- Taiwan

- /

- Tech Hardware

- /

- TWSE:2356

Inventec's (TWSE:2356) Returns On Capital Tell Us There Is Reason To Feel Uneasy

When we're researching a company, it's sometimes hard to find the warning signs, but there are some financial metrics that can help spot trouble early. More often than not, we'll see a declining return on capital employed (ROCE) and a declining amount of capital employed. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. In light of that, from a first glance at Inventec (TWSE:2356), we've spotted some signs that it could be struggling, so let's investigate.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Inventec, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.095 = NT$6.6b ÷ (NT$253b - NT$183b) (Based on the trailing twelve months to September 2023).

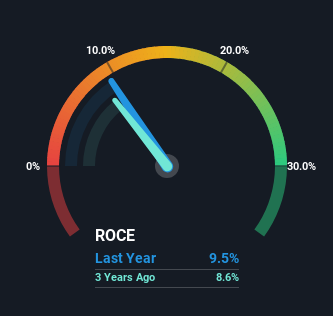

Therefore, Inventec has an ROCE of 9.5%. On its own, that's a low figure but it's around the 11% average generated by the Tech industry.

View our latest analysis for Inventec

Above you can see how the current ROCE for Inventec compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Inventec .

How Are Returns Trending?

There is reason to be cautious about Inventec, given the returns are trending downwards. Unfortunately the returns on capital have diminished from the 13% that they were earning five years ago. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Inventec to turn into a multi-bagger.

On a side note, Inventec's current liabilities are still rather high at 72% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

Our Take On Inventec's ROCE

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. The market must be rosy on the stock's future because even though the underlying trends aren't too encouraging, the stock has soared 204%. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

If you'd like to know about the risks facing Inventec, we've discovered 2 warning signs that you should be aware of.

While Inventec may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2356

Inventec

Develops, manufactures, processes, and trades in computers and related products in Taiwan, the United States, Japan, Hong Kong, Macau, Mainland China, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion