- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6205

Is Chant Sincere (TPE:6205) Likely To Turn Things Around?

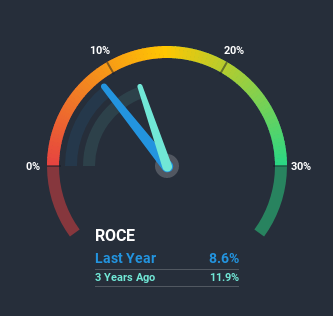

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. In light of that, when we looked at Chant Sincere (TPE:6205) and its ROCE trend, we weren't exactly thrilled.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Chant Sincere:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.086 = NT$161m ÷ (NT$2.3b - NT$420m) (Based on the trailing twelve months to September 2020).

Thus, Chant Sincere has an ROCE of 8.6%. In absolute terms, that's a low return but it's around the Electronic industry average of 10%.

Check out our latest analysis for Chant Sincere

In the above chart we have measured Chant Sincere's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Chant Sincere here for free.

So How Is Chant Sincere's ROCE Trending?

Things have been pretty stable at Chant Sincere, with its capital employed and returns on that capital staying somewhat the same for the last five years. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. So unless we see a substantial change at Chant Sincere in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

The Key Takeaway

We can conclude that in regards to Chant Sincere's returns on capital employed and the trends, there isn't much change to report on. Investors must think there's better things to come because the stock has knocked it out of the park, delivering a 125% gain to shareholders who have held over the last five years. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

If you'd like to know about the risks facing Chant Sincere, we've discovered 2 warning signs that you should be aware of.

While Chant Sincere isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

When trading Chant Sincere or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6205

Chant Sincere

Engages in the design, manufacture, and sale of connectors and cable products in Taiwan.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026