- Taiwan

- /

- Tech Hardware

- /

- TWSE:2059

King Slide Works Co., Ltd. (TWSE:2059) May Have Run Too Fast Too Soon With Recent 30% Price Plummet

King Slide Works Co., Ltd. (TWSE:2059) shares have had a horrible month, losing 30% after a relatively good period beforehand. Indeed, the recent drop has reduced its annual gain to a relatively sedate 9.4% over the last twelve months.

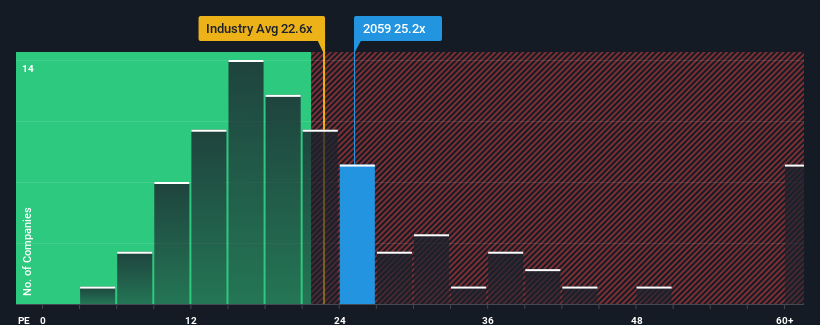

Although its price has dipped substantially, given around half the companies in Taiwan have price-to-earnings ratios (or "P/E's") below 22x, you may still consider King Slide Works as a stock to potentially avoid with its 25.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Recent times have been pleasing for King Slide Works as its earnings have risen in spite of the market's earnings going into reverse. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for King Slide Works

How Is King Slide Works' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as King Slide Works' is when the company's growth is on track to outshine the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Although pleasingly EPS has lifted 219% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 13% per annum over the next three years. That's shaping up to be similar to the 13% per annum growth forecast for the broader market.

With this information, we find it interesting that King Slide Works is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Key Takeaway

There's still some solid strength behind King Slide Works' P/E, if not its share price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that King Slide Works currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about this 1 warning sign we've spotted with King Slide Works.

If you're unsure about the strength of King Slide Works' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if King Slide Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2059

King Slide Works

Designs, manufactures, and sells rail kits for computer and network communications equipment, furniture wooden kitchen accessories, slides, and molds in Taiwan, the United States, China, and internationally.

High growth potential with solid track record.

Market Insights

Community Narratives