- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2492

Is Walsin Technology Corporation (TPE:2492) A Good Fit For Your Dividend Portfolio?

Is Walsin Technology Corporation (TPE:2492) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

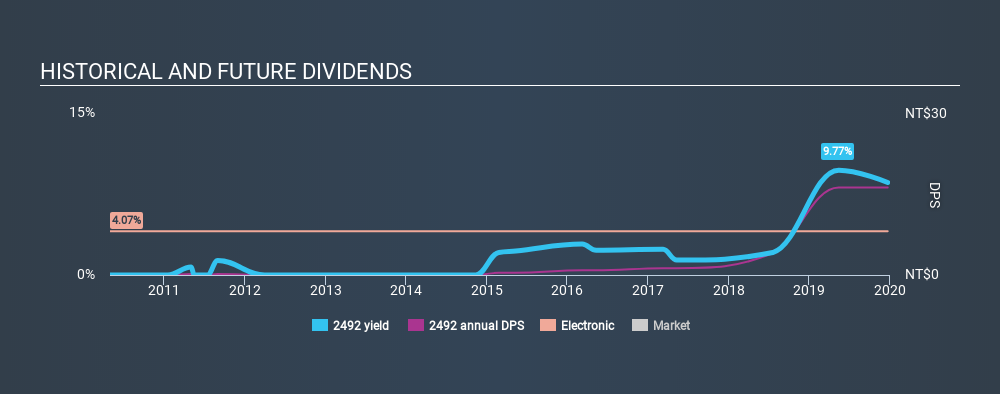

With a nine-year payment history and a 8.6% yield, many investors probably find Walsin Technology intriguing. It sure looks interesting on these metrics - but there's always more to the story . There are a few simple ways to reduce the risks of buying Walsin Technology for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on Walsin Technology!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 76% of Walsin Technology's profits were paid out as dividends in the last 12 months. It's paying out most of its earnings, which limits the amount that can be reinvested in the business. This may indicate limited need for further capital within the business, or highlight a commitment to paying a dividend.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. The company paid out 64% of its free cash flow, which is not bad per se, but does start to limit the amount of cash Walsin Technology has available to meet other needs. It's positive to see that Walsin Technology's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

While the above analysis focuses on dividends relative to a company's earnings, we do note Walsin Technology's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Remember, you can always get a snapshot of Walsin Technology's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the last decade of data, we can see that Walsin Technology paid its first dividend at least nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once by more than 20%, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was NT$0.17 in 2010, compared to NT$16.30 last year. Dividends per share have grown at approximately 66% per year over this time. Walsin Technology's dividend payments have fluctuated, so it hasn't grown 66% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Walsin Technology has grown its earnings per share at 65% per annum over the past five years. A majority of profits are being paid out as dividends, which raises the question of what happens to the current dividend if earnings decline. However, the rapid growth in earnings may indicate that is less of a risk.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we think Walsin Technology is paying out an acceptable percentage of its cashflow and profit. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. Ultimately, Walsin Technology comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Are management backing themselves to deliver performance? Check their shareholdings in Walsin Technology in our latest insider ownership analysis.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TWSE:2492

Walsin Technology

Develops, manufactures, and sells passive electronic components in Asia, the America, and Europe.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)