- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3504

Is Young Optics (TPE:3504) Weighed On By Its Debt Load?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Young Optics Inc. (TPE:3504) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Young Optics

What Is Young Optics's Net Debt?

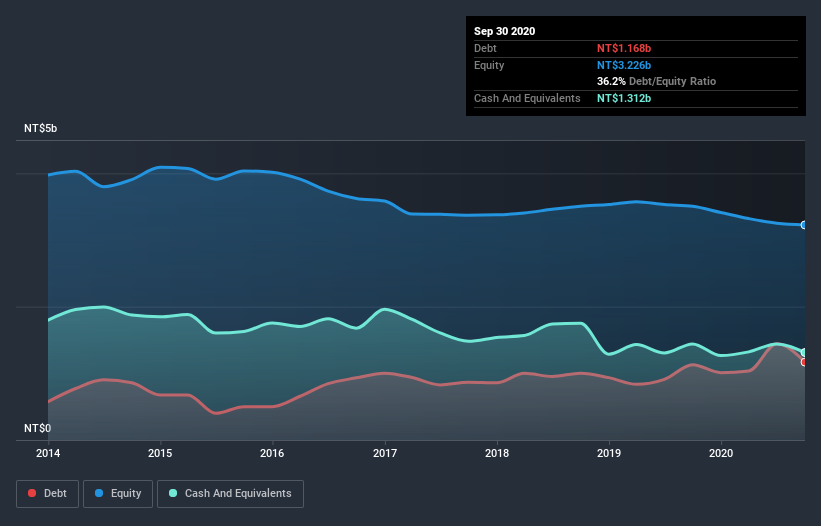

As you can see below, Young Optics had NT$1.17b of debt, at September 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have NT$1.31b in cash offsetting this, leading to net cash of NT$143.9m.

A Look At Young Optics's Liabilities

We can see from the most recent balance sheet that Young Optics had liabilities of NT$1.67b falling due within a year, and liabilities of NT$985.4m due beyond that. Offsetting these obligations, it had cash of NT$1.31b as well as receivables valued at NT$830.9m due within 12 months. So its liabilities total NT$514.6m more than the combination of its cash and short-term receivables.

Of course, Young Optics has a market capitalization of NT$6.62b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Young Optics boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Young Optics will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Young Optics made a loss at the EBIT level, and saw its revenue drop to NT$4.0b, which is a fall of 20%. We would much prefer see growth.

So How Risky Is Young Optics?

Statistically speaking companies that lose money are riskier than those that make money. And the fact is that over the last twelve months Young Optics lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of NT$120m and booked a NT$216m accounting loss. Given it only has net cash of NT$143.9m, the company may need to raise more capital if it doesn't reach break-even soon. Summing up, we're a little skeptical of this one, as it seems fairly risky in the absence of free cashflow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Young Optics that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Young Optics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3504

Young Optics

Engages in the research, design, manufacture, and sale of optical components, optical engine, and optics modules in Taiwan.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026