- Japan

- /

- Trade Distributors

- /

- TSE:9960

3 Reliable Dividend Stocks With At Least 3.7% Yield

Reviewed by Simply Wall St

Amidst recent fluctuations in global markets, driven by tariff uncertainties and mixed economic data, investors are increasingly seeking stability through reliable income-generating investments. In the current environment of cautious optimism and gradual economic recovery, dividend stocks with solid yields offer an attractive option for those looking to balance risk while potentially benefiting from consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.39% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

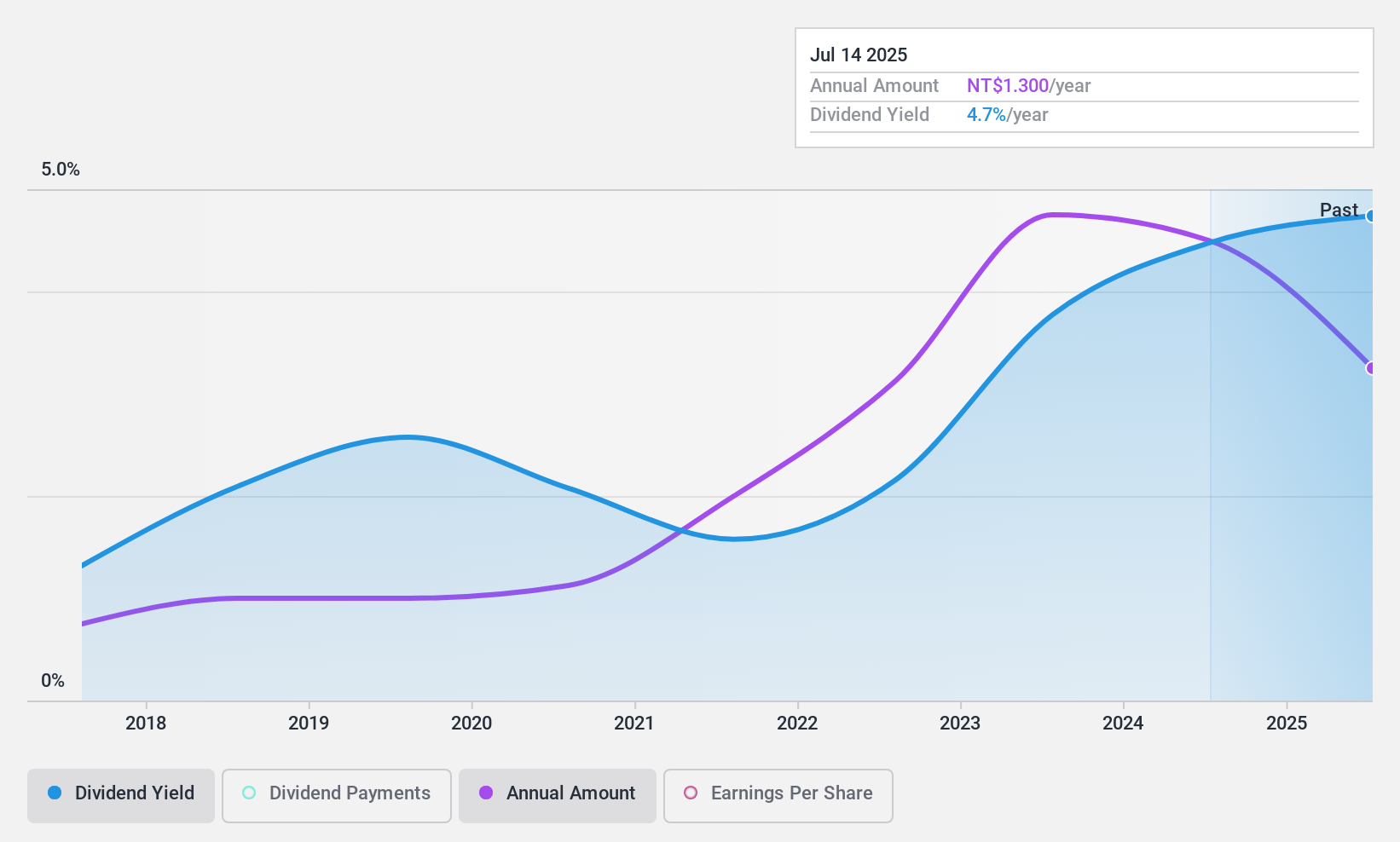

Info-Tek (TPEX:8183)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Info-Tek Corporation manufactures, assembles, processes, sells, and distributes information electronic products across Taiwan, China, the rest of Asia, the United States, and Europe with a market cap of NT$4.81 billion.

Operations: Info-Tek Corporation's revenue segments include NT$327.23 million from PCBA - EMS1 and NT$6.33 billion from PCBA - EMS3.

Dividend Yield: 4.5%

Info-Tek's dividend payments, while volatile over the past decade, are well covered by both earnings (56% payout ratio) and cash flows (40.5% cash payout ratio), suggesting a sustainable distribution despite an unstable track record. Trading at 50.1% below its estimated fair value, Info-Tek offers a competitive dividend yield of 4.52%, placing it in the top quartile among TW market payers. However, past unreliability may concern cautious investors seeking consistent growth.

