- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214150

Insider Owned Growth Leaders Techwing And Two More

Reviewed by Simply Wall St

In the wake of significant political shifts and economic policy changes, global markets have seen a notable rally, with U.S. indices reaching record highs amid expectations for growth-friendly policies. As investors navigate this evolving landscape, companies with high insider ownership often stand out as promising candidates due to their alignment of interests between management and shareholders, particularly in growth sectors like technology where innovation drives potential opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 32% |

| On Holding (NYSE:ONON) | 31% | 29.8% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Techwing (KOSDAQ:A089030)

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc., along with its subsidiaries, is engaged in the development, manufacturing, sale, and servicing of semiconductor inspection equipment both in South Korea and internationally, with a market cap of ₩1.28 trillion.

Operations: Techwing's revenue is primarily derived from the development, manufacturing, sale, and servicing of semiconductor inspection equipment across domestic and international markets.

Insider Ownership: 18.7%

Return On Equity Forecast: 50% (2027 estimate)

Techwing's revenue is projected to grow significantly at 62.5% annually, outpacing the Korean market's average growth rate. Despite its high volatility in share price recently, Techwing is expected to achieve profitability within three years, with earnings forecasted to rise by 83.65% per year and a very high return on equity of 50%. Although there has been no substantial insider trading activity over the past three months, these growth prospects highlight potential investor interest.

- Click to explore a detailed breakdown of our findings in Techwing's earnings growth report.

- Our valuation report here indicates Techwing may be overvalued.

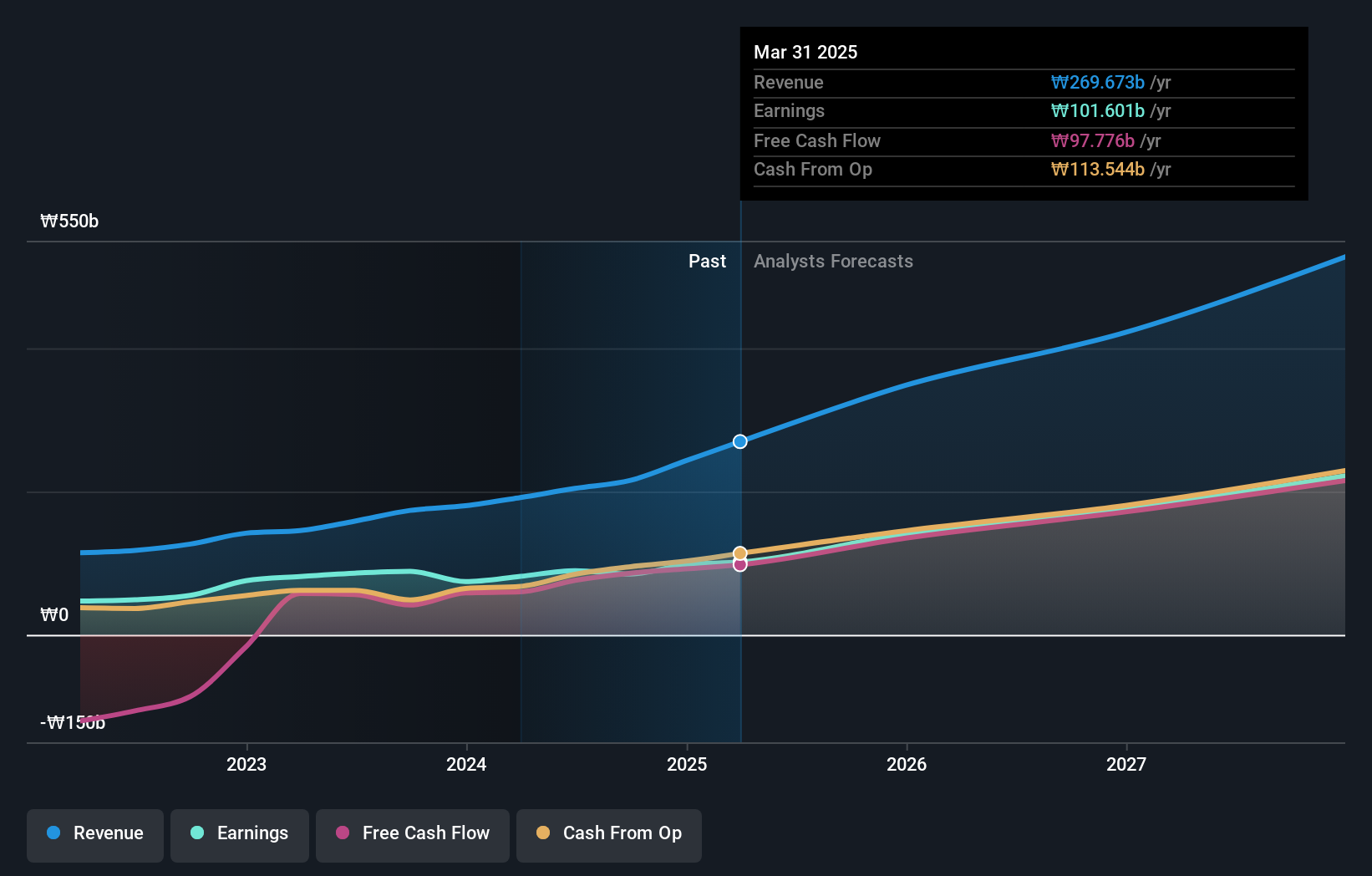

CLASSYS (KOSDAQ:A214150)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CLASSYS Inc. is a company that offers medical aesthetics devices globally, with a market capitalization of ₩2.99 trillion.

Operations: The company generates its revenue primarily from the Surgical & Medical Equipment segment, which accounted for ₩204.37 billion.

Insider Ownership: 13.7%

Return On Equity Forecast: 29% (2027 estimate)

CLASSYS is poised for growth with its revenue expected to increase by 24.5% annually, outpacing the Korean market's average. Despite trading 23% below estimated fair value, earnings are projected to grow at a slower rate of 24.2%. The recent partnership with Cartessa Aesthetics marks CLASSYS's entry into the US market with innovative technology in skin treatment. Analysts anticipate a potential stock price rise of 37.7%, though shareholders experienced dilution last year.

- Click here to discover the nuances of CLASSYS with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that CLASSYS is trading behind its estimated value.

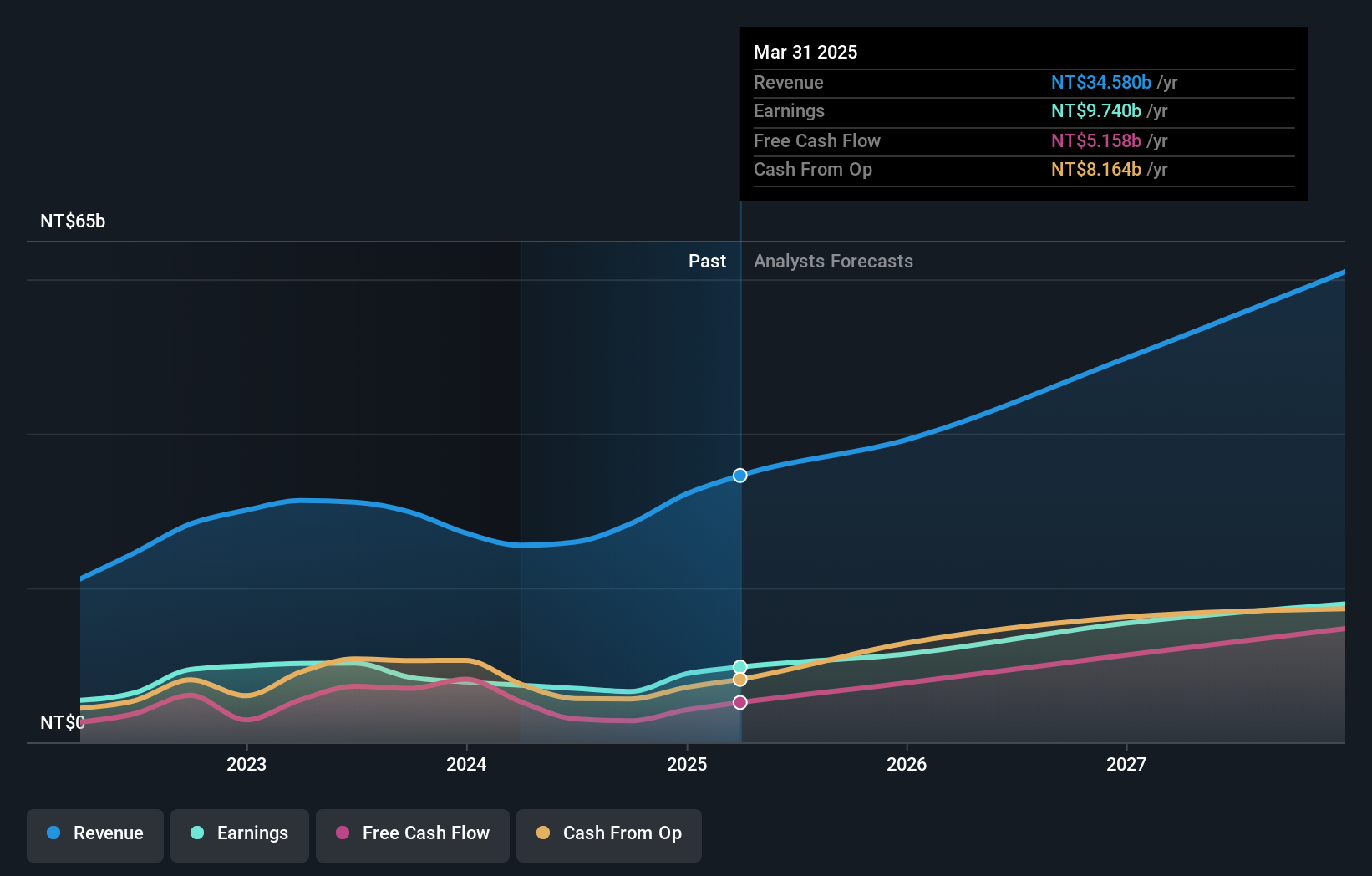

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. is engaged in the research, development, manufacturing, and sale of electronic paper display panels globally, with a market cap of NT$314.85 billion.

Operations: The company's revenue segment primarily consists of electronic components and parts, generating NT$28.32 billion.

Insider Ownership: 10.8%

Return On Equity Forecast: 27% (2027 estimate)

E Ink Holdings is positioned for growth, with revenue projected to rise by 30.9% annually, surpassing the Taiwanese market average. Despite trading at 24.5% below its fair value estimate, earnings are expected to grow significantly at 42.7% per year, outpacing the market's 19.4%. Recent earnings showed increased sales but a decline in net income and EPS compared to last year. Analysts agree on a potential stock price increase of 21.5%.

- Delve into the full analysis future growth report here for a deeper understanding of E Ink Holdings.

- The analysis detailed in our E Ink Holdings valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Gain an insight into the universe of 1515 Fast Growing Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A214150

Exceptional growth potential with solid track record.

Market Insights

Community Narratives