- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3029

Will Zero One TechnologyLtd (TPE:3029) Become A Multi-Bagger?

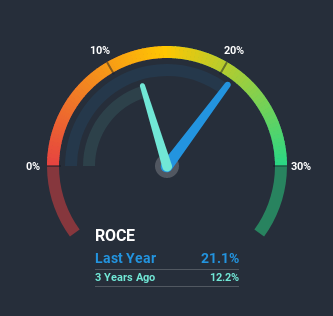

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Typically, we'll want to notice a trend of growing return on capital employed (ROCE) and alongside that, an expanding base of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So when we looked at the ROCE trend of Zero One TechnologyLtd (TPE:3029) we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. Analysts use this formula to calculate it for Zero One TechnologyLtd:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.21 = NT$544m ÷ (NT$4.8b - NT$2.2b) (Based on the trailing twelve months to September 2020).

Therefore, Zero One TechnologyLtd has an ROCE of 21%. That's a fantastic return and not only that, it outpaces the average of 11% earned by companies in a similar industry.

See our latest analysis for Zero One TechnologyLtd

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Zero One TechnologyLtd, check out these free graphs here.

What Can We Tell From Zero One TechnologyLtd's ROCE Trend?

Zero One TechnologyLtd is displaying some positive trends. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 21%. Basically the business is earning more per dollar of capital invested and in addition to that, 35% more capital is being employed now too. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Effectively this means that suppliers or short-term creditors are now funding 46% of the business, which is more than it was five years ago. And with current liabilities at those levels, that's pretty high.Our Take On Zero One TechnologyLtd's ROCE

All in all, it's terrific to see that Zero One TechnologyLtd is reaping the rewards from prior investments and is growing its capital base. And a remarkable 208% total return over the last five years tells us that investors are expecting more good things to come in the future. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One more thing, we've spotted 1 warning sign facing Zero One TechnologyLtd that you might find interesting.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

If you’re looking to trade Zero One TechnologyLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zero One Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3029

Zero One Technology

Provides enterprise information technology solutions in Taiwan and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion