- China

- /

- Tech Hardware

- /

- SZSE:300857

High Growth Tech Stocks Including These 3 Top Picks For Potential Growth

Reviewed by Simply Wall St

Amidst a volatile global market landscape, the technology sector has faced significant fluctuations, with the Nasdaq Composite experiencing notable declines due to competitive pressures from emerging AI developments and mixed corporate earnings reports. In this environment, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential and resilience to market disruptions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★☆ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★★

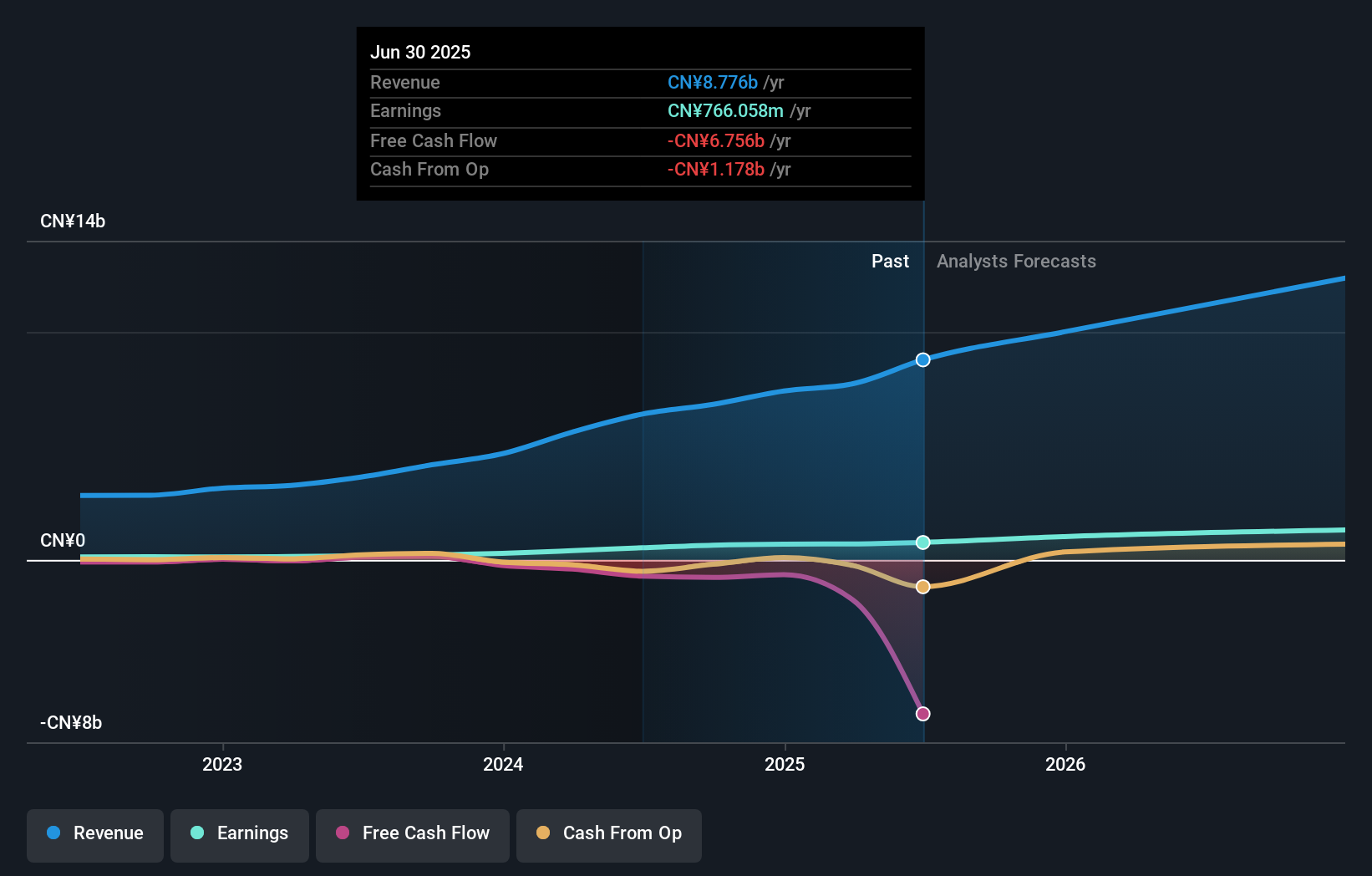

Overview: Sharetronic Data Technology Co., Ltd. is a company that provides wireless IoT products both in China and internationally, with a market cap of CN¥21.83 billion.

Operations: Sharetronic Data Technology focuses on the development and sale of wireless IoT products, catering to both domestic and international markets. The company generates revenue primarily through its technology solutions, with an emphasis on innovation in the IoT sector.

Sharetronic Data Technology has demonstrated robust financial performance with a remarkable 207.5% earnings growth over the past year, significantly outpacing the tech industry's average of 3%. This growth trajectory is supported by an aggressive R&D commitment, which not only fuels innovation but also aligns with projected annual revenue increases of 22.8% and earnings growth of 29.1%. Recent inclusion in the Shenzhen Stock Exchange A Share Index underscores its rising prominence within the tech sector. Despite a volatile share price and concerns about non-cash earnings components, Sharetronic's strategic amendments to its business scope suggest a forward-looking approach to sustaining its rapid growth in a competitive landscape.

- Click here and access our complete health analysis report to understand the dynamics of Sharetronic Data Technology.

Learn about Sharetronic Data Technology's historical performance.

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★★☆

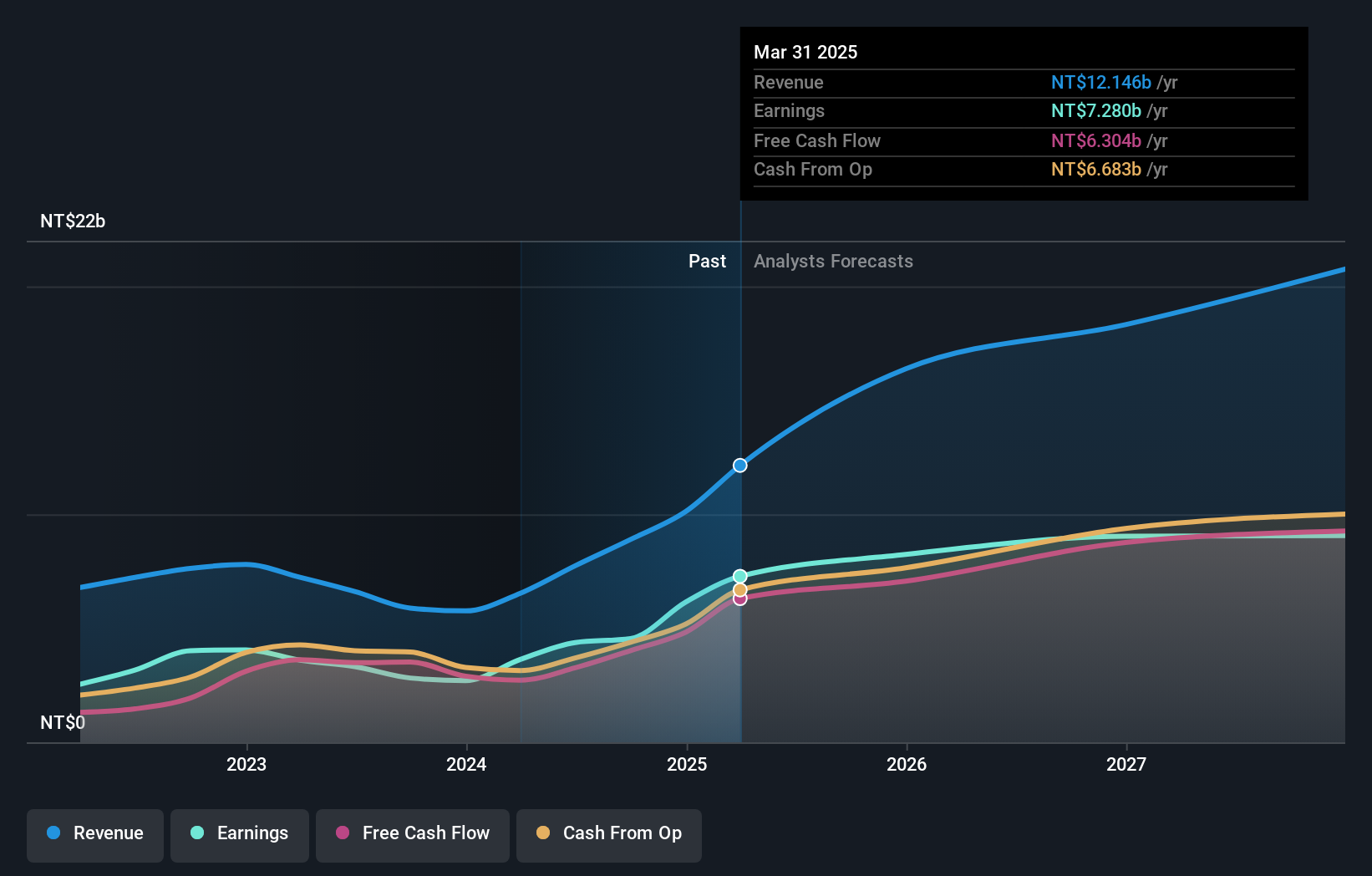

Overview: King Slide Works Co., Ltd. specializes in the R&D, design, and sale of rail kits for servers and network communication equipment in Taiwan, with a market cap of approximately NT$135.80 billion.

Operations: The company generates revenue primarily through its subsidiaries, Chuan Yi Company and Chuanhu Company, with contributions of NT$7.12 billion and NT$2.16 billion, respectively.

King Slide Works has been making notable strides in the tech industry, evidenced by a substantial 61.3% earnings growth over the past year, surpassing the tech sector's average of 12.9%. This performance is underpinned by significant R&D investments and a series of high-profile presentations at major industry events, signaling robust engagement with market trends and investor interests. Despite a highly volatile share price recently, the company's forward-looking strategies are set to harness its 21.1% forecasted annual revenue growth and an anticipated earnings increase of 17.8%, positioning it favorably against competitors in Taiwan's fast-evolving tech landscape.

- Click to explore a detailed breakdown of our findings in King Slide Works' health report.

Explore historical data to track King Slide Works' performance over time in our Past section.

Accton Technology (TWSE:2345)

Simply Wall St Growth Rating: ★★★★★★

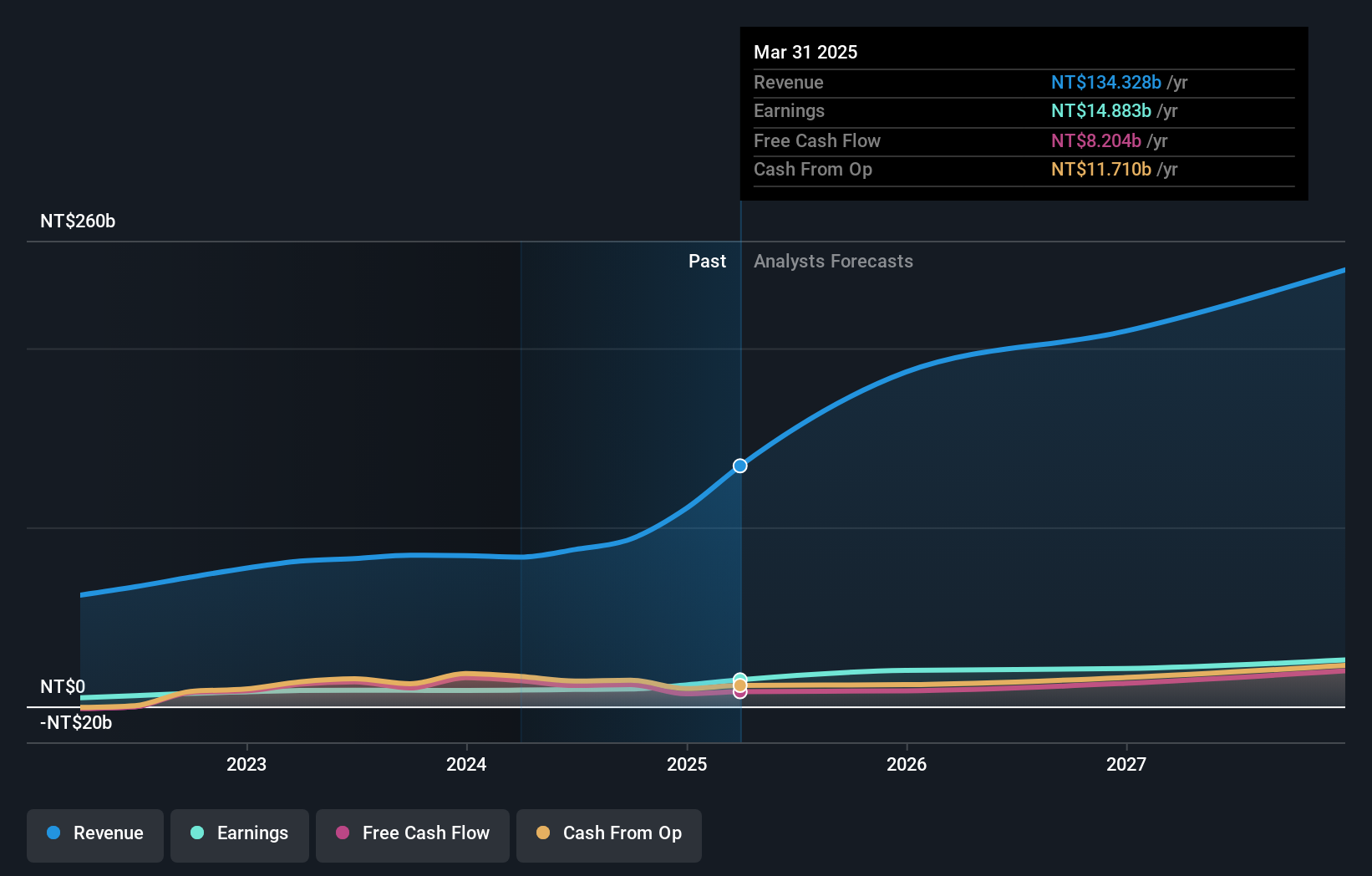

Overview: Accton Technology Corporation engages in the research, development, manufacturing, and sale of network communication equipment across Taiwan, America, Asia, Europe, and other international markets with a market cap of NT$424.21 billion.

Operations: Accton focuses on the computer networks segment, generating NT$93.41 billion in revenue. The company's operations span Taiwan, America, Asia, and Europe.

Accton Technology, demonstrating a robust trajectory in the tech sector, has recently committed to significant expansions with a $25 million investment in its Vietnam factory. This move aligns with its impressive 20.4% annual revenue growth and the strategic establishment of an ESG committee, reflecting its proactive stance on governance and sustainability. Moreover, the company's R&D expenditure remains pivotal, maintaining a healthy ratio to revenue at 15.2%, underpinning future innovations and competitive edge in global markets. These developments suggest Accton is effectively positioning itself for sustained growth amidst evolving industry demands.

- Click here to discover the nuances of Accton Technology with our detailed analytical health report.

Assess Accton Technology's past performance with our detailed historical performance reports.

Key Takeaways

- Dive into all 1226 of the High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300857

Sharetronic Data Technology

Operates as a provider of wireless IoT products in China and internationally.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives