- Taiwan

- /

- Communications

- /

- TWSE:6674

Introducing Compal Broadband Networks (TPE:6674), The Stock That Dropped 31% In The Last Year

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Compal Broadband Networks, Inc. (TPE:6674) have tasted that bitter downside in the last year, as the share price dropped 31%. That's well bellow the market return of 14%. Compal Broadband Networks may have better days ahead, of course; we've only looked at a one year period. Unhappily, the share price slid 1.1% in the last week.

View our latest analysis for Compal Broadband Networks

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

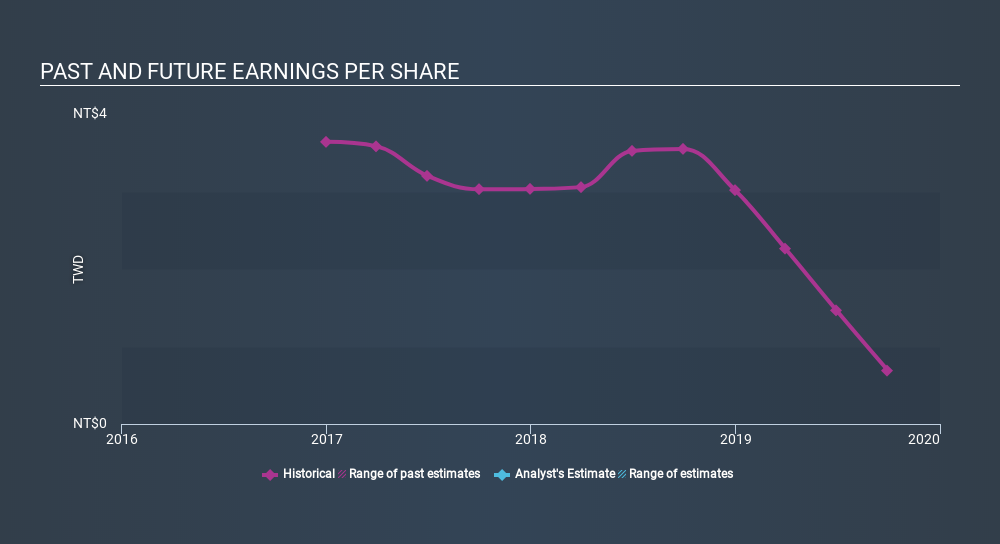

Unhappily, Compal Broadband Networks had to report a 81% decline in EPS over the last year. This fall in the EPS is significantly worse than the 31% the share price fall. It may have been that the weak EPS was not as bad as some had feared.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Compal Broadband Networks's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Compal Broadband Networks, it has a TSR of -27% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Given that the market gained 14% in the last year, Compal Broadband Networks shareholders might be miffed that they lost 27% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 7.6% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Compal Broadband Networks better, we need to consider many other factors. For instance, we've identified 6 warning signs for Compal Broadband Networks (2 are potentially serious) that you should be aware of.

Of course Compal Broadband Networks may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TWSE:6674

Compal Broadband Networks

Provides networking, home security, home entertainment, and wireless accessories in Europe, the United States, Asia, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives