¥208.09 billion, and ITANDI segment at ¥5.82 billion. The focus on real estate brokerage is reflected in these revenue streams.

GA Technologies has demonstrated robust financial performance, with a notable 96.8% earnings growth over the past year, outpacing the Interactive Media and Services industry's 17.4%. This growth is complemented by an aggressive R&D strategy, as evidenced by their recent appointment of a CTO and focused investments in AI to streamline operations within their RENOSY Marketplace and ITANDI Business segments. These initiatives have significantly enhanced operational efficiency and customer acquisition through optimized advertising strategies, leading to an upward revision in their earnings forecast for FY2025. The company's revenue is also expected to surge by 26.3% annually, further solidifying its position in high-growth tech sectors in Asia.

- Unlock comprehensive insights into our analysis of GA technologies stock in this health report.

Understand GA technologies' track record by examining our Past report.

Nippon Electric Glass (TSE:5214)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nippon Electric Glass Co., Ltd. and its subsidiaries are involved in the production and sale of specialty glass products and glass making machinery both domestically in Japan and internationally, with a market capitalization of ¥312.72 billion.

Operations: The company generates revenue through the manufacture and sale of specialty glass products and glass making machinery across domestic and international markets. With a market capitalization of ¥312.72 billion, it focuses on leveraging its expertise in specialty glass to serve various industries globally.

Nippon Electric Glass demonstrates a strategic pivot in its operations, evidenced by the recent cessation of its UK subsidiary to realign focus and enhance profitability in its composites business. This move is part of a broader strategy to optimize production and promote high-value products, aligning with an aggressive buyback program where 3.61 million shares were repurchased for ¥12.41 billion, reflecting confidence in the company's financial health. Additionally, revised earnings guidance anticipates substantial growth with net sales expected to reach ¥310 billion and operating profit projected at ¥23 billion for the fiscal year, underpinning a robust outlook despite current unprofitability.

- Navigate through the intricacies of Nippon Electric Glass with our comprehensive health report here.

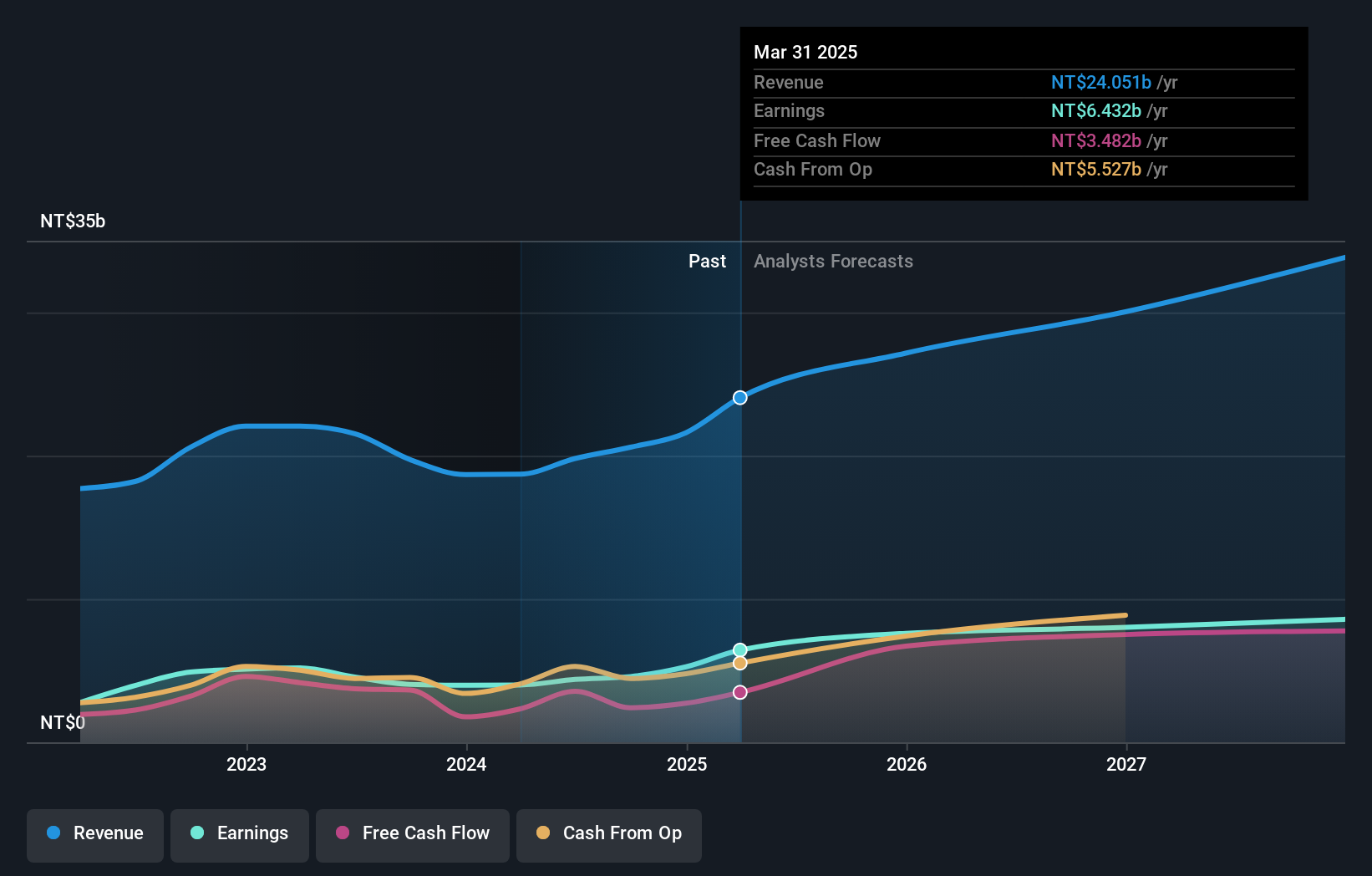

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chroma ATE Inc. operates in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as test systems and instruments across Taiwan, China, the United States, and other international markets with a market cap of NT$182.39 billion.

Operations: Chroma ATE Inc. generates revenue primarily from its Measuring Instruments Business, which accounts for NT$37.61 billion, and Automated Transport Engineering, contributing NT$1.55 billion. The company's operations span multiple regions including Taiwan, China, and the United States.

Chroma ATE has demonstrated robust growth dynamics, with earnings surging by 60.9% over the past year, outpacing the electronic industry's average of 13.9%. This performance is underpinned by strategic presentations at key global conferences, such as the Advanced Automotive Battery Conference in Europe and the UBS Asian Investment Conference, signaling strong market engagement and sectoral influence. Looking ahead, Chroma ATE is expected to sustain a revenue growth rate of 13.1% annually, surpassing Taiwan's market average of 9.8%, supported by a forecasted return on equity of an impressive 28.4% in three years' time. These figures reflect not only a solid financial footing but also an aggressive pursuit of innovation and market expansion within high-tech sectors in Asia.

Make It Happen

- Unlock our comprehensive list of 167 Asian High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives