- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:1582

We Think Syncmold Enterprise (TPE:1582) Can Manage Its Debt With Ease

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Syncmold Enterprise Corp. (TPE:1582) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Syncmold Enterprise

What Is Syncmold Enterprise's Net Debt?

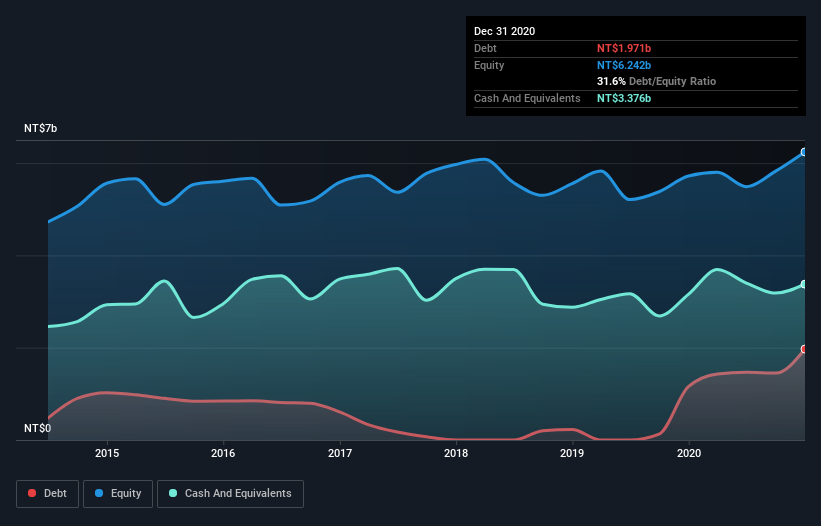

The image below, which you can click on for greater detail, shows that at December 2020 Syncmold Enterprise had debt of NT$1.97b, up from NT$1.16b in one year. However, it does have NT$3.38b in cash offsetting this, leading to net cash of NT$1.41b.

How Strong Is Syncmold Enterprise's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Syncmold Enterprise had liabilities of NT$4.93b due within 12 months and liabilities of NT$599.6m due beyond that. Offsetting these obligations, it had cash of NT$3.38b as well as receivables valued at NT$4.02b due within 12 months. So it can boast NT$1.87b more liquid assets than total liabilities.

It's good to see that Syncmold Enterprise has plenty of liquidity on its balance sheet, suggesting conservative management of liabilities. Because it has plenty of assets, it is unlikely to have trouble with its lenders. Succinctly put, Syncmold Enterprise boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that Syncmold Enterprise grew its EBIT by 20% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Syncmold Enterprise's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Syncmold Enterprise may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Syncmold Enterprise's free cash flow amounted to 44% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While it is always sensible to investigate a company's debt, in this case Syncmold Enterprise has NT$1.41b in net cash and a decent-looking balance sheet. And we liked the look of last year's 20% year-on-year EBIT growth. So we don't think Syncmold Enterprise's use of debt is risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for Syncmold Enterprise you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1582

Syncmold Enterprise

Engages in the processing, manufacturing, trading, technology authorization, import and export of various metal molds, plastic molds, and electronic parts in Taiwan.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.