- Click to explore a detailed breakdown of our findings in Info-Tek's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Info-Tek shares in the market.

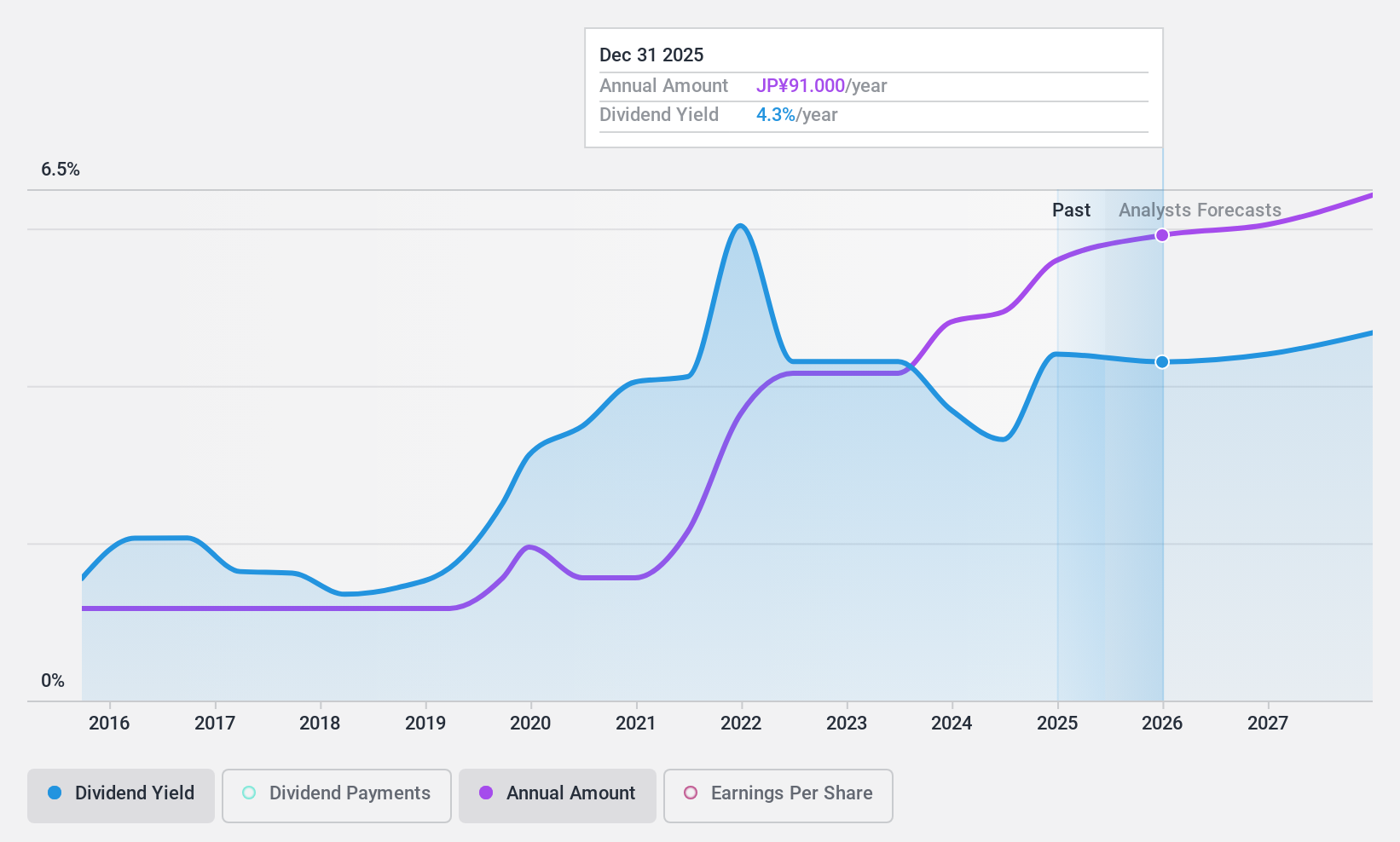

Inpex (TSE:1605)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Inpex Corporation is involved in the research, exploration, development, production, and sale of oil, natural gas, and other mineral resources both in Japan and internationally with a market cap of approximately ¥2.27 trillion.

Operations: Inpex Corporation's revenue segments include ¥208.55 million from Oil & Gas Japan, ¥1.69 billion from Oil & Gas Overseas - Other Project, and ¥401.55 million from the Oil & Gas Overseas - Ichthys Project.

Dividend Yield: 4.5%

Inpex offers a robust dividend profile with stable and growing payouts over the past decade, supported by low payout ratios of 24.7% for earnings and 25.5% for cash flows, ensuring sustainability. Its dividend yield of 4.54% ranks in the top quartile of the JP market. The company is trading at a favorable valuation with a P/E ratio of 5.7x, below the market average, despite recent buybacks totaling ¥79.99 billion enhancing shareholder value.

- Click here and access our complete dividend analysis report to understand the dynamics of Inpex.

- The analysis detailed in our Inpex valuation report hints at an deflated share price compared to its estimated value.

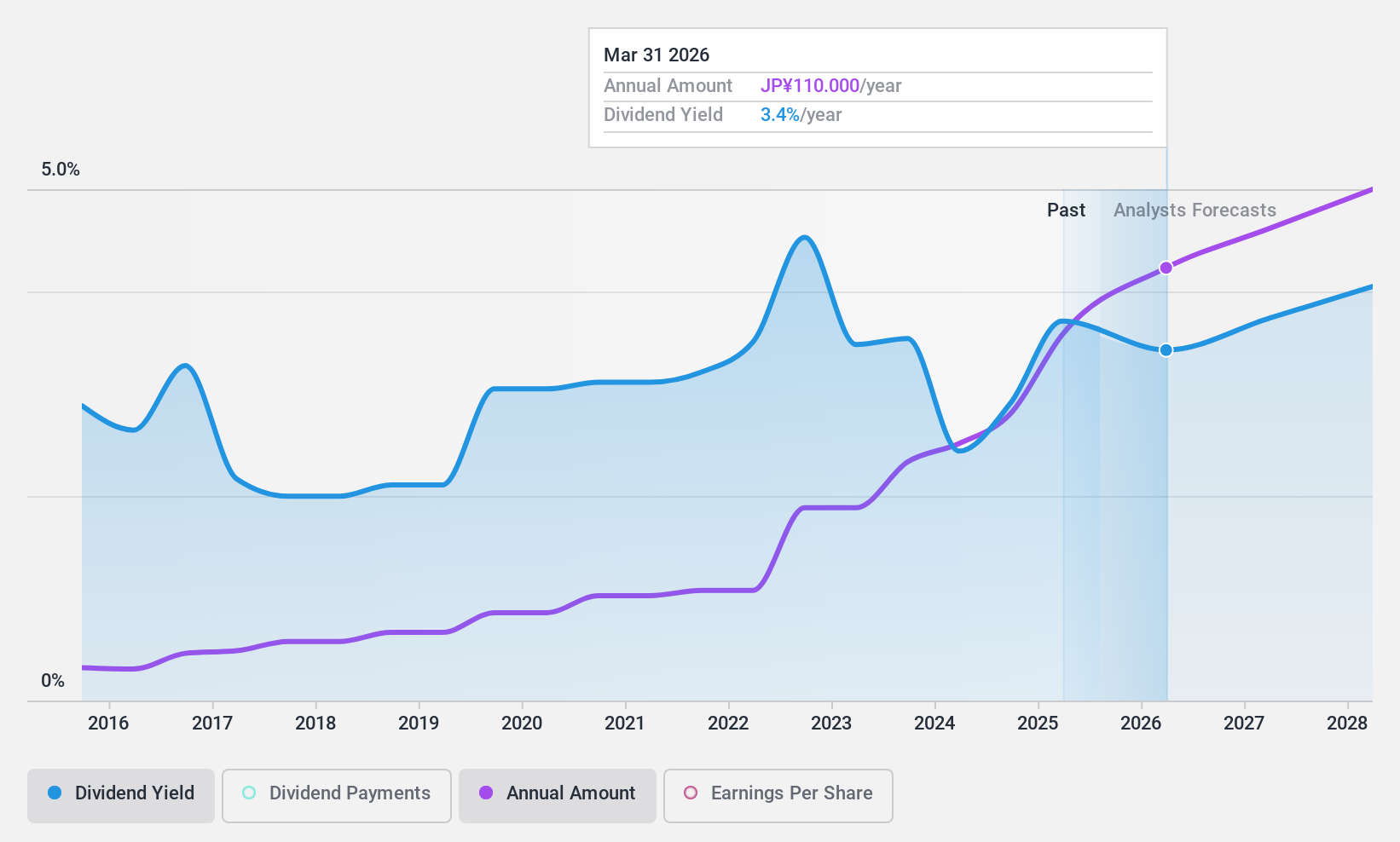

Totech (TSE:9960)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Totech Corporation operates in Japan, focusing on the sale of environment control equipment, with a market cap of ¥96.84 billion.

Operations: Totech Corporation's revenue is primarily derived from its Merchandise Sales Business, which contributes ¥86.50 billion, and its Construction Business, which adds ¥61.32 billion.

Dividend Yield: 3.7%

Totech's dividend is well-supported, with a low payout ratio of 33.4% and a cash payout ratio of 30%, indicating sustainability. Although its yield of 3.74% is slightly below the top quartile in Japan, dividends have been stable and growing over the past decade. The stock trades at a significant discount to estimated fair value, offering potential upside. Recent follow-on equity offerings could impact share price dynamics but don't affect its strong dividend fundamentals.

- Unlock comprehensive insights into our analysis of Totech stock in this dividend report.

- In light of our recent valuation report, it seems possible that Totech is trading behind its estimated value.

Key Takeaways

- Unlock our comprehensive list of 1960 Top Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Totech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9960

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)