Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Elitegroup Computer Systems Co.,Ltd. (TPE:2331) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Elitegroup Computer SystemsLtd

What Is Elitegroup Computer SystemsLtd's Debt?

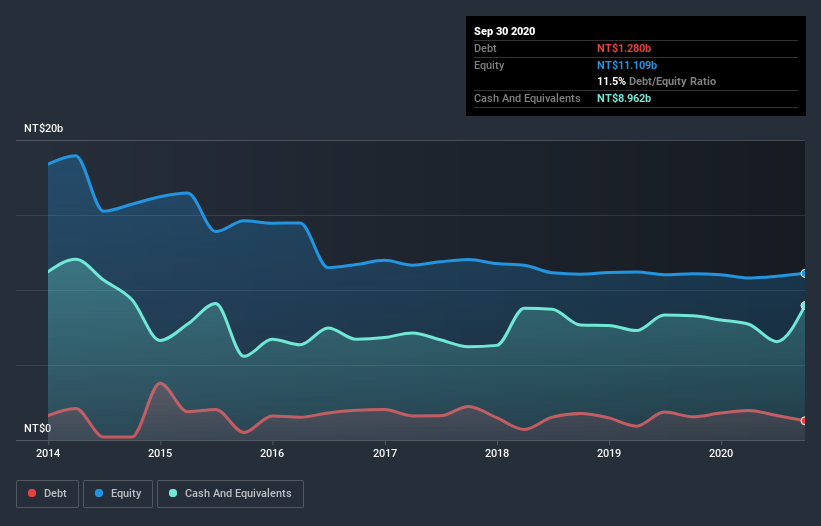

The image below, which you can click on for greater detail, shows that Elitegroup Computer SystemsLtd had debt of NT$1.28b at the end of September 2020, a reduction from NT$1.55b over a year. But on the other hand it also has NT$8.96b in cash, leading to a NT$7.68b net cash position.

How Strong Is Elitegroup Computer SystemsLtd's Balance Sheet?

We can see from the most recent balance sheet that Elitegroup Computer SystemsLtd had liabilities of NT$11.9b falling due within a year, and liabilities of NT$852.3m due beyond that. On the other hand, it had cash of NT$8.96b and NT$3.74b worth of receivables due within a year. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

Having regard to Elitegroup Computer SystemsLtd's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the NT$10.5b company is short on cash, but still worth keeping an eye on the balance sheet. Despite its noteworthy liabilities, Elitegroup Computer SystemsLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

It was also good to see that despite losing money on the EBIT line last year, Elitegroup Computer SystemsLtd turned things around in the last 12 months, delivering and EBIT of NT$379m. There's no doubt that we learn most about debt from the balance sheet. But it is Elitegroup Computer SystemsLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Elitegroup Computer SystemsLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last year, Elitegroup Computer SystemsLtd created free cash flow amounting to 7.5% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Summing up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Elitegroup Computer SystemsLtd has NT$7.68b in net cash. So we don't have any problem with Elitegroup Computer SystemsLtd's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Elitegroup Computer SystemsLtd (1 is a bit unpleasant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

When trading Elitegroup Computer SystemsLtd or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Elitegroup Computer SystemsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2331

Elitegroup Computer SystemsLtd

Designs, develops, manufactures, and sells computer equipment in Asia, America, Europe, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026