- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

3 Asian Growth Stocks Insiders Own With 29% Revenue Growth

Reviewed by Simply Wall St

As global markets react to new trade deals and economic data, Asian stocks have been buoyed by hopes for tariff truce extensions and favorable agreements, contributing to a positive market sentiment. In this environment, growth companies with high insider ownership can be particularly appealing due to their potential alignment of interests between management and shareholders, which may drive strong performance amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.9% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 25.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 26.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

We'll examine a selection from our screener results.

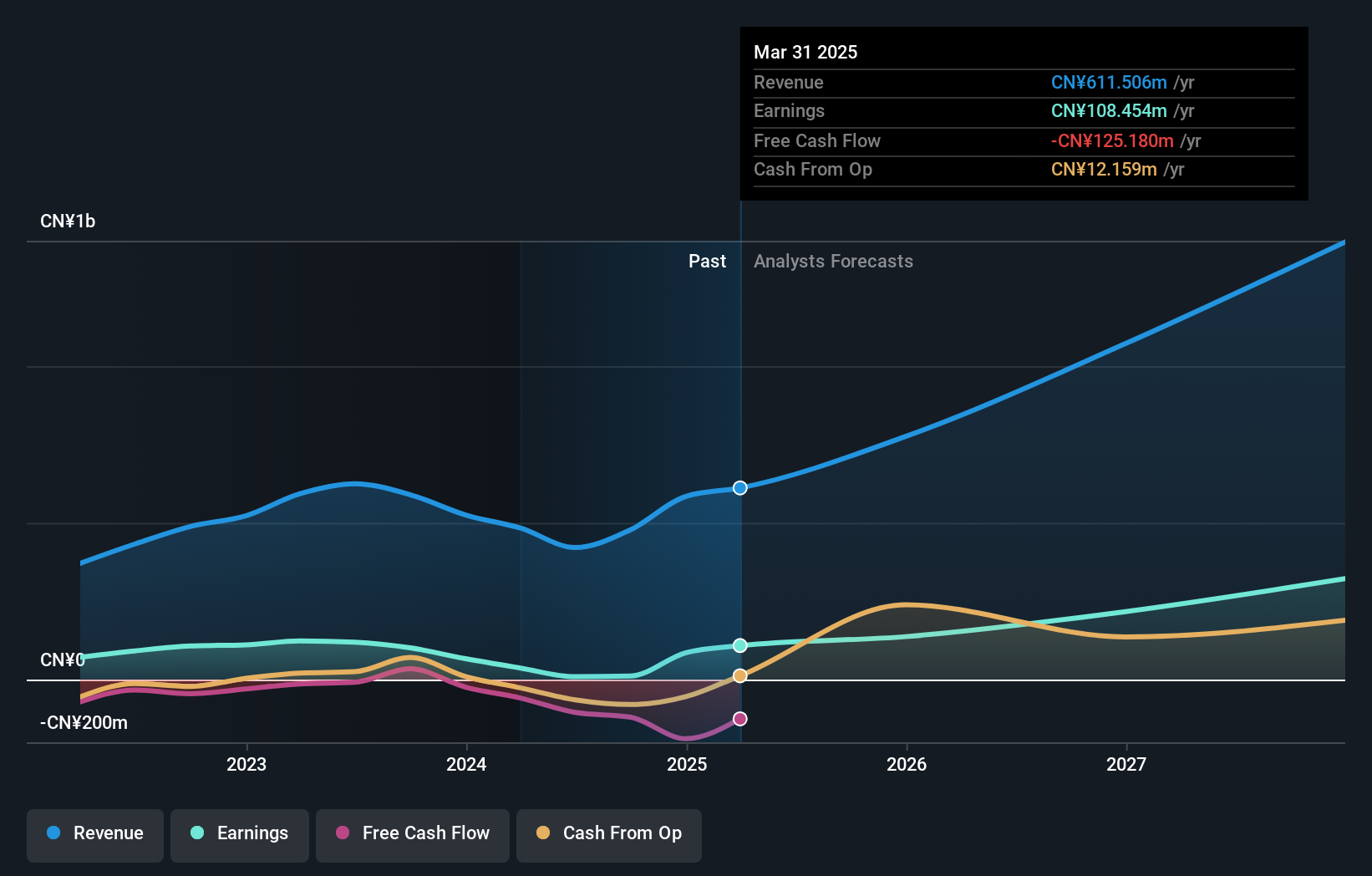

SBT Ultrasonic Technology (SHSE:688392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SBT Ultrasonic Technology Co., Ltd. develops, manufactures, and sells ultrasonic equipment and application solutions globally, with a market cap of CN¥8.87 billion.

Operations: The company's revenue primarily comes from its Machinery & Industrial Equipment segment, generating CN¥611.51 million.

Insider Ownership: 21.2%

Revenue Growth Forecast: 29.9% p.a.

SBT Ultrasonic Technology is experiencing substantial growth, with revenue projected to increase by 29.9% annually, outpacing the CN market's 12.5%. Earnings are forecast to grow significantly at 40.1% per year, surpassing the market average of 23.5%. Despite a volatile share price recently and low future return on equity projections (11.9%), the company benefits from high insider ownership, which may align management interests with shareholders' goals and support its growth trajectory in Asia.

- Unlock comprehensive insights into our analysis of SBT Ultrasonic Technology stock in this growth report.

- Our comprehensive valuation report raises the possibility that SBT Ultrasonic Technology is priced higher than what may be justified by its financials.

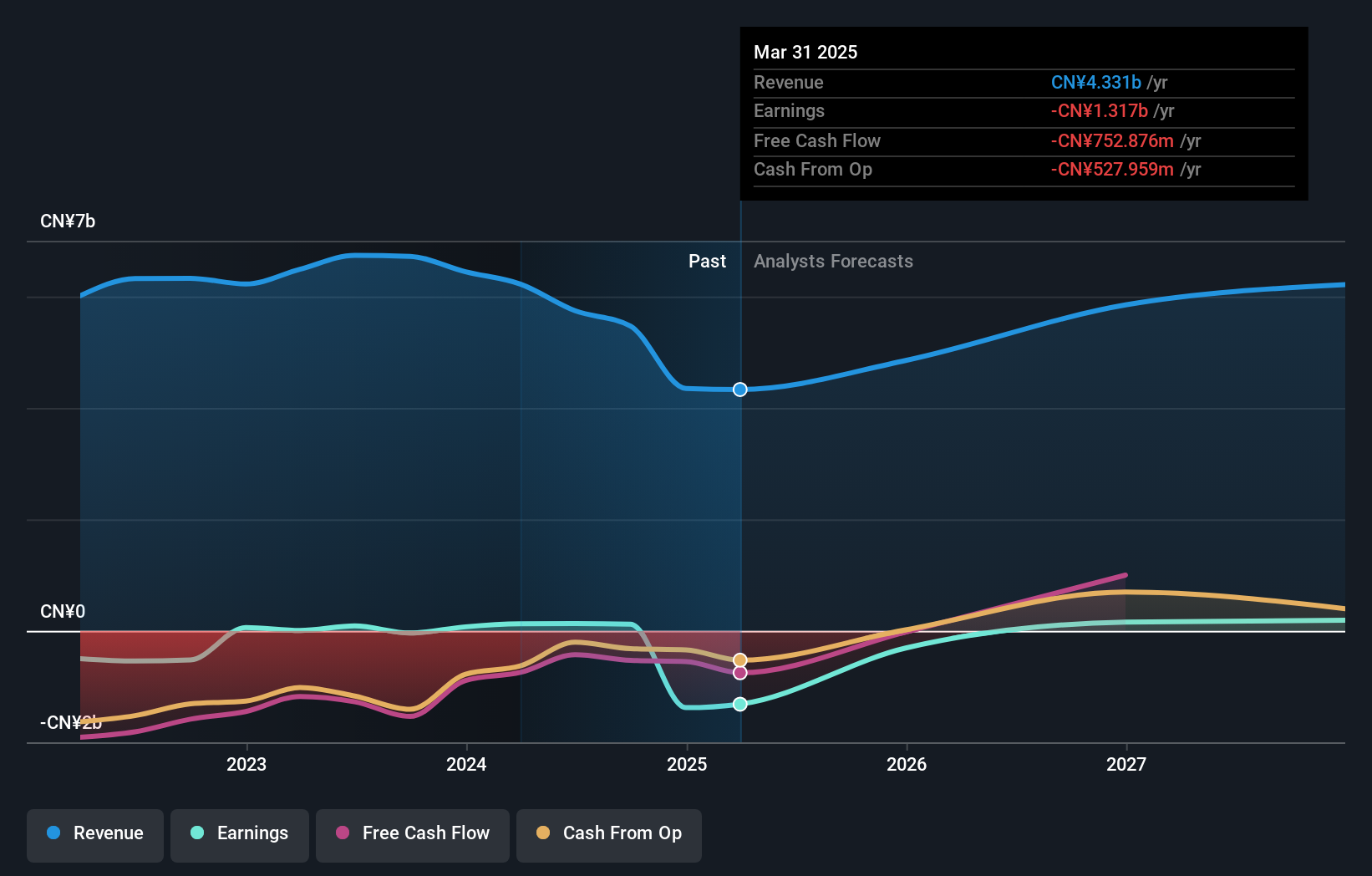

Qi An Xin Technology Group (SHSE:688561)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qi An Xin Technology Group Inc. is a cybersecurity company that offers products and services to government, enterprises, and other institutions in China and internationally, with a market cap of CN¥24.60 billion.

Operations: The company's revenue from the Information Security Industry segment amounts to CN¥4.33 billion.

Insider Ownership: 22%

Revenue Growth Forecast: 13.9% p.a.

Qi An Xin Technology Group's revenue is expected to grow at 13.9% annually, slightly above the CN market average of 12.5%, with earnings projected to increase significantly by over 120% per year, outpacing the market. Although trading at a substantial discount to its estimated fair value and offering good relative value compared to peers, its future return on equity is forecasted low at 0.9%. A recent private placement aims to raise CNY 300 million, pending shareholder approval.

- Take a closer look at Qi An Xin Technology Group's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Qi An Xin Technology Group's current price could be quite moderate.

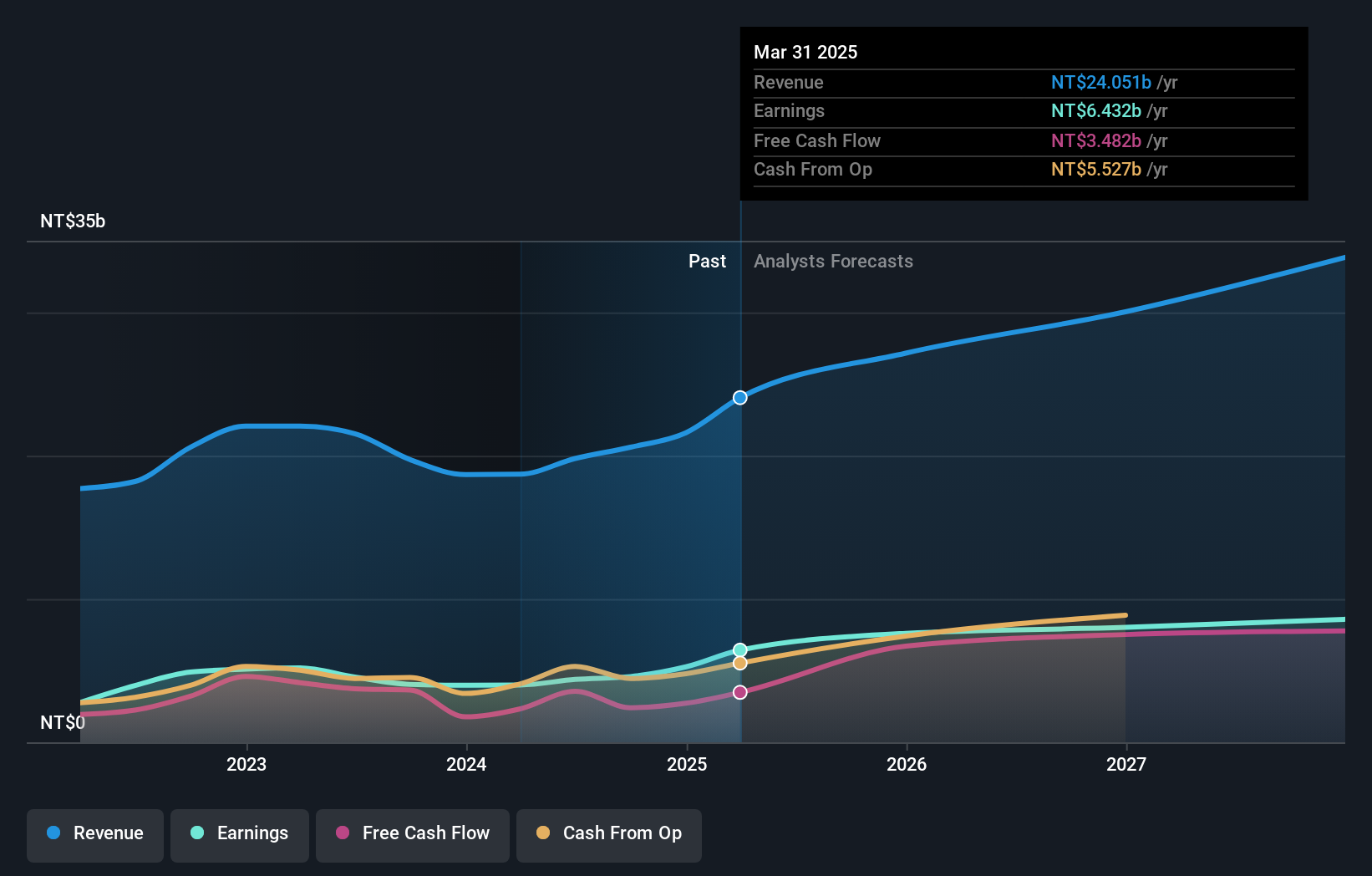

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chroma ATE Inc. is engaged in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various electronic test instruments and systems globally; it has a market cap of NT$182.39 billion.

Operations: The company's revenue primarily comes from its Measuring Instruments Business, which generated NT$37.61 billion, and its Automated Transport Engineering segment, contributing NT$1.55 billion.

Insider Ownership: 14.5%

Revenue Growth Forecast: 13.1% p.a.

Chroma ATE's earnings are forecast to grow 13.7% annually, outpacing the Taiwan market average of 13%. Despite a dividend yield of 2.09% not covered by free cash flows, its return on equity is expected to reach a high 28.4% in three years. Recent engagements include presentations at major conferences like the Advanced Automotive Battery Conference and amendments approved in its Articles of Incorporation during a shareholders meeting on June 10, 2025.

- Navigate through the intricacies of Chroma ATE with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Chroma ATE is trading beyond its estimated value.

Next Steps

- Embark on your investment journey to our 589 Fast Growing Asian Companies With High Insider Ownership selection here.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives