- Taiwan

- /

- Tech Hardware

- /

- TWSE:2356

Inventec Corporation (TWSE:2356) Just Reported And Analysts Have Been Lifting Their Price Targets

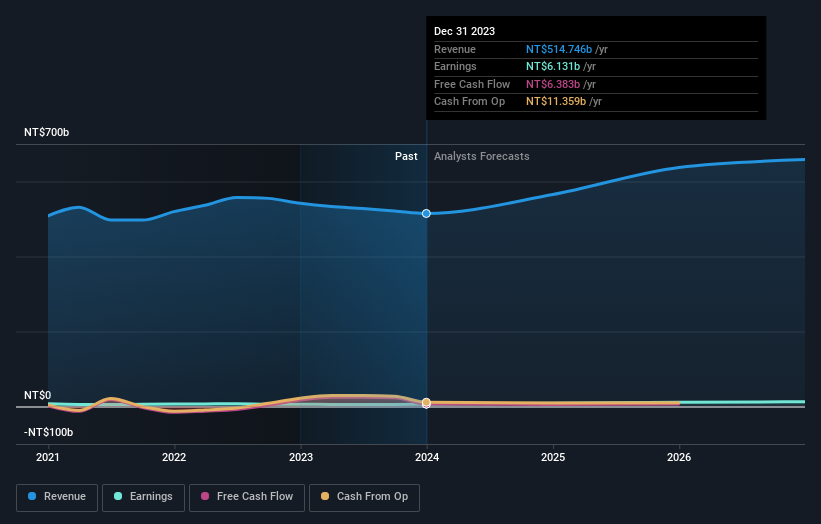

As you might know, Inventec Corporation (TWSE:2356) recently reported its full-year numbers. Results were roughly in line with estimates, with revenues of NT$515b and statutory earnings per share of NT$1.70. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Inventec

Following the latest results, Inventec's seven analysts are now forecasting revenues of NT$565.3b in 2024. This would be a meaningful 9.8% improvement in revenue compared to the last 12 months. Statutory earnings per share are predicted to jump 40% to NT$2.39. In the lead-up to this report, the analysts had been modelling revenues of NT$577.5b and earnings per share (EPS) of NT$2.20 in 2024. So it's pretty clear that while sentiment around revenues has declined following the latest results, the analysts are now more bullish on the company's earnings power.

The average price target increased 14% to NT$55.26, with the analysts signalling that the improved earnings outlook is more important to the company's valuation than its revenue. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Inventec analyst has a price target of NT$70.00 per share, while the most pessimistic values it at NT$41.00. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's clear from the latest estimates that Inventec's rate of growth is expected to accelerate meaningfully, with the forecast 9.8% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 1.4% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 16% per year. It seems obvious that, while the future growth outlook is brighter than the recent past, Inventec is expected to grow slower than the wider industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Inventec's earnings potential next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply they will perform worse than the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple Inventec analysts - going out to 2026, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Inventec that you should be aware of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2356

Inventec

Develops, manufactures, processes, and trades in computers and related products in Taiwan, the United States, Japan, Hong Kong, Macau, Mainland China, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion