- Taiwan

- /

- Tech Hardware

- /

- TWSE:2357

3 Global Dividend Stocks Yielding Up To 4.8%

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with the U.S. labor market showing signs of weakness and interest rate adjustments on the horizon, investors are increasingly looking towards stable income sources such as dividend stocks. In this environment, selecting stocks that offer reliable dividend yields can be an attractive strategy for those seeking to balance potential market volatility with steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.93% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.65% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.31% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.69% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.40% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.81% | ★★★★★★ |

| NCD (TSE:4783) | 4.30% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.24% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.65% | ★★★★★★ |

Click here to see the full list of 1316 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

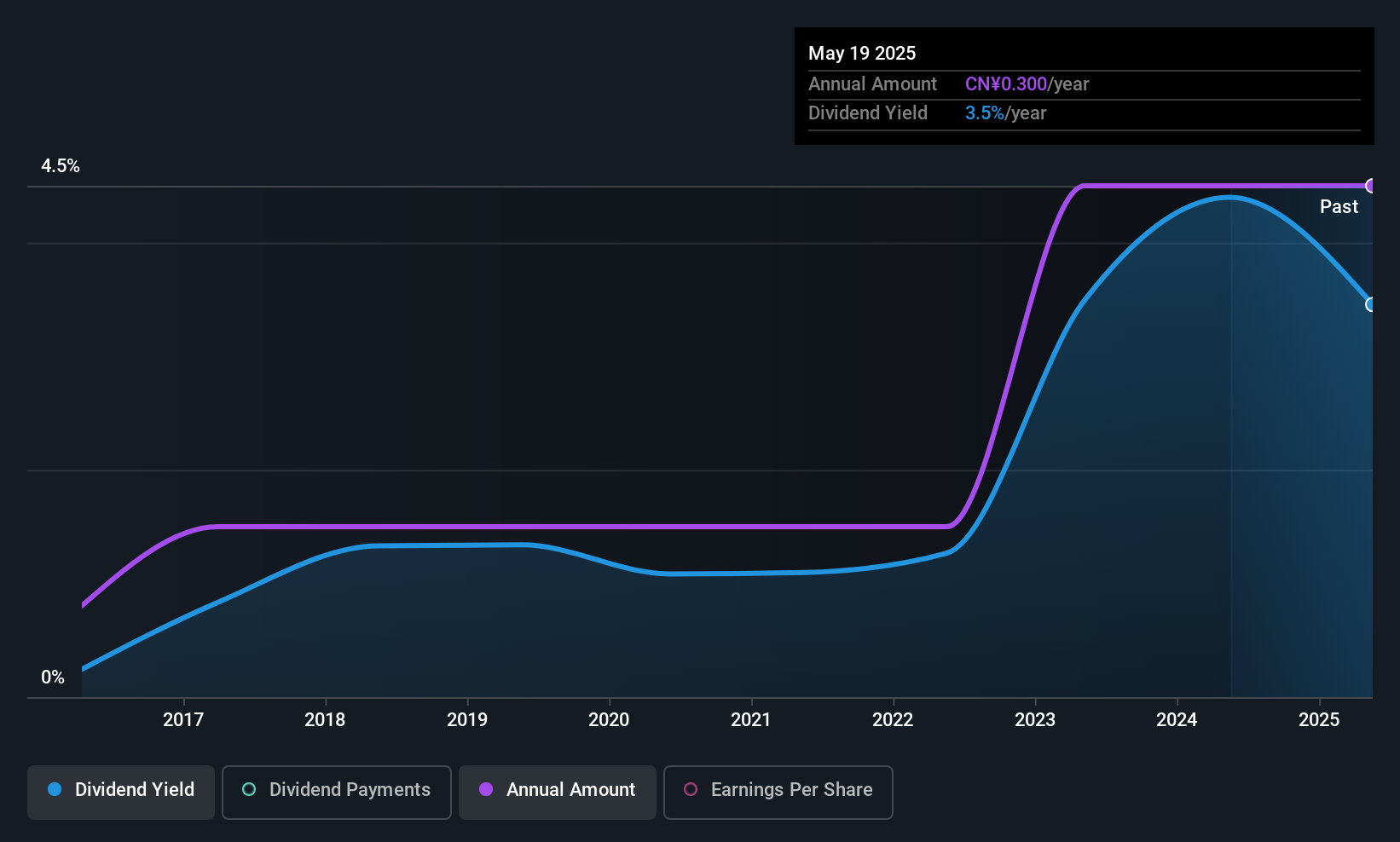

Tianshui Zhongxing Bio-technologyLtd (SZSE:002772)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Tianshui Zhongxing Bio-technology Co., Ltd., along with its subsidiaries, focuses on the research, development, production, and sale of edible fungi both in China and internationally, with a market cap of CN¥3.13 billion.

Operations: Tianshui Zhongxing Bio-technology Co., Ltd. generates revenue primarily from its agricultural planting industry segment, which amounts to CN¥1.93 billion.

Dividend Yield: 3.3%

Tianshui Zhongxing Bio-technology Ltd. offers a compelling dividend profile, with a stable and reliable dividend yield of 3.27%, placing it in the top 25% of CN market payers. The company's dividends are well-covered by both earnings (payout ratio: 68.5%) and cash flows (cash payout ratio: 80.1%). Recent earnings show net income growth to CNY 69.02 million, supporting sustainable dividend payments despite minor revenue declines, ensuring continued attractiveness for income-focused investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Tianshui Zhongxing Bio-technologyLtd.

- Insights from our recent valuation report point to the potential overvaluation of Tianshui Zhongxing Bio-technologyLtd shares in the market.

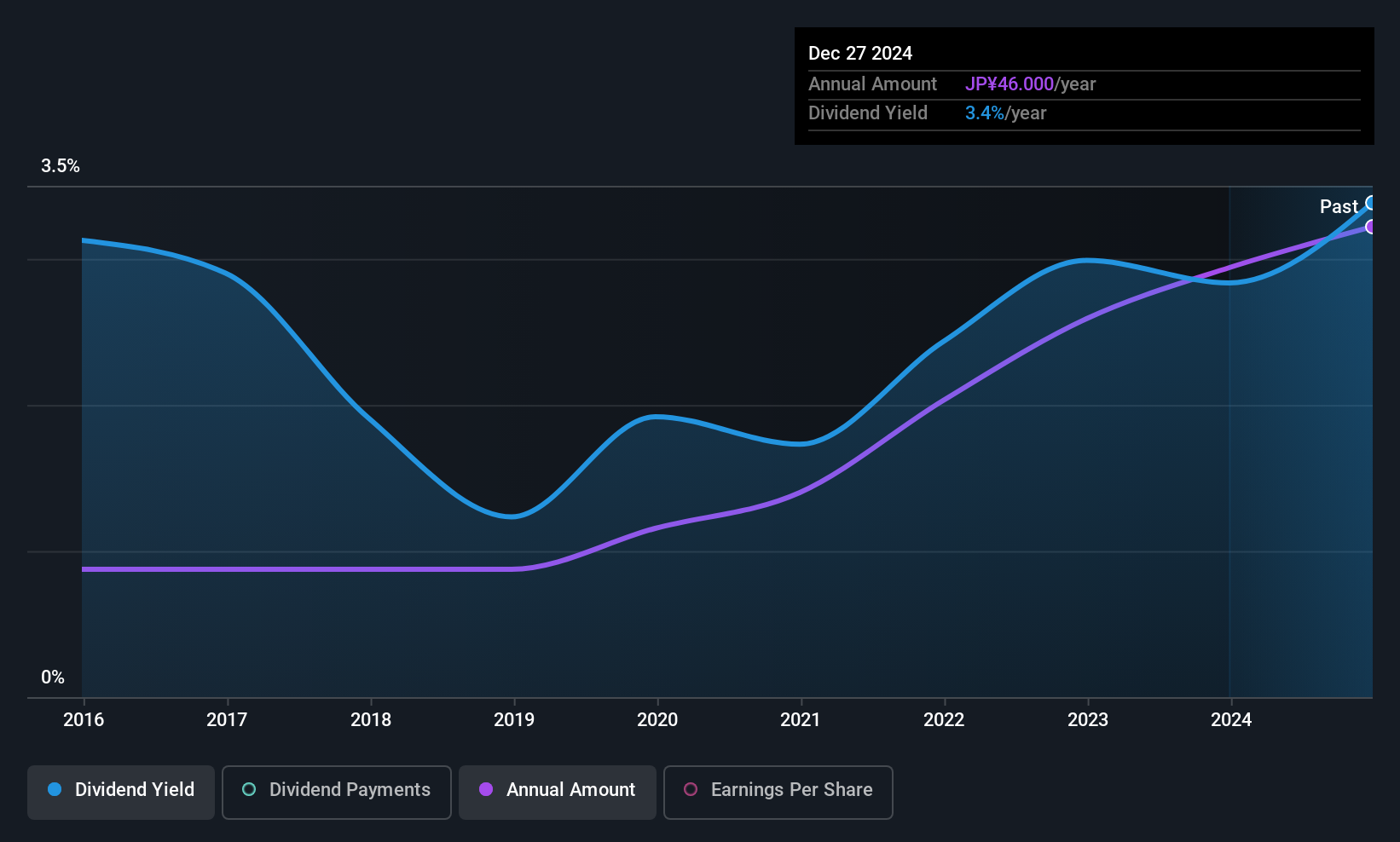

ISB (TSE:9702)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ISB Corporation provides embedded software development services for mobile, medical, and automotive applications in Japan with a market cap of ¥20.36 billion.

Operations: ISB Corporation's revenue is primarily derived from its Security System segment, which generated ¥5.30 billion, and its Information Service segment, contributing ¥30.61 billion.

Dividend Yield: 3%

ISB Corporation's dividend yield of 3.03% is below the top quartile in Japan but remains reliable and stable over a decade. The payout ratio of 36.5% indicates dividends are well-covered by earnings, while a cash payout ratio of 70.8% suggests solid coverage by cash flows. Recent guidance revisions raised year-end dividends to JPY 55 per share, reflecting improved financial performance with increased sales and profits, supporting its commitment to shareholder returns amidst strategic growth investments.

- Navigate through the intricacies of ISB with our comprehensive dividend report here.

- The analysis detailed in our ISB valuation report hints at an inflated share price compared to its estimated value.

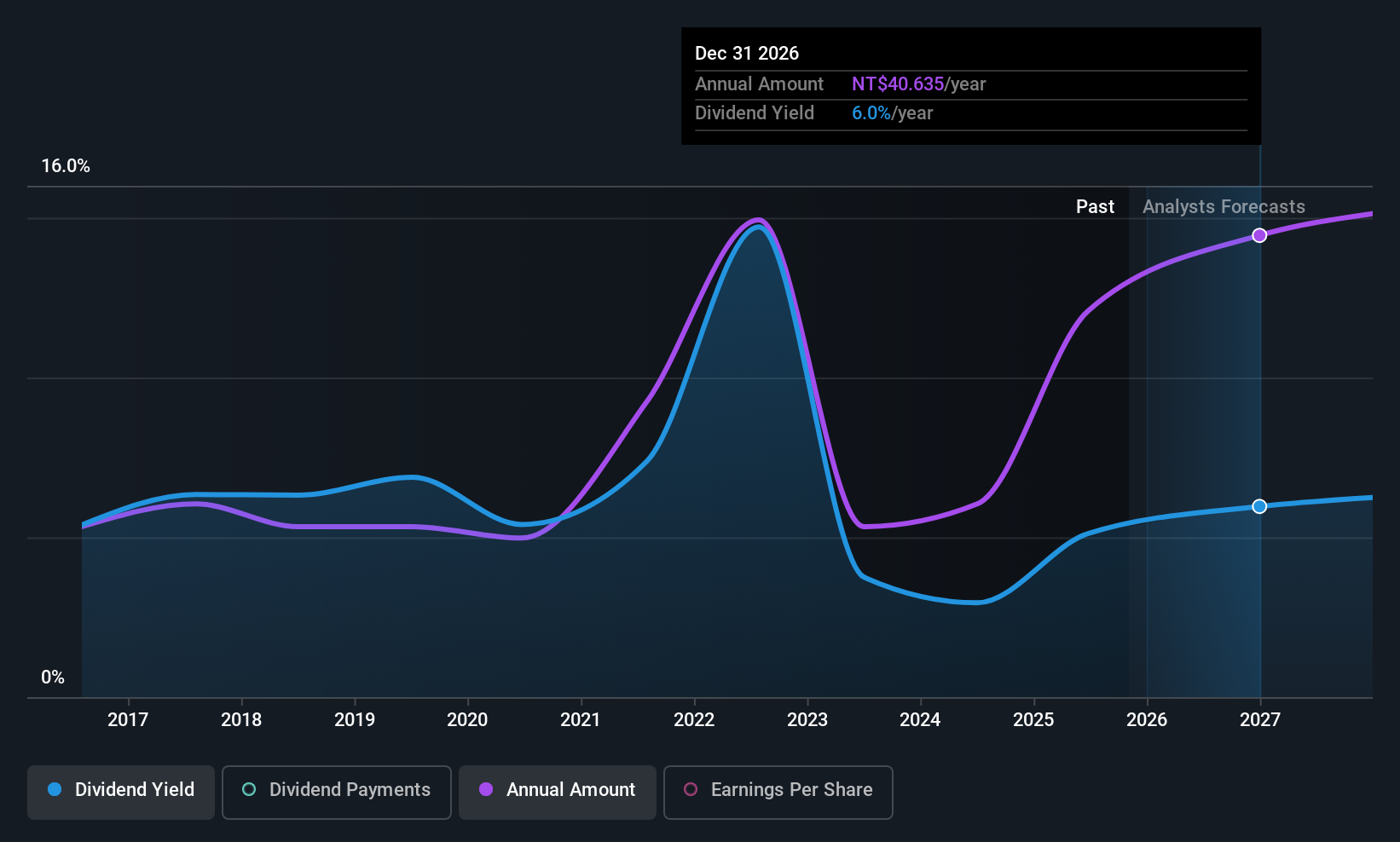

ASUSTeK Computer (TWSE:2357)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ASUSTeK Computer Inc. engages in the research, development, design, manufacture, sale, and repair of computers, communications, and consumer electronic products across Taiwan, China, Singapore, Europe, the United States, and internationally with a market cap of NT$496.16 billion.

Operations: ASUSTeK Computer Inc. generates revenue primarily from its 3C Brand segment, which accounts for NT$614.92 billion.

Dividend Yield: 4.9%

ASUSTeK Computer's dividend is covered by earnings and cash flow, with payout ratios of 68.7% and 45.3%, respectively. Despite a volatile dividend history, payments have grown over the past decade. The current yield of 4.9% is below Taiwan's top quartile but suggests reasonable value with a price-to-earnings ratio of 14x, lower than the market average. Recent earnings growth underscores financial resilience, though dividends remain unstable due to historical volatility in payouts.

- Take a closer look at ASUSTeK Computer's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that ASUSTeK Computer is priced lower than what may be justified by its financials.

Next Steps

- Click through to start exploring the rest of the 1313 Top Global Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2357

ASUSTeK Computer

Researches and develops, designs, manufactures, sells, and repairs computers, communications, and consumer electronic products in Taiwan, China, Singapore, Europe, the United States, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion